Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

**

Question

I earn between 100k–120k monthly (although this is not stable, as it depends on sales). My rent is 250k (the cheapest room in an area close to my workplace). I plan to get a new laptop to upgrade my skill in a bid to get a better job and also to relocate to the UK before the year runs out via the study route (my second attempt after being denied a visa to study in Canada due to insufficient funds in the past). The process has begun and I have paid half of my tuition, which took a whole year to come through on this with the help of family and friends. What is left is the visa fees. With my income, it does not seem like I can achieve all this within a year. How do I go about this?

Answer

From your question, you have several financial goals that you are working towards which are:

- getting a new laptop

- upgrading your skills

- relocating to the UK

- paying for your tuition and visa fees

Some steps you can take to help you achieve these goals are:

Prioritise your goals

Choose your top priority and put your first efforts there. If moving to the UK is your primary priority, for instance, you might put more of your attention into saving money for your visa fees than into upgrading your laptop or paying off your tuition.

Create a budget

Create a budget that includes all of your expenses, including your rent, bills and savings for your goals. Look for ways to reduce your expenses, such as finding a cheaper place to live or cutting back on non-essential expenses.

Research ways to get financial assistance

Research scholarships, grants or other financial assistance programmes that may be available to you. You can also reach out to family and friends for help.

Be flexible

Be prepared to adjust your plans if necessary. If you find that you can’t achieve all of your goals within a year, consider setting smaller, more achievable goals and working towards them over time.

***

Question

I find it hard to have money and not think of ways to spend it. Most times I spend on important things that I need, even though, sometimes, these needs can actually wait. I really want to break free. I only save money when it is inaccessible or in a safe lock.

Answer

Controlling your expenditures can be challenging, especially if your income is consistent.

However consider the following;

- Set specific financial goals: Having specific goals in mind, such as saving for a family vacation or for a trip or new phone, can help you stay motivated to save money.

- Create a budget and stick to it: Having a budget will help you keep track of your income and expenses, and it will help you identify areas where you can cut back on spending.

- Automate your savings: Consider setting up automatic transfers to a savings account. That way, you won’t have to rely on willpower to save money.

- Avoid impulse purchases: Before making a purchase, think about whether you really need the item or if it’s just an impulse buy.

- Find other ways to utilise your time: Instead of spending money on entertainment or shopping, find alternative ways like reading or exercising.

- Find a saving partner: Find a friend or family member who is also trying to save money and do well to support each other in your saving efforts.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

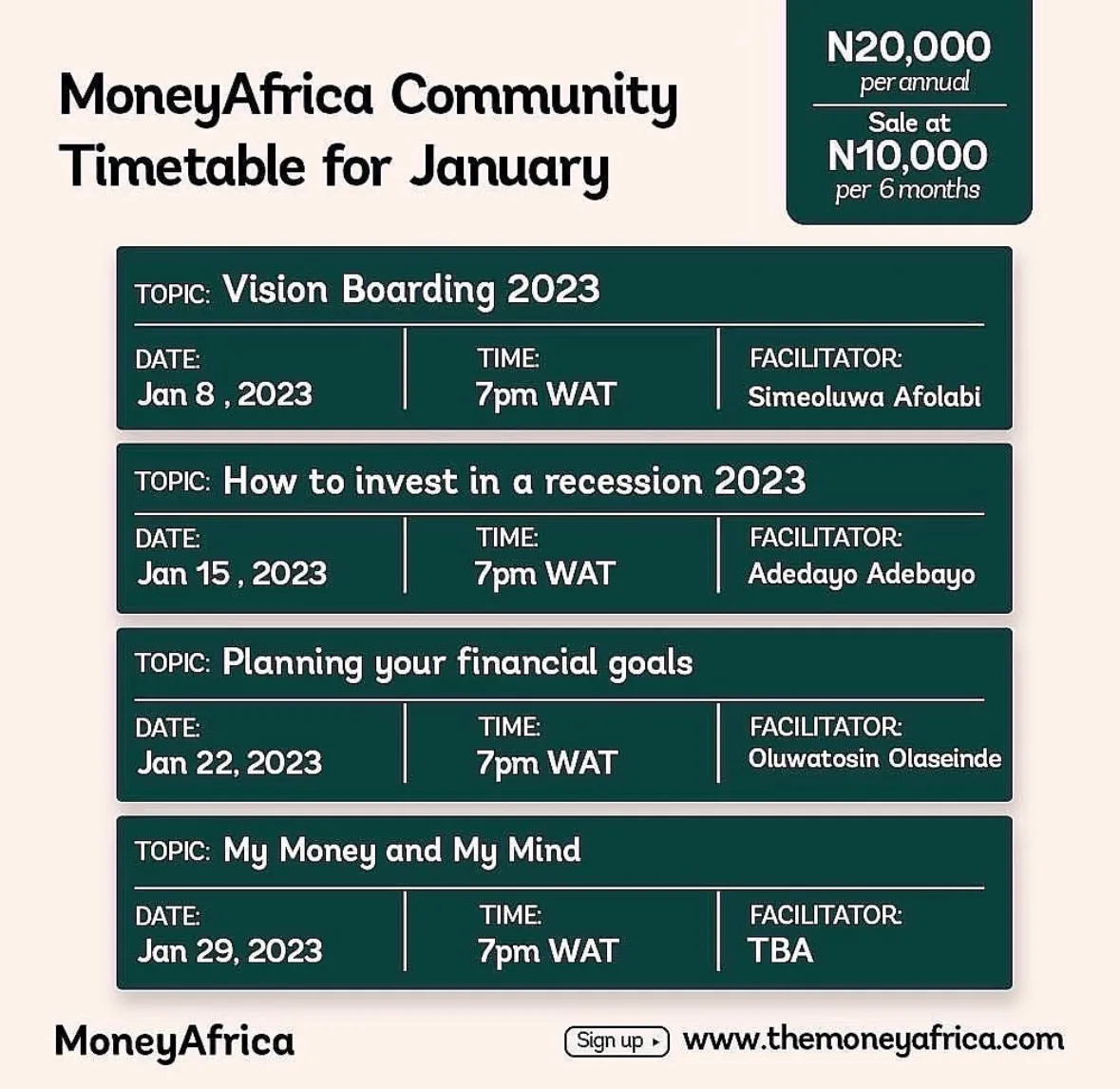

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com