Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

**

Question

I’m a 23-year-old female, and my monthly salary is about N363,000, with some other yearly benefits that are almost close to N2 million. I still live with my parents, I am not married and I don’t have children. I can say I have a pretty mid/high-risk tolerance, and I would love it if you can advise me on the exact things I can invest in as well as a platform I could use.

Answer

Please note that before you start investing, it’s important to have a safety net in place. Consider setting aside 3-6 months worth of living expenses in a high-yield savings account so that you have funds to fall back on in case of an emergency.

Also note that even though you have a high-risk tolerance, you should adequately balance your investment portfolio by investing in low-risk assets as well, such as investing in a high-yield savings account using the Ladda app.

Exciting news!

We are pleased to announce that Ladda 2.0 is now available for iPhone and Android users.

In the new version, you will find many improvements, including a more intuitive user interface, faster loading times, and additional security measures to protect your personal and financial information. We have also added new features to make it easier for you to save towards your goals.

Some mid-high-risk investment options

With your current financial situation and risk profile, consider these investment options:

- Invest in stocks or mutual funds: If you’re comfortable with taking on some risk, investing in the stock market can yield high returns over the long term. Consider opening a brokerage account with a reputable firm and begin investing in individual stocks or mutual funds that align with your investment goals.

- Stocks of small, new, or high-growth companies: These companies have the potential for high returns but are also more volatile and carry a higher risk of failure than established companies.

- Invest in real estate: You could consider investing in real estate by purchasing a rental property or investing in a real estate investment trust (REIT). REITs are publicly traded companies that own and operate income-generating real estate, and they can offer a diversified portfolio of real estate investments.

- Cryptocurrencies: Cryptocurrencies such as Bitcoin are highly volatile and can experience significant fluctuations in price over short periods of time. They are also not regulated by governments or central banks, which can increase risk.

Regarding investment platforms, there are several options available in Nigeria such as Cowrywise, Bamboo, Trove and Chaka. It’s essential to do your research and choose a reputable platform that aligns with your investment goals. Additionally, consider consulting with a financial advisor at MoneyAfrica to help guide you in making informed investment decisions.

***

Question

How can I save adequately and what are the various forms of (and the best) investments I can do?

Answer

Saving money is important to achieving financial stability and achieving long-term financial goals. In order to save properly and make the best use of your savings, you should set a savings goal, make a budget, automate your savings, and use a high-yield savings account.

Did you know you can do many of these and even more on the Ladda app? Download Ladda now and start saving towards your financial goals.

There are various forms of investment options available, and the best type of investment for you will depend on three key things:

- your financial goals

- risk tolerance

- investment horizon

Some of the most common types of investments are:

- Stocks:

Investing in stocks means buying a small ownership stake in a publicly traded company. Stocks are generally considered long-term investments, and they can offer significant returns over time.

- Bonds

Bonds are a type of debt security issued by companies or governments to raise money. They are generally considered less risky than stocks but also offer lower returns.

- Mutual funds

Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks, bonds or other assets. This can reduce risk and provide broader exposure to different sectors.

- Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds, but they trade like stocks on an exchange. They can offer diversification and low fees.

- Real estate

Real estate can offer steady income through rental properties or long-term appreciation through ownership. Real estate investment trusts (REITs) are a popular way to invest in real estate without buying the property directly.

- Cryptocurrencies

Cryptocurrencies such as Bitcoin are a relatively new investment option that can offer high returns but are also highly volatile.

In summary, It’s essential to understand the risk in each investment option and the potential rewards before making any investment decisions.

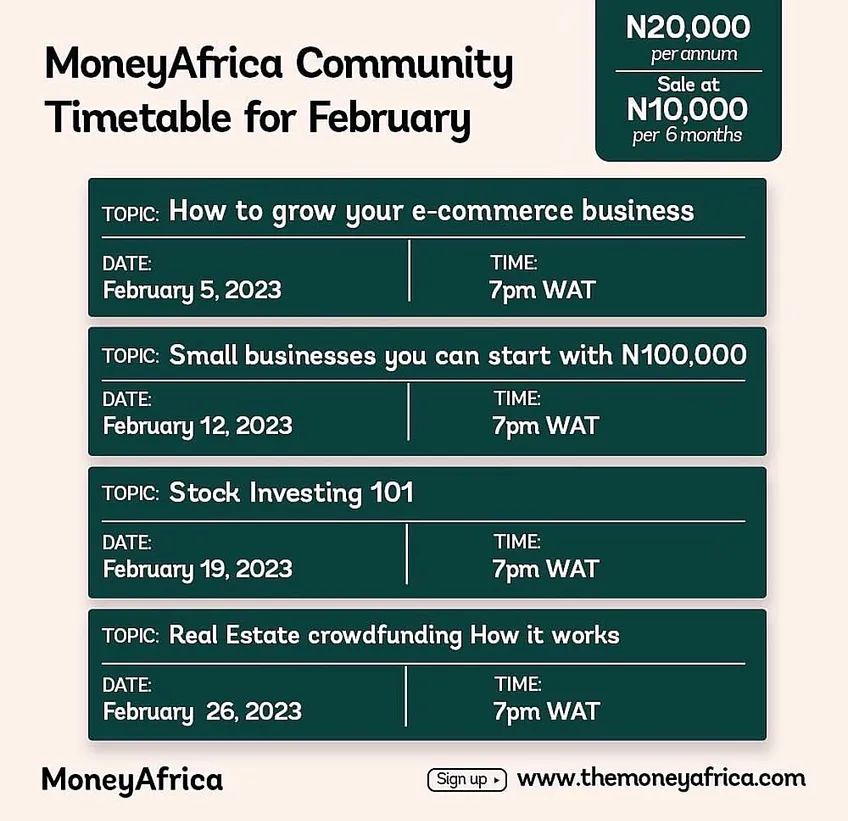

The season of love is upon us. One way you can show love is to be intentional about the growth of your partner/loved one. If you love them, you’d want them to be financially intelligent.

With our super easy Valentine offerings, you can go on your financial independence journey together with your partner/loved one.

- 50% off our annual community plan (

₦20,000₦10,000).

On the community plan, you’ll have:

- Access to over 5 hours of recorded finance and investment videos on subjects like budgeting, savings, investing, etc. on our edtech platform that you can watch at your pace

- Access to a Telegram community

- Community support from the MoneyAfrica team and fellow investors like you

- Access to an ongoing weekly finance and Investment class (personal finance marathon). Recordings are available)

- Access to freebies

To make payment for the annual community plan, please visit www.themoneyafrica.com

- Did you know that money matters is one of the top three reasons for divorce?

As we celebrate Valentine’s Day, we are offering intending and married couples a flat fee of ₦100,000 for personalised one-on-one financial planning. Here, two people get the price of 1 premium plan:

To make payment, please visit https://paystack.com/pay/couplesession

When there’s money, the love is sweeter (in Davido’s voice).

Join our community today.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com