Question:

Does compounding really work? If yes, how is it beneficial to me?

Answer

Let’s build an understanding of what compounding means before taking a look at the benefits you can gain as an investor from compounding. Compounding refers to earning returns not only on the initial amount invested, but also on the accumulated returns from that investment through the power of compound interest. It is a process through which the initial returns from an investment are reinvested and additional returns are generated over time.

Compound interest is the interest on a loan or deposit that accrues on both the initial principal amount and the accumulated interest generated from that money. It simply means earning interest on previously earned interest. The power of compound interest cannot be underestimated and this is why Albert Einstein referred to compounding as the eighth wonder of the world. It is a vital tool for successful long-term saving and investing. Through compound interest, your money starts making money and over time, this plays an important role in how you grow and build your wealth.

Compounding could be daily, monthly, quarterly or yearly. The bank or financial institution in charge makes the decision on the frequency of compounding.

How does compounding work?

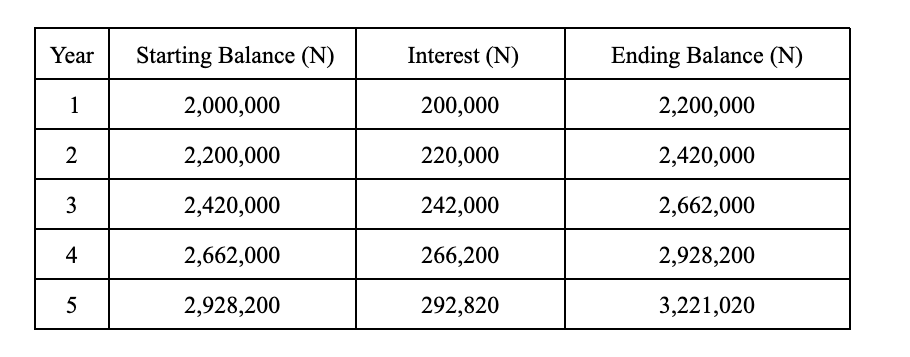

Let’s assume you have N2 million to invest at an interest rate of 10% per year for 5 years. In this scenario, let’s base our assumption on the interest being compounded annually.

The formula for compound interest is:

A = P (1+r/n)nt

Where:

A – Compound interest

P – Principal (N2,000,000)

r – interest rate (10%)

n – number of compounding periods

t – number of years (5 years)

At the end of the five-year period, you would earn an interest of N1,221,020. With higher compounding periods, the interest earned would be higher. When interest is compounded more frequently, you earn interest on interest more often, leading to a faster growth of your money, especially when investing for a long-term.

Compounding shows the importance of starting your saving and investment journey early. Time is of the essence when saving or investing. The earlier you invest, the more effective compounding is for you.

For instance, Bola starts saving a sum of N100,000 per month towards retirement at an interest rate of 5% annually at age 21 while Temi also starts saving the same sum at the same rate at age 30 every month. If they save this way till they become 50 years old, Bola would have an accumulated sum of N59.2 million and Temi would have an accumulated sum of N39.7 million. Bola was able to gain more returns on her savings because she started earlier. By starting early and being consistent, you would gain optimum benefits from the power of compounding.

How is compounding beneficial to me?

- Wealth creation: Through compounding, the amount of money you invest grows faster, especially when you invest for the long-term. Even if you start with a small amount, compounding can turn your money into a significant amount over time. The process of building wealth is accelerated by reinvesting your returns and earning returns on your returns.

- Generation of passive income: Compounding helps you generate passive income as your money is put to work for you literally. Reinvested returns would create additional income streams for you easily.

- Eliminating the impact of short term market volatility: The power of compounding can help you eliminate the effect of short-term market volatility. Starting early and investing for the long-term would allow your money to grow steadily regardless of short-term market volatility.

Are there any potential downsides to compounding?

- Patience is required: The full benefits of compounding are realised over long periods. If you expect quick returns and do not give your investments enough time to grow, the impact of compounding could be reduced significantly. To maximise the benefits from compounding, you need to be patient and consistent.

- Slow initial growth: It takes time for compounding to accelerate the growth of the money you have invested or saved at an initial stage. The growth might seem slow or minimal.

In a nutshell, compounding is a powerful and effective tool for building wealth over time. However, to reap the full benefits of compounding, it is very important to be disciplined and consistent.***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2024.

Don’t forget to:

- Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com