Good Morning 😃

How are you doing?

This week’s newsletter was inspired by a chapter in the book we are currently reading in our community. The title of the book is “Just Keep Buying” by Nick Magiulli. It is a simple read, and I strongly suggest that you find time to read the book.

Nick the author looked at one of the greatest “lies” told in personal finance. The lie is that one can become wealthy by cutting expenses to the bone. Achieving financial freedom does not only need discipline, but a combination of discipline with growing one’s income and investing.

So what are the other lies (I prefer the word “myths”) that we tell ourselves?

“I will start investing when I have money”

As you progress in your career and start to earn more, your definition of “big money” increases. You will keep shifting the goalpost.

You can start investing with any amount of money once you have set aside money for your essentials and emergency fund.

A multiplicity of apps means you can start investing and saving with as little as $5 or N5,000.

“I’m too old to start investing”

There is no such thing as being too old to start investing (especially if you have no savings or investments of any kind).

Advances in medicine and better lifestyle means that people are living much longer and leading more productive lifestyles. Regardless of your age, there is always a productive niche.

“Insurance is a scam”

That’s also a big lie. Although the claims payment process can sometimes be slow. Insurance can and should be written simpler. At its core, though, insurance is and will always be a viable option. The absence of insurance means any losses that come to pass will be sorted from your pocket. So why not at least have an option or multiple options? Not every insurance firm is difficult.

“Investing must be complex”

I must admit that there is a wide variety of investment options, some of them so esoteric even for finance people. This, however, doesn’t mean that you have to invest in all of them, or any of them.

The best of investors and asset managers would advise you to keep your investments simple.

The three biggest ingredients that you need are consistency, continually increasing your income and diversification.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

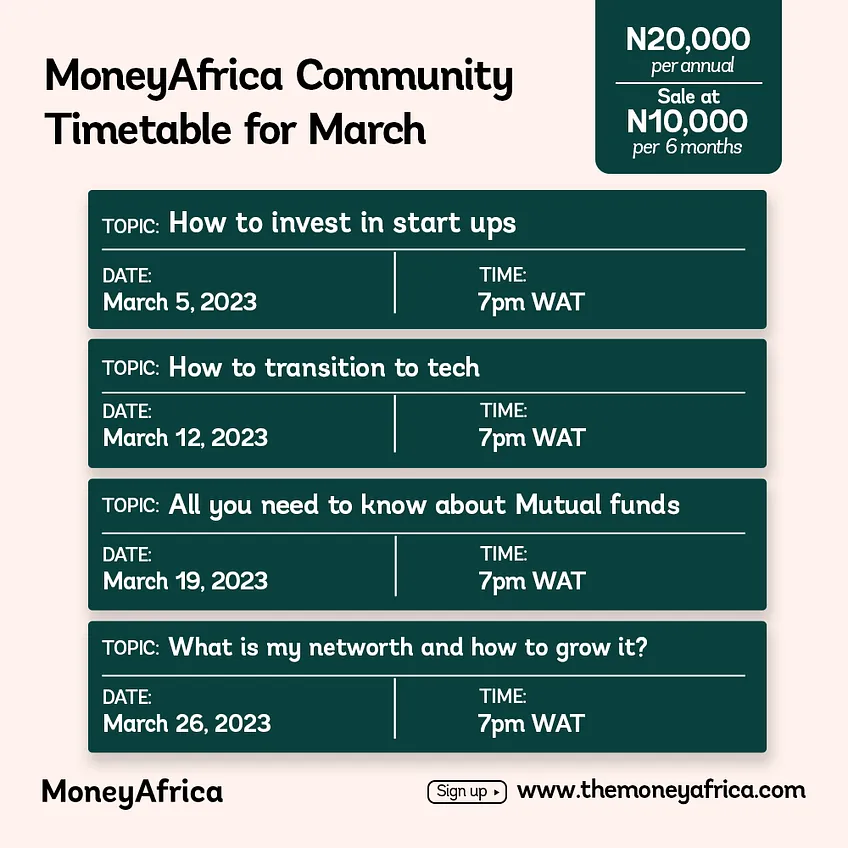

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com