Good Afternoon 😃

Around this time last year, I ordered journals for 2023.

For me, 2023 was the year I committed to achieving all my set goals.

However, we were welcomed by a cash crunch in January, followed by elections in February, subsidy removal, forex unification, and other challenges.

To be honest, the “gbas gbos” this year was just too much, but here we are in December.

If you’re feeling down because you didn’t quite hit your 2023 financial goals, take a deep breath and relax. You’re not alone.

Not everyone managed to check off everything on their list, and that’s okay. Life has a funny way of throwing us curveballs, and sometimes our plans just don’t pan out the way we hoped.

But here’s the thing: It’s not the end of the world. You’ve got a whole new year ahead of you, and it’s the perfect opportunity to turn things around and set yourself up for financial success in 2024.

So, let’s talk about how you can ensure that 2024 is the year you finally achieve the financial freedom you’ve been dreaming of. It’s time to take control of your future and set yourself up for success. Here are 5 things you need to start doing to ensure you finish 2024 on a high note and achieve your financial goals:

- Create a Clear Financial Plan: The first step to achieving financial freedom is to have a clear plan in place. Take some time to sit down and assess your current financial situation. What are your income sources? What are your expenses? What are your short-term and long-term financial goals? By clearly understanding where you stand and where you want to go, you can start mapping out a plan to get there.

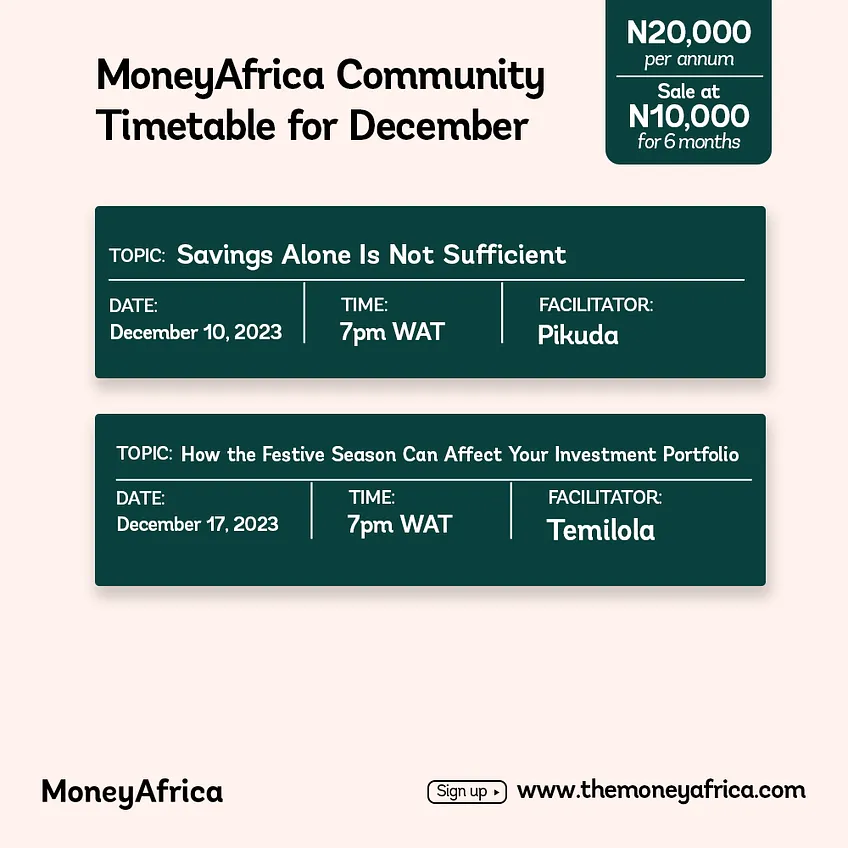

This is why I celebrate those who are part of the MoneyAfrica community. They have a financial journal that comes with their subscription package. “I have my plans in my mind, or in my son’s notebook,” is not a plan. Here is the sign that you need to join us ASAP if you are not already part of the community. Also, take advantage of the ongoing discount. Send a mail to sales@themoneyafrica.com

- Set Attainable Goals: While it’s great to dream big, it’s important to set realistic and attainable financial goals. Break down your larger goals into smaller, actionable steps. Whether it’s paying off debt, saving for a down payment on a house, or investing for retirement, setting specific, measurable, achievable, relevant, and time-bound (SMART) goals will help you stay focused and motivated.

- Invest in Yourself: Investing in yourself is one of the best investments you can make. Take the time to learn new skills, further your education, or pursue certifications that will make you more valuable in the job market. By investing in yourself, you’ll increase your earning potential and open up new opportunities for career advancement.

- Track Your Spending and Budget Wisely: Understanding where your money is going is crucial for taking control of your finances. Take the time to track your spending and identify areas where you can cut back or make adjustments. Creating a monthly budget can help you allocate your income towards essential expenses, savings, and investments. Embrace the mindset of living within your means and prioritise your financial goals over unnecessary expenses.

- Hustle Harder: If you want to change your financial status in 2024, you’re going to have to put in some extra work. Whether it’s picking up a side hustle, taking on freelance gigs, or putting in extra hours at your current job, finding ways to increase your income is key. Look for opportunities to leverage your skills and talents to bring in some extra cash. The more you hustle, the closer you’ll get to reaching your financial goals.

So, there you have it. 2023 might not have been your year, but 2024 is a clean slate waiting for you to make your mark. By creating a clear financial plan, setting attainable goals, tracking your spending, hustling harder, and investing in yourself, you’ll be well on your way to achieving financial freedom in the year ahead. It won’t be easy, but with determination and a solid plan, you’ve got this. Here’s to making 2024 your best financial year yet!

If you need help with how you can structure your investment for next year, send an email to sales@themoneyafrica.com

Also, don’t forget to take advantage of our REITs investment returning 20% per annum.

To learn more about this, use the link below.

Did you find this newsletter useful?

You can read previous newsletters here

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com