Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

**

Question

Is it preferable to save according to targets (e.g. for rent) or just save freely?

Answer

When it comes to savings, two things must be of priority:

- emergency savings

- short-term goals-based savings (rent, vacation, etc.)

Only freely save if it falls into either of these two buckets. Once you have your emergency fund and have saved towards important goals, you can start investing for the long-term towards wealth creation.

Otherwise, you are not putting your money to good use.

***

Question

I joined MoneyAfrica because I really needed a lasting solution to my financial problems.

I have a debt burden of over N5 million taken from different financial institutions and payment apps. In early 2021 post covid, the organisation I worked with lost a bid for the execution of a donor-funded project, and this led to the loss of my job.

During this period, my wife was pregnant, and the pregnancy was diagnosed with a deadly infection that was rare (with only less than a 5% survival rate globally). Before now, we had lost three babies at birth after the first one in 2015 (he is 7 years old now).

During this period, I neither had any HMO nor money for medical bills. The little savings and investments I had prior to the loss of my job were all liquidated in the crypto trade.

The pregnancy and medical situation kept us at the hospital for three months in intensive care and in contact with surgeon consultants, pediatric consultants, etc.

By the grace of God, the baby survived and was discharged from the hospital two months after birth and one month prior to staying.

I got another job in late 2021 with a salary of about N500,000 per month. My wife does not work but she bakes cakes and makes small chops. The issue is that her customer base is still very small.

All the bills, school fees, rent, everything is centered on my 9–5 salary. If I am to pay all the institutions I owe monthly, my gross salary will not be enough. Please, how do I manage these debts and still live a happy life? I was depressed for the whole of 2022 despite working and having a salary.

I started 2023 with a negative account balance. As we speak, almost 80% of my expected January salary is already spent minus loan repayment. At some point in 2023, I contemplated suicide but then, to what gain would it be to me?

I am stuck in a deep hole, and I need help. I have considered consolidating my loans to a single institution so that my repayment can be streamlined, but all the loans have gone into bad debt, and I am no longer qualified for any loan due to a bad report on the credit bureau.

Please, what can I do?

Answer

It appears that the main problem you are facing is crippling debt. The main solution for you is to find some debt relief. You need to find a way to reduce your monthly interest payments to levels that your income can sustain. Growing your income as a remedy is difficult because it takes time, and you won’t even be in the correct frame of mind as long as your debt issues persist.

Please do well to consider any of these actions to control your debts.

- Discuss with the financial institutions you owe

You might contact the financial institutions you owe money to explain your circumstances, and ask if they can provide you with a debt management plan or other solutions like debt reduction or extension of the maturity of the debt to reduce monthly interest payments.

- Contact a credit counselling organisation

These groups can give you a budget, assist you in settling debts with creditors, and develop a strategy for paying off your debts.

- Consult your employer

Think about telling your employer about your financial predicament and seeing if there are any options for modifying your compensation or benefits to help you manage your debt obligations.

- Ask for legal counsel

You could have some legal choices that a lawyer can advise you on, but be careful about legal costs.

- Create a strategy to boost your income

Think about ways to enhance your income like getting a side hustle or part-time work. This can help you pay off your debts more quickly and improve your overall financial status. However, this takes time to achieve and highly depends on your skills.

In conclusion, you can also consider talking to friends and family, as they could be a great support system.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

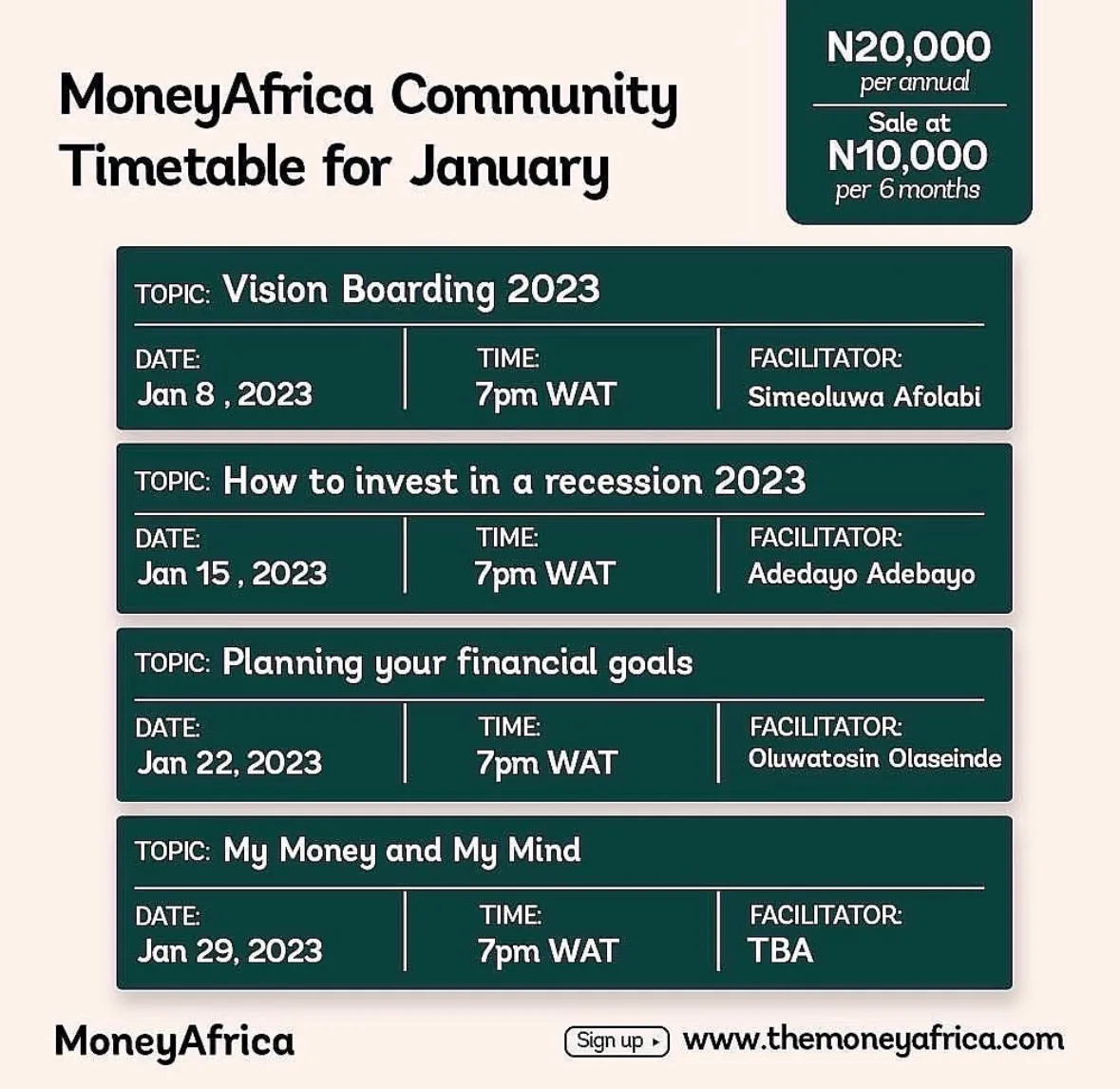

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com