Bukola and her friend, Ada, love the festive season. Every December, they would go all out buying gifts for family, going to endless parties, travelling and engaging in activities that left their social media glittering with memories. But by January, they always found themselves in the same predicament, drowning in bills and obligations with a near-empty bank account.

Last year was the worst. Bukola had to borrow money just to get through January, which meant starting the year in debt. She vowed to never let it happen again.

This December, Bukola’s approach will be different. She’s still going to have fun, but this time, she’s doing it smartly.

Anyone who has worked the entire year wants to have fun during the festive season. It is the season of fun, concerts, holidays and parties. January is the season of paying bills. It is mostly the time to pay rent, school fees and other expenses. January often arrives with financial hangovers from the holiday splurge. This usually leads to financial stress and anxiety.

Here is how to plan your dirty December without dreading January.

1. Set a December budget: Setting a December budget is an essential first step. This means taking the time to assess your financial situation and deciding how much you can afford to spend without putting your financial needs in January at risk. Start by reviewing your income and essential expenses, then allocate funds for gifts, celebrations, and other holiday-related activities. By clearly defining your spending limits, you can enjoy the festivities without the looming anxiety of a January financial hangover.

2. Automate savings towards the December budget: This means setting up automatic transfers to a savings account specifically designated for your holiday expenses. By doing this, money will be tucked away for your holiday plans without you having to stress over it. This approach will not only allow you to save, but it will also ensure that you have a dedicated fund for unexpected expenses that may arise during the festive season.

3. Prioritise experiences over expensive items: Instead of splurging on the latest gadgets or designer clothes, think about creating memorable experiences with your loved ones. This could be anything from hosting a cosy holiday gathering at home to planning a weekend getaway. These experiences often leave lasting impressions, while material items may quickly lose their charm. You can opt to live stream that concert instead of being there physically. By focusing on what truly matters, you can create joy without breaking the bank.

4. Plan the timing of January expenses: Review your January expenses and see what can be rescheduled or reduced. Consider delaying non-essential payments or negotiating with service providers for temporary payment deferments. This will help manage your cash flow and alleviate financial pressure in the new year.

Enjoy December, but prepare for January. The best time to prepare and save for the holiday season is at the beginning of the year. The second best time is now. Mindful holiday spending can let you enjoy a festive December without sacrificing your January. A few intentional choices now can leave you celebrating well into the new year

***

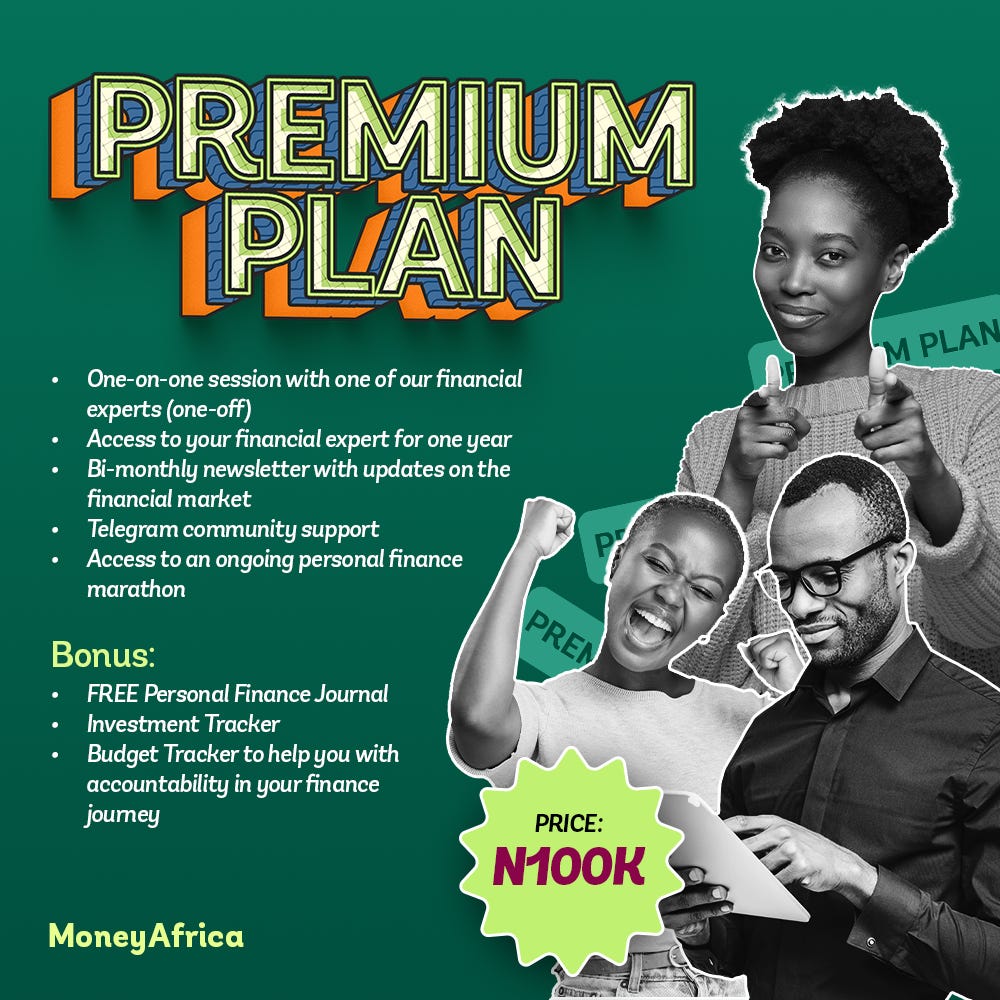

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2024.

Don’t forget to:

- Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com