Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

**

Question

How do I say “no” to family needs?

Most of my finances are spent on family members. How do I curb this to enable me to have savings?

Answer

Saying “no” to family needs can be a difficult and delicate situation, but it is important to prioritise your financial stability and well-being.

Note that you can’t avoid helping family, but you can set guidelines or boundaries.

Some steps you can take to help curb your spending on family members and start saving are discussed below:

Evaluate your financial situation: Take a closer look at your income, expenses, and debts. This will help you understand how much you can realistically afford to spend on your family members and still have enough left over for your own needs and savings.

Set boundaries: It is important to set boundaries and communicate them clearly with your family members. Let them know what you can and cannot afford to do for them. Be honest and firm, compassionate and understanding.

Prioritise your own needs: Make a list of your own financial goals and needs such as saving for retirement, paying off debt, or building an emergency fund. Use these goals as a guide for your spending decisions.

Offer alternative solutions: If you are unable to provide financial assistance to your family members, offer alternative solutions. For example, you could help them with budgeting or financial planning, or offer to help them find other sources of support.

Seek help from financial experts: If you are struggling to say “no” to family needs, seek outside help from a financial advisor at MoneyAfrica. We can provide you with additional support and guidance on managing your finances and communicating with your family members.

***

Question

I have about N200,000 to start a business (physical product) but I’m afraid to start now as I have a few months to graduate from school, which means that I’d be changing location. What can I do since I do not want to fix the money till after school?

Answer

If you have concerns about starting a business while you are still in school and potentially relocating soon, there are a few options you could consider:

Wait till school is over:

Since you have just a few months to graduate from school, why not just wait till school is over before you start your business?

After school is usually NYSC for most people. It’s a great option to start your business during your NYSC as a side hustle alongside your work from your place of primary assignment.

Start small:

Rather than launching a full-scale business, consider starting small as a side hustle or a hobby that can generate some income. This can help you test out your product idea and build up some experience before launching a full-scale business.

Focus on building your brand:

Even if you’re not ready to launch your business right away, you can still start building your brand and developing your marketing strategy. This can include creating a website or social media presence, networking with potential customers or partners, and developing a marketing plan.

Consider online sales: If you’re worried about relocating and the impact it may have on your business, consider selling your product online. This can help you reach a wider audience and give you more flexibility in terms of location.

Look for funding options: If you’re not ready to launch your business yet but don’t want to leave your money sitting idle, you could consider investing it in a high-yield savings account or other low-risk investment. Alternatively, you could look for funding options that are specifically designed for small business owners such as microloans or crowdfunding.

Ultimately, the decision to start a business while you’re still in school and potentially relocating soon is a personal one that depends on your individual circumstances and goals. It may be helpful to talk to other entrepreneurs or seek advice from a mentor or business coach to help you make the best decision for your situation.

Amazing news!

We’re giving away cervical cancer kits to celebrate International Women’s Day.

To participate in this giveaway, kindly follow these simple steps:

Step 1: FOLLOW @moneyafrica and @healthtracka on IG

Step 2: LIKE this post and SHARE it on your Instagram story

Step 3: Tag two female friends in the comment section of this post who you think would benefit from this kit.

That’s it! We’ll randomly select ten lucky winners.

***

Also, we recently started a new street interview series called “10 Questions with MoneyAfrica.”

Click this link to check it out.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

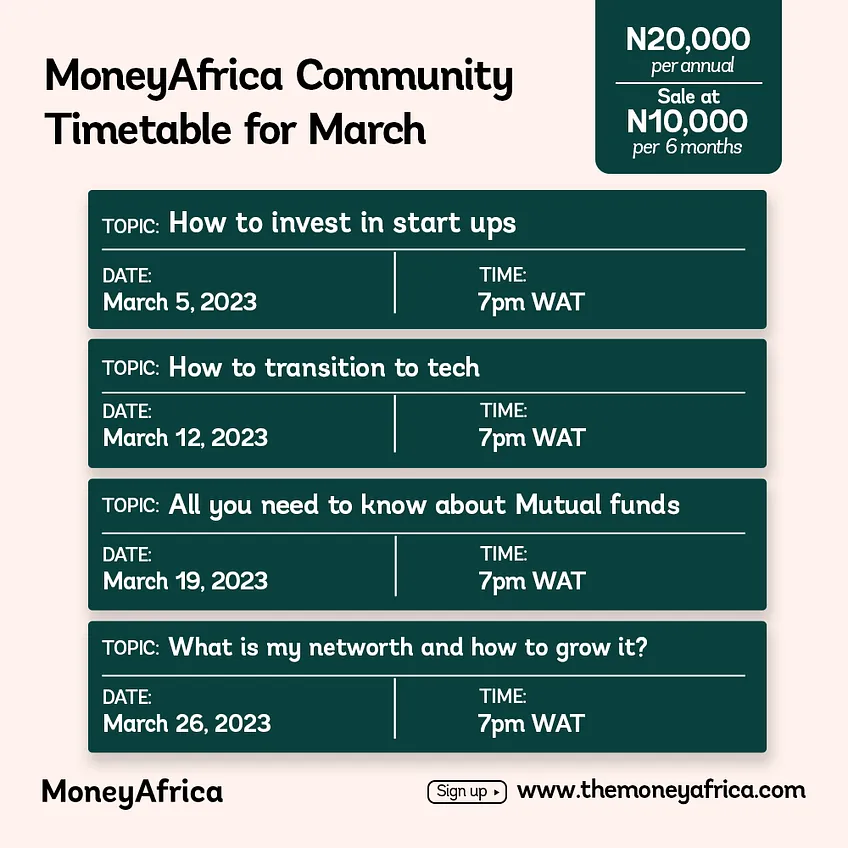

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com