Good Morning 😃

Compliments of the season.

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

**

Question

I have made about N150,000 from raising chickens. I usually raise chickens around October–December. How can I invest this money from now till October and make a great profit because if I hold on to it, the value will fall and I might spend it?

Answer

***

Congratulations on your successful chicken-raising endeavour. You have a lot of alternatives when it comes to investing the money you have made from keeping hens. Here are several examples:

- Invest in a fixed mutual fund

A fixed mutual fund is a type of investment vehicle that pools money from many investors and uses it to buy a diversified portfolio of fixed-income securities. Fixed mutual funds are generally considered to be less risky than stock mutual funds, but also offer lower potential returns. They may be suitable for investors who are seeking a stable, income-oriented investment with a moderate level of risk.

- Invest in a high-yield savings account or fixed deposit

In addition to having a low-risk profile, these options also have small growth potential. Ladda is an example of a fintech app you can use for this purpose. Installing the app will allow you to save money using the savings option and withdraw it easily whenever you’re ready. With Ladda, you can get up to about 10% interest on your savings.

- Invest in a dollar savings account

Dollar savings accounts are similar to other types of savings accounts in that they offer a safe and convenient place to keep your money and earn a modest return. Some benefits of this are that it is safe, secure, liquid and requires low minimum balance, amongst others. However, it has drawbacks like low-interest rates and risks of inflation.

In conclusion, when determining how to invest your money, it’s vital to thoroughly assess your goals and risk tolerance.

***

Question

I reached my 2023 vacation target of N1.5m savings early. This does not include costs of visa return ticket and accommodation.

My travel is set for early May but I hate the fact that the money is sitting in my bank account doing nothing.

How and where can I invest the money in a responsible way that allows me to withdraw at ease in April 2023 ahead of my travel in May?

Answer

***

One choice you might take into account is a high-yield savings account, which normally provides a greater interest rate than a conventional savings account. By doing this, you would be able to increase the return on your investments while maintaining easy access to your money when you need it. Ladda is an example of a fintech app you can use for this purpose.

Installing the app will allow you to save money using the savings option and withdraw it easily whenever you’re ready. With Ladda, you can get up to about 10% interest on your savings.

Also, consider investing in a short-term bond fund if you want to take on more risk and are open to the possibility of a bigger return on your investment. This kind of fund invests in bonds with a quicker maturity date, allowing you to get access to your money very quickly.

Nevertheless, it’s crucial to keep in mind that bond prices might change, and you risk losing money if you sell your bonds before they mature.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

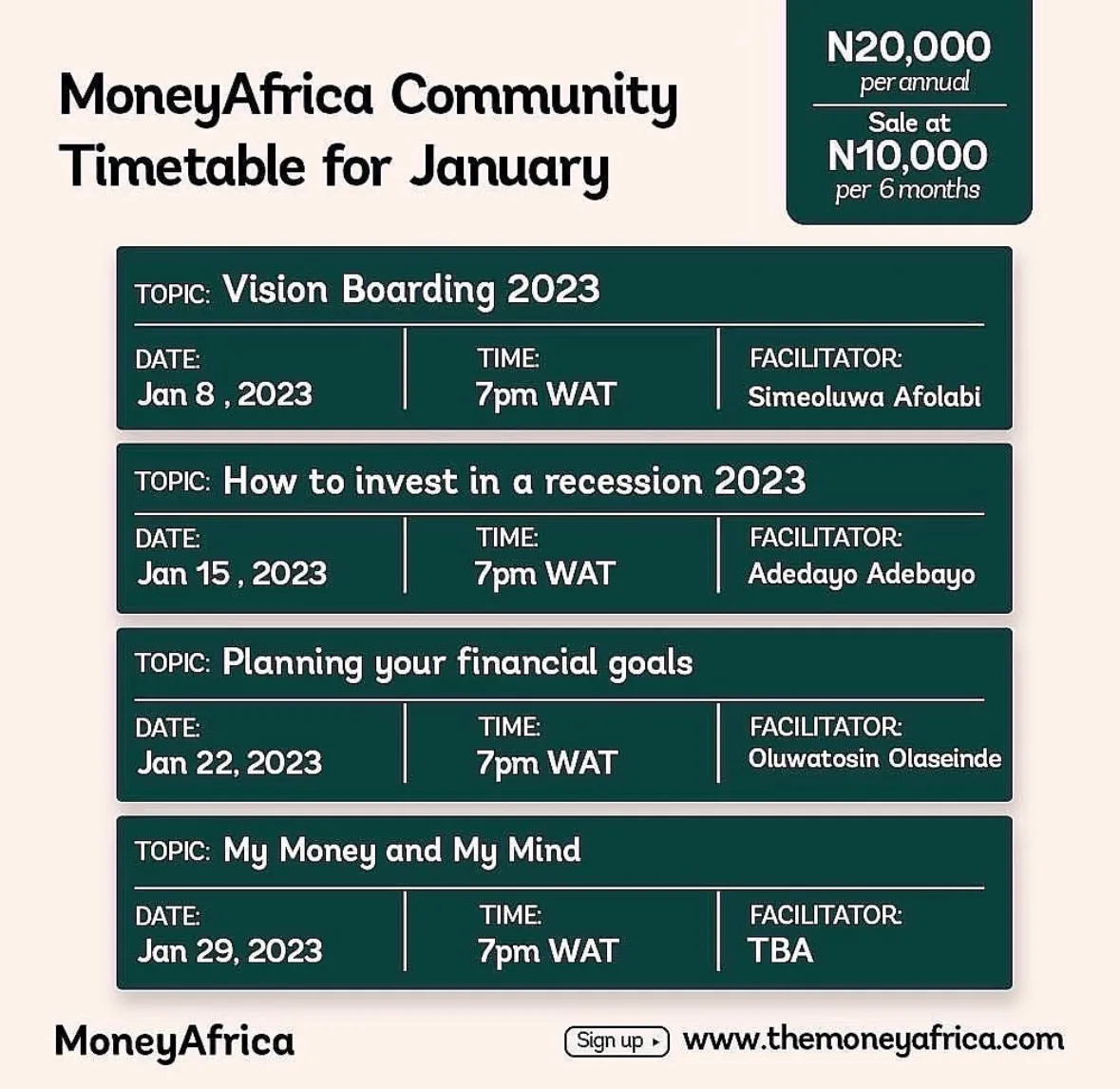

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com