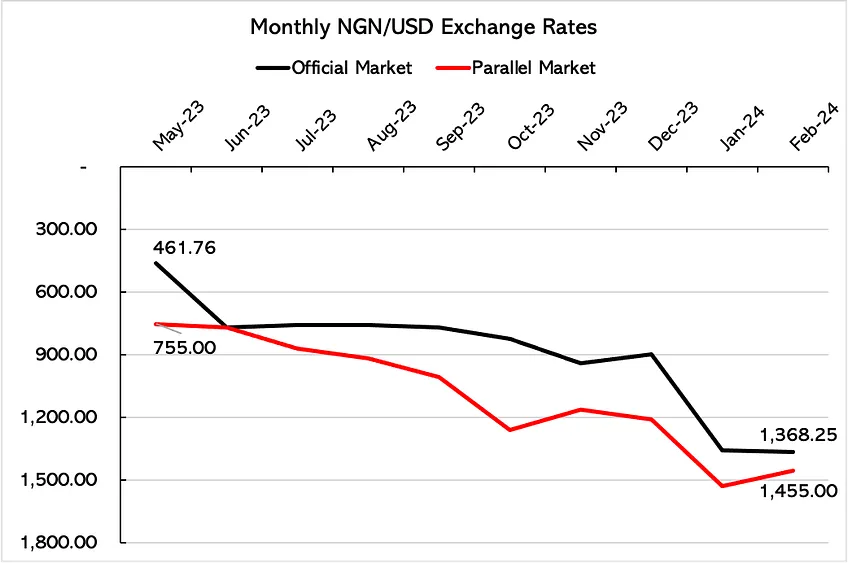

There has been concern about movements in the Naira to USD exchange rate over the past few months. This concern is not unusual, as the exchange rate matters for our purchasing power and the investing decisions we make.

The recent movements in the exchange rate has been driven by reforms embarked upon by the new government and the CBN. Upon resumption of office in mid-2023, the new administration signalled its intentions to correct the huge differential between exchange rates in the official and parallel markets by allowing buyers and sellers to trade freely and at the prices they want.

These changes have led to a free fall in the exchange rate.

The depreciation in the NGN/USD exchange rate and the volatility in the official FX market since the new government came into office have been unprecedented.

Source: MoneyAfrica, CBN Data

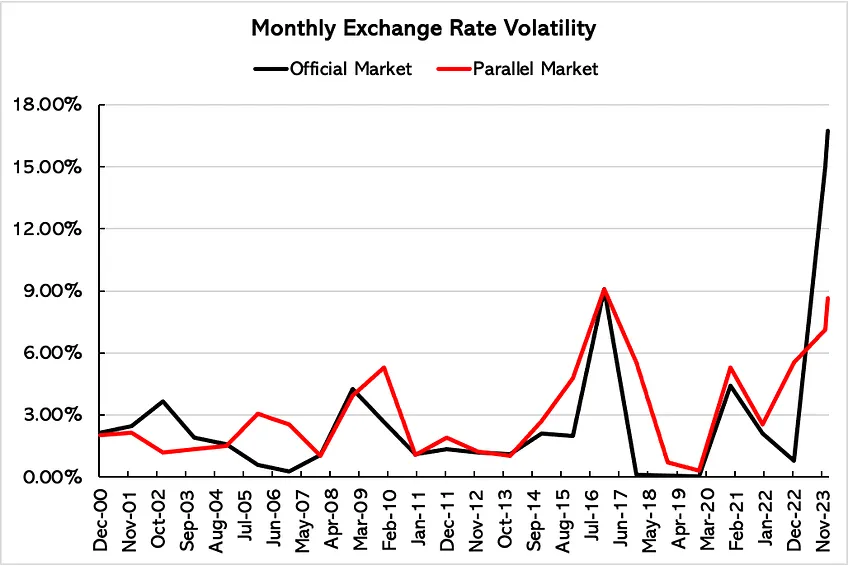

How Volatile Has the Exchange Rate Been?

Our measure of volatility considers the extent of exchange rate depreciation over what is normal (the average) for a period. When there is stability in the exchange rate, like in 2018, then volatility is close to 0%. The higher the rate, the more volatility there is.

This measure suggests that monthly volatility in the official market reached a peak of 16.7% in January 2024, the highest on record using data from 2000. This is unsurprising, as the exchange rate in the official market was highly repressed prior to June 2023.

In the parallel market, monthly volatility was 8.6% in January 2024, the highest since December 2016.

Source: MoneyAfrica, CBN Data

Why Is a Volatile Exchange Rate a Big Concern?

We try not to obsess too much about the exchange rate, but in periods of massive volatility, everyone is forced to pay attention.

While the exchange rate depreciation does not translate to price increases on a 1:1 ratio, its impact is significant in some areas more than others.

Consider energy prices like petrol and electricity, which are subsidised and have huge dollar costs. Petrol pricing, for instance, is purely dollar-denominated, save for local transport costs, which are negligible. These energy prices are highly sensitive to exchange rate movements and have a massive impact on inflation.

Overall inflation increased from 22.4% in May 2023 to 28.9% in December 2023. And food inflation is much worse, increasing from 24.8% to 33.9% over the same period. In practical terms, this means that food prices will double every two years. This is not sustainable.

More Policy Changes in the FX Market

In the past one week, the CBN has issued circulars on new regulations around the FX market.

One of the circulars was focused on enabling more flexibility for trading FX and making the exchange rate more reflective of market conditions. This is why the exchange rate in the official market depreciated by 33.7% from N899/USD to N1,357/USD in a day.

With another circular, the desire for more flexibility extended to the exchange rate quoted by International Money Transfer Operators (IMTOs) who facilitate remittances. The cap on the exchange rate has been lifted, giving them the freedom to quote rates that best reflect market conditions. With this, we believe the CBN is aiming to encourage more inflow of remittance dollars through official sources and better price discovery (exchange rate in tune with demand and supply).

Then the CBN came for the banks, which have been instructed not to bet on the USD against the Naira. Nigerian banks have been declaring huge gains because they have more dollar assets than liabilities. They are now expected to bet on the Naira, or at worst, stay neutral. It remains to be seen how fast banks can change course and how it will impact the market. However, we believe that when market participants (individuals and corporations) are incentivised to bet on the dollar, their behaviour cannot be completely changed by fiat.

Will These Changes Bring Stability?

These new policy changes in the FX market make sense. However, we believe it will not bring automatic stability.

The volatility in the exchange rate has been driven by many factors that do not inspire confidence or incentivise economic agents to hold the naira.

The CBN’s external reserves are constrained by FX liabilities and a huge backlog of FX obligations to investors, airlines, banks, and other corporations. While the CBN governor announced in an interview with Arise TV on Monday that they have made progress in clearing these obligations, the nature of their approach and the outstanding obligations do not completely ease concerns. The Governor mentioned that $2.2 billion remained unsettled in outstanding obligations of $7.0 billion, while around $2.4 billion were not genuine claims.

On the policy front, the sustained expansion of money supply and low-interest rates relative to the inflation rate continues to drive up demand for USD. If investors can earn around 4.6% investing in US securities for a year, which gives a real return of 1.1%, then they would expect at least a 30.0% return to invest in Nigeria.

Meanwhile, the Federal Government is embarking on another record of spending in 2024 which is unsupported by revenues and will most likely be financed by borrowing from the CBN for any decent chance at a strong implementation.

With all of the above issues unresolved and oil exports still extremely poor, the NGN/USD exchange rate will continue to be under pressure.

What Does This Mean for Consumers and Investors?

It means more hardship in 2024, unless policy makers resolve the issues that can bring stability.

The prices of consumer items will continue to increase and hurt household budgets. If you are not expecting any income increases, this would affect your ability to save and invest. Finding ways to increase income and contain expenses, such as bulk buying of durable items, for instance, will be helpful.

For those who want to invest, the case for investing outside Nigeria and in USD remains strong.

Will the CBN Convert Domiciliary Account Balances to Naira?

Citing anonymous sources from the Presidency, The Punch reported last week that the Federal Government was considering a conversion of domiciliary account balances to Naira to support the exchange rate.

This was quickly refuted by the CBN in a statement where they restated their intention to continue to boost confidence in the currency and the economy.

For us, this is nothing new. Whenever there is an exchange rate crisis, rumours of these poor ideas are common. To their credit, the CBN is always quick to condemn the rumours.

However, the mere fact that it comes up frequently makes holders of domiciliary accounts uneasy. In this case, we encourage people who are looking to protect themselves against a worst-case scenario to explore options offshore.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2024.

Don’t forget to:

- Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com