Friday letters are usually dedicated to taking questions from our community. Do you have a question for us?

Kindly follow our Instagram backup page here to stay in the loop and keep the conversation going!

Please feel free to:

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

Can you help me understand how dollar-cost averaging is beneficial and useful to me?

Answer

Think about dollar-cost averaging approach as an investment strategy—one that divides your investments into smaller bits at regular intervals regardless of how small or large the total value of the asset is and also regardless of any market fluctuation. This investment approach is big on consistency, which is a key principle every serious investor should follow. So, instead of purchasing shares at a single price point, with dollar-cost averaging, you buy in smaller amounts at regular intervals, regardless of price. The idea behind this is that by doing this, you will be buying at different rates and will even out the market value and risk, especially as no one can predict what will happen in the future.

How does dollar-cost averaging work?

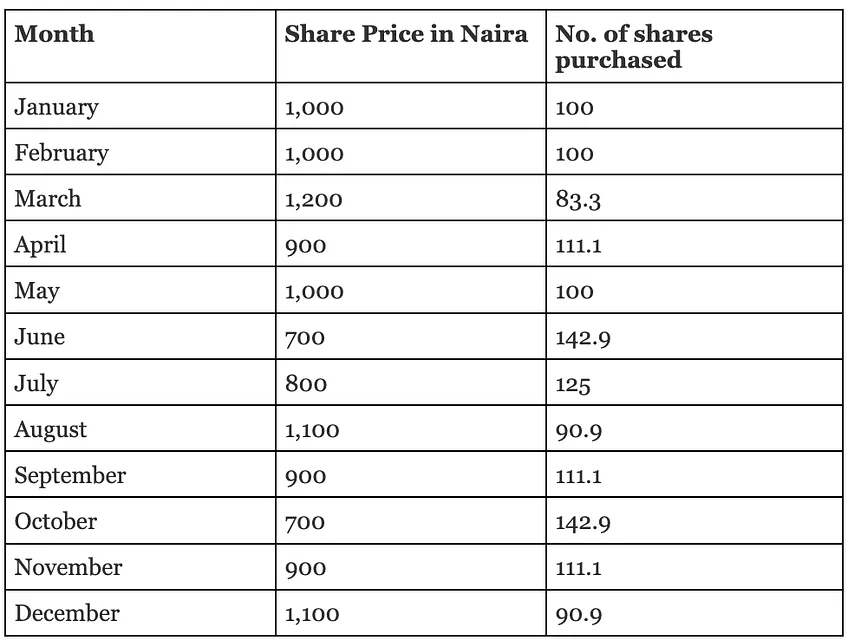

Let’s assume you have N1.2 million to invest in an asset like a company’s stocks, here are two options before you. You can decide to invest all of the N1.2 million at the current market of the shares or you can go through the dollar-cost averaging method which suggests you divide your investment into smaller bits and buy whatever amount of shares the market allows you to based on the value of the share. You can decide to save N100,000 per month for a year to exhaust the entire N1.2 million. Here is a table that illustrates how the dollar-cost averaging works:

In the example above, if you bought a lump sum of the investment at the market price of 1,000 per share in January, you would have bought 1,200 shares which is fine. However, if you spread out your investment like dollar-cost averaging suggests, your average market price per share would be N941.67! This means you would have saved about N58.33 a share and would own 1,309 shares by the end of the year. This is the power of the dollar-cost averaging method. It affords you the opportunity to buy more when the prices are low, and less when the prices are high. The upside to this technique is that it amounts to lower average price when the market is volatile.

I understand how it works now, but how is it beneficial to me?

I can tell you this for free, the stock market has a volatile environment and can fluctuate either ways depending on foreseen and unforeseen events.This simply means share prices go up and down. However, in the long run share prices tend to trend upwards and by sharing your investments, you maximise your chances of paying a lower average price over time. You will be protecting your assets against sharp market fluctuations while still earning long-term profits. You also decrease your exposure to the risk of paying too much for a stock even in a case where the prices drop. In a case where the value of the asset decreases shortly after, this technique saves you from losing significant amounts of money.

As illustrated in the table above, this technique could give you the opportunity to buy more shares. My best part about this technique is how it gets your money to work for you on a long-term basis. It cultivates that consistent nature every investor should have. It also takes off the constant worry and overwhelming feeling that could come with figuring out the right time to invest. Instead of stalling, you can get started with this technique and let it work its magic.

Another benefit of this approach is how effective it is in allowing you as an investor to adjust your investment strategy and customise it to your current situation and pocket. When you make a lump sum, you do not always have that luxury. This can help you reach your financial goals in due course.

You mean there are no downsides to this technique?

As much as there are pros of using this technique, it is important to also touch on the cons attached to it to give a balanced perspective to this topic.

Here are some of the downsides to using the dollar-cost averaging technique:

- Higher fees: Since you have to invest multiple times as opposed to the lump sum technique, which is done once and for all, you could be paying a much higher accumulated transaction fee which could eat into your investment gains. To work around this, do your research and be sure of the fees associated with every transaction you will be making, and make a decision based on that.

- Risk and Return: As an investor, one basic principle to always note is that with lower risk, comes lower potential returns. The dollar-cost averaging technique aims to spread your risk, and this could reduce your overall returns, especially when compared with what is attainable using the lump sum technique.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2024.

Don’t forget to:

- Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com