Like me, perhaps you have also wondered why prices aren’t dropping. Shouldn’t lower dollar rates make things cheaper?

We’re facing a peculiar situation known as the ratchet effect. The ratchet effect describes a scenario where prices rise quickly during inflation but are slow to decrease when inflation rates start to decline.

Here’s how it works:

- Inflationary period:

During high inflation, prices rise quickly due to rising production costs, strong demand, or policies increasing the money supply. Businesses hike prices to maintain profits, causing a cycle of inflation.

- Expectations and adjustments:

Businesses and consumers adjust their expectations during high inflation. They anticipate rising prices and make decisions accordingly, like negotiating higher wages or buying sooner to avoid paying more later.

- Resistance to decreases:

When inflation starts to drop, businesses hesitate to lower prices right away. They worry about signalling weakness or losing profits, delaying their adjustment to lower expectations.

- Slow adjustment:

Even as inflation rates decrease, prices may stay high. This is because prices tend to “ratchet up” during inflation but are slow to “ratchet down” during deflation.

The ratchet effect can prolong inflation even after its causes subside. Policy makers need to manage expectations carefully and take appropriate measures to address inflation and prevent the ratchet effect from worsening inflationary pressures or hindering efforts to reduce inflation rates.

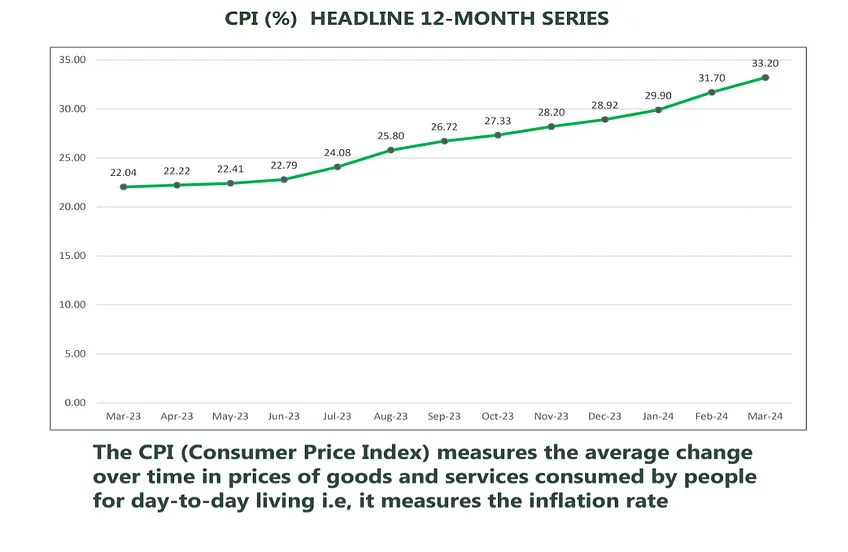

According to National Bureau of Statistics

CPI and Inflation Report for March, the headline inflation rate in March 2024 rose to 33.20% from February’s 31.70%, indicating a 1.50% point increase. Compared to March 2023, it was 11.16% points higher. On a month-on-month basis, March 2024 saw a 3.02% increase, slightly lower than February’s 3.12%, suggesting a slower rate of price increase.

Source: March CPI and Inflation Report, NBS

Prices are tracked using the Consumer Price Index (CPI), which measures changes in prices over time across various categories. The CPI uses a weighting system to calculate overall inflation, but people may feel prices are rising faster due to focusing on items like food and energy.

Inflation rates vary across states, balancing each other out when calculating overall inflation. Inflation is measured year-on-year and month-on-month, with recent trends showing a slight decrease in month-on-month inflation, particularly in rural food prices.

Falling inflation doesn’t mean all prices will drop; it indicates that prices are increasing at a slower rate.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2024.

Don’t forget to:

- Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com