Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

I have N300k in my savings and a long-term debt of N1.5m. My salary is N239k but due to the debt, I receive only N173k. I’m planning to level up my looks (N400k has been spent on my looks so far. I’m to balance N300k). It is paying so far. I want to know how to use and invest funds with my current income so I can truly be financially stable and debt-free. What investments can I do with about N200k? I also want to keep N100k for emergencies. I have issues with discipline, though.

Answer

First things first. It’s excellent that you’re setting aside N100k for emergencies. Having that safety net is super important. Now, let’s talk about that big debt of N1.5m. We need to tackle it head-on. Alright, tackling that big N1.5m debt might seem daunting, but you’ve got this! Start by looking at the debts with the highest interest rates—they’re the real troublemakers. Clear those out first.

Now, let’s make a plan. Write down all your debts, how much you owe, and the interest rates. This visual can help you see the big picture. Some folks like the “snowball” method, starting with the smallest debt and working up. It feels like quick wins. But if you’re all about saving money, the “avalanche” method is your friend—pay off the debt with the highest interest rate first.

Finding extra cash to throw at your debt is crucial. Maybe it’s time to trim some expenses. Also, look for ways to make more money, like a side gig or asking for a raise. If things get tough, don’t be shy to chat with your creditors. They might cut you some slack.

Discipline, particularly in managing finances, can be very challenging and I understand that. A helpful strategy to navigate this challenge is crafting a budget. Numerous user-friendly mobile applications are available to help with this process such as Expensify, Inflow, and Sparkle, to name a few. These applications offer insights into your spending habits, categorise expenses, and provide a visual representation of your financial situation, thereby assisting you in adhering to your financial goals.

In addition to setting up a budget, it’s essential for you to identify areas where a significant portion of your income is being consumed and when doing this, please be honest with yourself. Once these areas are recognised, you can explore strategies to either minimise those expenses or, ideally, eliminate them entirely. This proactive approach can further help you to take control of your finances and allocate your income more effectively.

What I’d advise, at least for now, is to focus on clearing out your debt. It’s good that you’re thinking about investing, I love that, but it’s important that you take debt repayment as a priority. This is to avoid a situation whereby the pressure from the debt repayment would make you sell your investment assets at a loss. When you’re done repaying your debt, you can dip your toes into the stock market. Think about investing in companies or exchange-traded funds (ETFs) to spread the risk. Real estate can be a good play too. Look into local property or Real Estate Investment Trusts (REITs). These can be solid investments over time.

This isn’t a race. Investing is a marathon, not a sprint. Stay patient, and don’t rush into decisions. Diversify your investments—don’t put all your eggs in one basket. Consider talking to a financial advisor and that’s what MoneyAfrica is here for! We can give you personalised advice based on your goals.

***

Question

I’m 19 and I feel time is slipping away quickly. I’m going to my 300 level in the university. What I’m studying (International Relations) has been my goal from a very young age. I’ve been procrastinating on starting a YouTube channel to share some topics I’m being taught in class to enlighten people. I’m not just strong on my motive for doing it. How do I get that drive?

Answer

I understand where you’re coming from. It’s not uncommon to feel like time is slipping away, especially when you’re in college and have big aspirations. Starting a YouTube channel can be an awesome way to share your knowledge and passion for international relations, but finding that motivation can be a challenge.

So, let’s break it down. Setting clear objectives for your YouTube channel is crucial. When you define specific, achievable goals, it gives you direction and keeps your motivation high. Breaking down the process into manageable steps reduces the initial burden. With a step-by-step plan, you can confidently tackle each task, knowing you’re making progress.

Consistency is a key factor in building a successful YouTube channel. Sticking to a regular upload schedule keeps your audience engaged and your motivation intact. Choosing topics you’re passionate and knowledgeable about, like international relations, elevates your content’s quality and authenticity, making it more engaging for viewers. To beat procrastination, treat your YouTube channel like a regular commitment and consider an accountability partner or group for support.

Pursuing your degree and performing well in your classes should be a priority. It’s a valuable investment in your future, and it’s a goal that must be achieved. Now, the key to starting a YouTube channel alongside your studies is finding a harmonious balance. Time management will be your best friend here. First, take stock of your class commitments and any other responsibilities you might have. Understand your schedule, identify your peak productivity hours, and allocate time for studying and attending classes.

Once you have a clear picture of your academic commitments, you can carve out dedicated slots for working on your YouTube channel. Consider starting small, perhaps with one video a month or even one every couple of months. This allows you to get a feel for content creation without overwhelming your schedule. As you become more comfortable with the process, you can gradually increase your output.

Another valuable approach is to integrate your YouTube content with your studies. Since you’re passionate about international relations, explore how you can create videos that align with your coursework. This not only reinforces your learning but also makes your content creation feel more purposeful.

Did you find this newsletter useful? You can read previous newsletters here

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

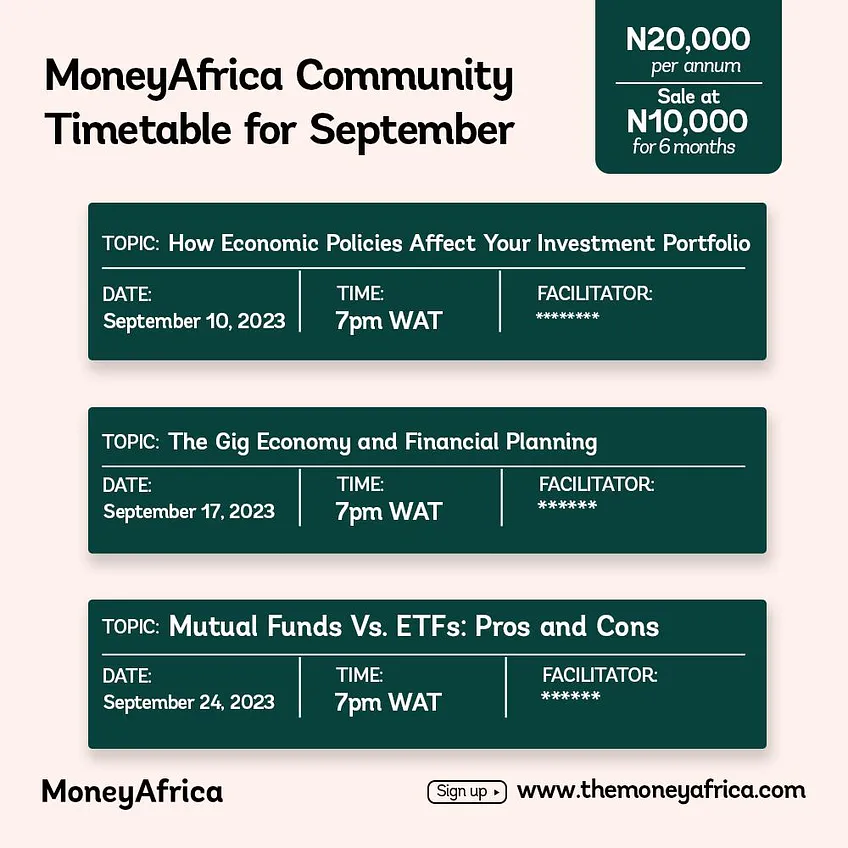

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com