Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

**

Question

I’m a college student. I also volunteer at two companies as a social media manager and a content writer. It’s very difficult to save for a laptop while being a student. You know the expenses that come with being a student in a Nigerian university. How do I save more and get my laptop before December?

Answer

Saving money takes huge discipline and commitment. Try following these steps to stay focused on your goal. You can save more and get your laptop before December!

Create a budget:

Start by tracking your expenses and income. Look for areas where you can cut back on expenses and allocate more money towards saving for your laptop.

Set a savings goal:

Determine how much you need to save for your laptop and set a specific savings goal. Break down the goal into manageable monthly or weekly amounts.

Prioritise saving:

Make saving a priority by setting up automatic transfers to a savings account each month. This way, you can save without even thinking about it.

Did you know you can do this on the Ladda app?

The Ladda app can help to save and achieve all your short-term goals while still getting up to 10% interest per annum. Download Ladda now to get started!

Increase your income:

Look for ways to increase your income by taking on more freelance work, asking for a raise or looking for part-time work.

Look for deals:

Do your research and look for deals on laptops. You can also consider buying a refurbished laptop or a second-hand laptop to save money.

Avoid unnecessary expenses:

Be mindful of your spending habits and avoid unnecessary expenses. Cut back on eating out, buying expensive clothes, and other non-essential items.

Explore scholarship opportunities:

Also consider exploring some scholarship opportunities available. This will ease off the burden of school fees on you. Some scholarships can even provide you with books, living expenses and accommodation. So, this is something you should definitely look into.

***

Question

I am 26 and I started my career journey in 2020 post-COVID. I really want to retire rich and young. This has been my main drive for savings, investment and financial literacy in general, although I have made a lot of investment mistakes that have led to the loss of all my life savings. (I’m happy I made those mistakes early enough.) I am at a crossroad now and don’t really know what to do. I’ve read a lot of books on financial literacy as well. I get all the financial knowledge I need from these books but it’s very hard to make a good investment decision. I lost over N1m to crypto last year, I later fell for some other ponzi scams and it’s really painful.

Answer

I can understand your frustration and disappointment with your investment decisions so far. However, it’s important to realise that investment mistakes are a part of the learning process, and it’s never too late to start making better decisions.

To help you get back on track toward your goal of retiring rich and young, these are some suggestions:

Invest in your education and career:

Investing in yourself by improving your education and advancing your career can lead to higher earning potential and greater financial stability in the long run.

Re-evaluate your investment strategy:

Take a step back and evaluate your investment strategy so far. Think about what worked and what didn’t, and why. Consider seeking advice from a financial advisor or mentor to help you create a more effective strategy going forward.

Diversify your portfolio:

One of the key principles of investing is diversification. Spread your investments across different asset classes such as stocks, bonds, and real estate, and within those asset classes, consider investing in a range of companies or properties.

Avoid get-rich-quick schemes:

As you’ve experienced, get-rich-quick schemes and scams are usually too good to be true. Be wary of any investment opportunity that promises quick and high returns without much effort or risk.

Be patient and disciplined:

Investing is a long-term game, and it’s important to stay patient and disciplined. Avoid making impulsive decisions based on short-term market fluctuations, and stick to your investment strategy even during times of uncertainty.

Building wealth and achieving financial independence takes time, effort, and discipline. With a solid investment strategy and a commitment to ongoing education and improvement, you can still achieve your goal of retiring rich and young.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

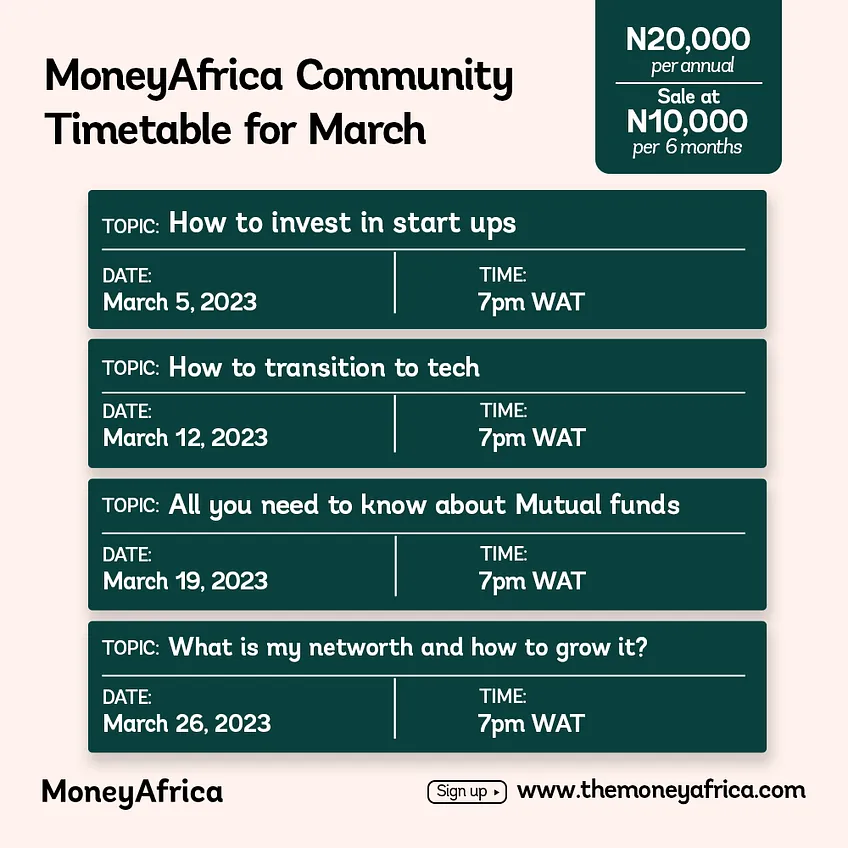

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com