Good Morning 😃

How are you doing?

Just as Nigeria entered a new phase with the anticipation of a new administration, an unexpected announcement greeted the nation that resulted in a surge in fuel prices. According to the newly released NNPC template, the pump price in Lagos will now be set at N488 per litre, while in Abuja, it will be sold at N537. The national oil company has also released new prices for PMS in other states as part of its deregulation policy. This increase in fuel prices has sparked a surge in transport fares across the country, leaving many commuters stranded.

With this new rate, most people now spend three times the amount initially budgeted for fuel on transportation. This hike will not only result in an increase in the prices of goods but also push more Nigerians below the poverty line. It is worth noting that the 2022 Multidimensional Poverty Index survey reported that 63% of individuals in Nigeria (133 million people) are multidimensionally poor. Given this new price, how can you ensure that your transportation budget remains manageable, thus safeguarding your overall financial stability?

Access your transportation need:

Evaluate your transportation needs and identify areas where you can reduce or optimise your fuel consumption. Consider carpooling, using public transportation, or combining errands to minimise the number of trips you need to make.

Budget for increased fuel expenses: Review your budget and allocate additional funds specifically for increased fuel expenses. Adjust your spending in other areas if needed to accommodate the higher fuel costs.

Maintain vehicle efficiency:

Ensure that your vehicle is well-maintained to maximise fuel efficiency. Regularly check tire pressure, perform scheduled maintenance, and keep up with oil changes. A well-maintained vehicle consumes less fuel.

Consider downsizing to a smaller vehicle:

Smaller vehicles are typically more fuel-efficient, requiring less fuel to travel the same distance compared to larger vehicles. By opting for a smaller vehicle, you can potentially save on fuel costs in the long run.

Carpool or share rides:

Consider carpooling with coworkers, friends, or neighbours who have similar destinations. Sharing rides not only reduces fuel expenses but also helps decrease traffic congestion and lowers overall carbon emissions.

Explore alternative modes of transportation:

Look for opportunities to use alternative modes of transportation, such as walking for short distances or using BRT (Bus Rapid Transit) systems, which use diesel and have controlled prices. Not only will this save you fuel costs, but you also enjoy health benefits when you trek.

Combine trips and errands:

Plan your trips strategically to combine multiple errands into a single outing. This reduces the number of separate trips you need to make, thus saving fuel.

Practice fuel-efficient driving habits:

Adopt fuel-efficient driving habits such as driving at a consistent speed, avoiding rapid acceleration and braking, and using cruise control on highways. These habits can significantly improve your vehicle’s fuel efficiency.

Consider remote work or flexible schedules:

If possible, explore options for remote work or flexible schedules to reduce the frequency of commuting. This can help minimise your fuel expenses during the season of increased fuel prices.

As the cost of fuel continues to rise, it’s essential to navigate this season of increased spending with careful planning and informed decision-making. By implementing the strategies and tips outlined in this newsletter, you can proactively manage your finances, mitigate the impact of fuel hikes, and stay on track toward your financial goals.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

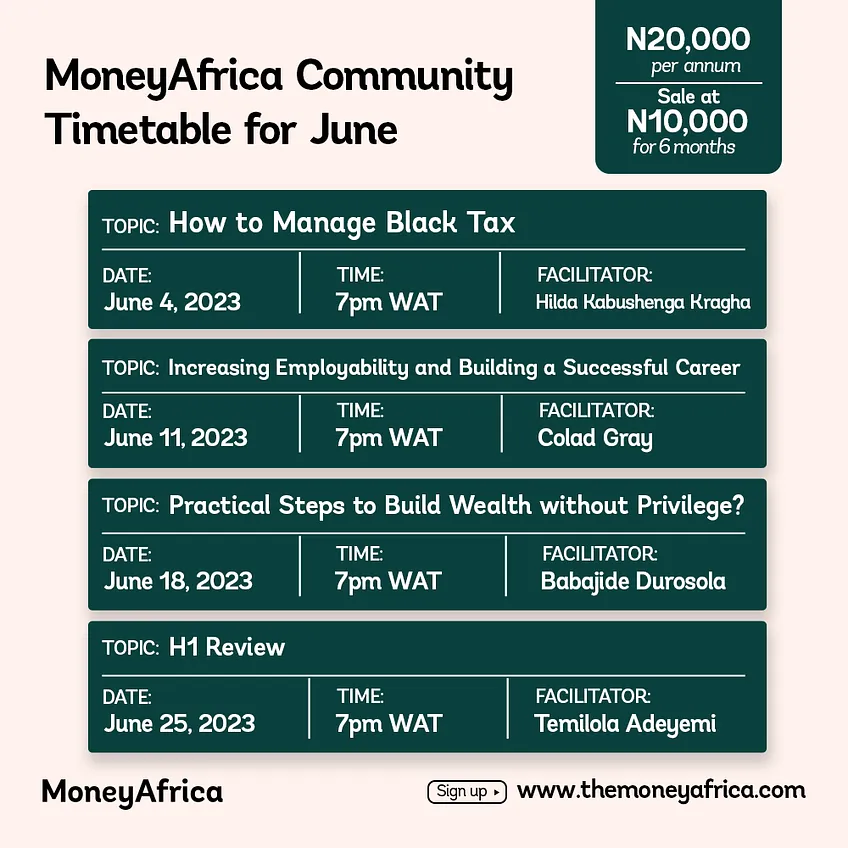

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.co