Have you ever experienced the headache that comes with getting paid by customers or clients abroad as a tech freelancer or a business owner? Now, especially with Nigeria’s unpredictable exchange rates and complex currency exchange landscape (rates are almost N1,600 to $1), most fintech platforms do not have licenses to facilitate cross-border transactions. This makes receiving money from clients and customers overseas a real hassle. There are also other hurdles like:

Higher costs: With numerous intermediaries involved in international money transfers, each charging a fee for their services, the process becomes notoriously expensive. International transactions always come with higher costs.

Slow process: Unlike the almost instant nature of domestic payments, international online money transfers made through traditional bank transfers can take anywhere from two to five days to process. This delay is due to the involvement of multiple parties in each transaction.

Safety concerns: When making international transactions, both senders and receivers understandably want assurance about the security of their money. Unfortunately, there’s no guarantee that a bank will be able to recover stolen funds in the event of a successful hacker attack on a cross-border payment pathway. Such losses can be significant. International transfer systems are also vulnerable to serious security breaches.

Now, we all know that international transactions are unavoidable, but not knowing where to find safe money transfer options can be really stressful, right?

Well, we have some good news: Sendsprint is a leading provider of international payment solutions. They cater to the payment needs of African businesses and freelancers with clients and customers in the UK, US, and Canada. Say goodbye to payment headaches and hello to smooth transactions with Sendsprint. Their product is a comprehensive 360-degree payment solution. It enables easy collection of payments from customers in the UK, US, and Canada, while supporting international supplier and vendor payouts for businesses with suppliers in Turkey, UK, Canada, China, UAE, and the US.

Sendsprint understands the challenges African businesses and freelancers face when it comes to expanding globally and managing international payments. That’s why they’re excited to offer, in collaboration with us, specialised classes on local to international business expansion, with a focus on making payments simpler and more efficient for tech freelancers and businesses.

In these classes, you’ll learn valuable strategies and tactics for navigating the complexities of international business expansion. We’ll cover topics such as:

Webinar Topic 1: Setting Up for International Expansion Success as a Business or Tech Freelancer [March 23]

- Free Tools for Setting Up Your Business for Success with International Customers and Clients

- Getting Started: How to Set Up Your Online Business (Business Pages, Ads, Portfolio)

- Managing Logistics, Shipping, and Nurturing Customer Relationships

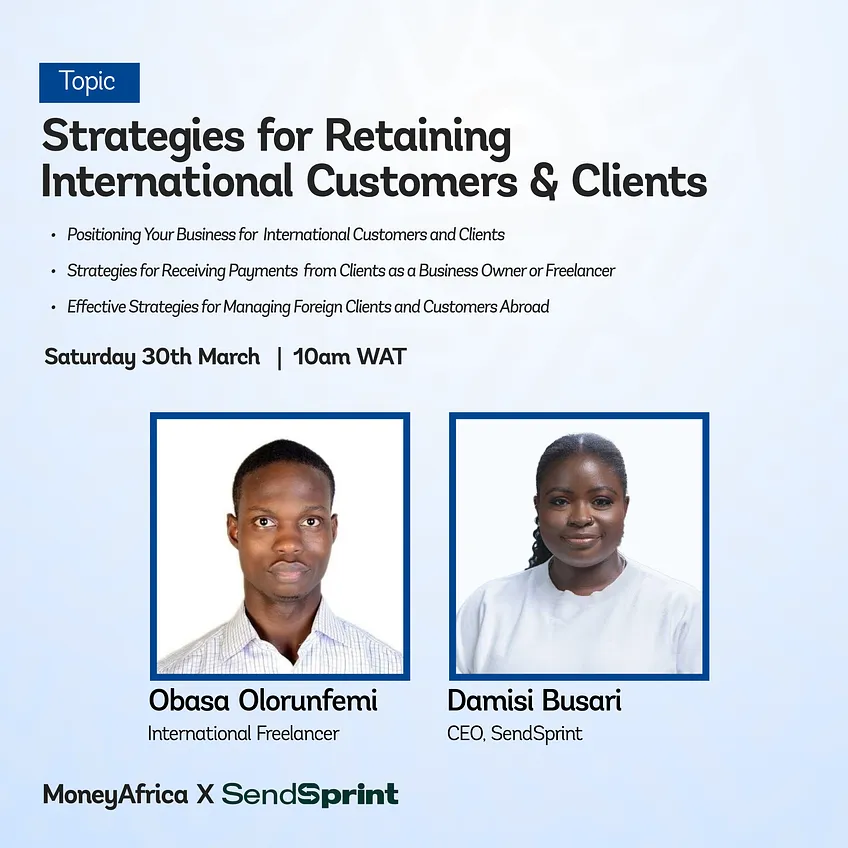

Webinar Topic 2: Strategies for Retaining International Customers & Clients [March 30]

- Positioning Your Business for International Customers and Clients

- Strategies for Receiving Payments from Clients as a Business Owner or Freelancer

- Effective Strategies for Managing Foreign Clients and Customers Abroad

Webinar Topic 3: Simplifying Foreign Payments for Business Owners and Freelancers [April 6]

- How to Receive Foreign Payments: Setting Up a Foreign Account for Businesses and Freelancers

- Setting Up a Domiciliary Account for International Transactions

- Managing Currency Exchange: Tips for Freelancers Working with International Clients

- The Best Solution: Sendsprint for Business.

Whether you’re a small business owner, freelancer, or entrepreneur with customers and clients in the UK, US, and Canada, these classes will provide you with the knowledge and skills you need to take your business to the next level. Don’t miss out on this opportunity to learn from industry experts. REGISTER HERE

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2024.

Don’t forget to:

- Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com