Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to send an e-mail to info@themoneyafrica.com; or send a DM to any of our social media channels, or simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

I am always scared of my financial future. Is this normal??

I grew up in a poor background where things were tough. After six years of consistent hard work, I am now financially buoyant and earn up to N1.5m working remotely. My monthly expenses are not up to N400k but I am still scared, considering the volatility of the industry I work in.

Answer

I totally understand where you’re coming from. Growing up with financial struggles can leave a lasting impression on how we view money and security. It’s completely understandable to have fears about going back to that place or losing what you’ve worked so hard to achieve.

It’s important to remember that you’ve come a long way. You’ve put in six years of consistent hard work and have managed to become financially stable. That’s a huge accomplishment! It’s normal to feel a bit scared, but try not to let it overshadow your success and the progress you’ve made.

Instead, focus on what you can control by doing the following:

- Create a financial plan: Develop a comprehensive financial plan that includes saving, investing, and contingency measures (i.e. have in place an emergency fund to effortlessly fund any form of emergency when it arises). It is advisable to have 3-6 months of your monthly expenses saved up as an emergency fund. Having a solid plan in place can provide a sense of security and direction.

- Build an emergency fund: Set aside some money in an emergency fund that can cover your living expenses for several months, advisably 3-6 months. This safety net can offer peace of mind in case of unexpected events or downturns in your industry.

- Diversify your income sources: Consider exploring additional streams of income or diversifying your skill set to reduce dependency on a single source. This can help mitigate the risk associated with industry volatility.

- Stay informed and adapt: Keep yourself updated about industry trends, technological advancements, and any potential changes that could impact your field. Being proactive and adaptable can help you stay ahead of the curve and navigate challenges more effectively.

- Seek professional advice: Consider consulting with a financial advisor. You can book a one-on-one session with us and you’ll be linked with one of our professionals who can offer personalised guidance based on your specific situation and goals. They provide valuable insights and help you develop strategies to manage and grow your wealth.

***

Question

How can you help me in managing my finances? I am a spendthrift and it’s not like I even earn much. I do not even spend it on myself. I cannot remember the last time I bought anything for myself. However, I have actually realised that I cannot keep money. I have tried to budget on my own but it’s not working.

Answer

It’s great that you’ve recognised the need for assistance, and I’ll do my best to guide you. Consider the following:

- Track your expenses: Begin by tracking all of your expenses for a month. This will give you a clear picture of where your money is going and help identify areas where you may be overspending. You have to track every single thing that you buy, even bottled water that costs you just N100.

- Create a realistic budget: Emphasis on ‘realistic’! Based on your tracked expenses, create a budget that reflects your income and financial goals. Allocate specific amounts for necessary expenses (rent, utilities, groceries) and set limits for discretionary spending (entertainment, dining out). Ensure you include savings as a priority within your budget. It’s advisable to use the 50:30:20 rule—50% of your income goes to your needs, 30% to your wants and 20% to your savings.

- Identify spending triggers: Reflect on what prompts you to spend impulsively. Are there certain emotions, situations, or triggers that lead to unnecessary purchases? Understanding your spending patterns can help you develop strategies to overcome impulsive buying behaviours.

- Implement strategies to curb spending: Consider adopting techniques like the 24-hour rule (wait 24 hours before making a non-essential purchase) or the envelope system (allocate cash into different envelopes for different spending categories identified in your realistic budget). These methods can help you think twice before spending and encourage more mindful consumption.

- Automate savings: Set up automatic transfers from your bank account to a dedicated savings account or savings app. I would recommend saving with a HYSA (High-Yield Savings Account) of which Ladda is one. The difference between Ladda and a traditional bank savings account is that it offers a higher rate of return. You can download the Ladda app and start saving today. It is available for both iOS and Android users. By automating your savings, you ensure that a portion of your income is consistently set aside before you have a chance to spend it.

- Seek accountability and support: Consider finding an accountability partner or joining a financial support group. The MoneyAfrica community is a great example of a financial support group and you can join us by sending a DM on Instagram. Sharing your goals and progress with someone else can help you stay on track and receive valuable feedback and encouragement.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

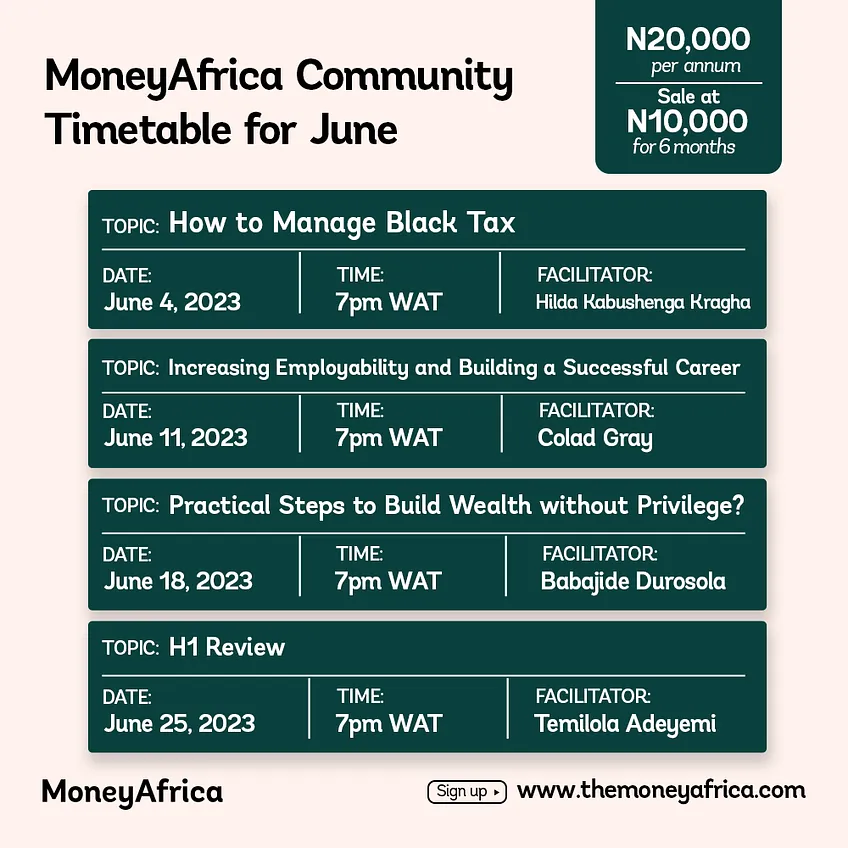

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.co