Good Morning 😃

How are you doing?

Losing one’s partner either as a result of death or divorce is not what anyone prays for at the beginning of a love-filled relationship, but it happens one way or the other. One wakes up one morning and all the beautiful promises of “till death do us part” are gone. We know that this experience comes with a lot of emotional and financial stress, especially when the issue of finance was not addressed before the loss of the partner.

It is even more challenging for single mothers who have left the management of the home to their husbands or who have been bearing the burden all their life. It would be a different story if the woman was working, as she will have the ability to take care of herself and her children, although it may not be as good as having two people taking on this responsibility.

That said, men also feel financial stress when making financial plans, especially if they are used to making such plans with their partner. This is why it is important you speak to a financial advisor before making any financial plan. In this article, we share six tips on how single parents can build a financial future.

- Improve your mindset, improve your income

We live in an environment where single parents, especially single mothers, are portrayed as struggling. So many single parents have that mentality, and it becomes a self-fulfilling prophecy. As a single parent, you must understand that your mindset matters because it influences what you do with your money.

You need to believe in your ability to earn well and take care of yourself and children without necessarily depending on your partner or other people for survival. So, it is important that you spend some time addressing your money fears and any negative self-talk that might be keeping you stuck in the same place.

- Take stock of your finances

Managing one’s finances either as a single person or a couple is the same. The only difference is that if one loses a working partner, he or she may have to cut down on expenses, and have a change of goals and children’s expectations. So, as a single parent, you may have to change your children’s school, let go of big vacations and expensive gifts for your children, or look out for scholarship opportunities to ease tuition stress.

If the amount left behind in the case of a partner’s death cannot take you far, then you may consider getting another source of income as soon as you can. You can’t rely on family and friends forever.

- Educate your children on financial matters

If you are just entering into this phase, a lot of things are going to change that your children may not necessarily understand. So, you’ll need to educate them about the changes in your spending and how it will affect their spending pattern. Schedule a monthly meeting with your children to share your own financial stories—the good, bad and ugly. Use it as a teaching moment so that they are well-equipped to make wise financial decisions as they grow older. It’s true that most parents don’t know how or where to start having these conversations. This is why we created MoneyAfrica Kids, to help your children learn how to manage their finances right from a young age. Check us out on IG @moneyafricakids if you need financial literacy resources for your children.

- Avoid debt

It’s common for single parents to take on debt when things are tight with no means of settling bills that keep pilling. Debt can be a major roadblock to achieving your financial goals as a single parent. This is why it is important you work with a strict budget that helps you keep your spending in check. And if you’re not prioritising paying off your debt soon, it’s time to come up with a rock-solid debt repayment plan. You can speak to your lender if they could give you an extension or reduce your interest rate. Extending your loan, however, will mean that you are paying more. Whatever your plan is, consistency is what matters.

- Protect yourself and your children financially

One of the most overlooked financial tips for single parents is getting life insurance. Have you ever thought of what becomes the fate of your children if anything happens to you? Who will take care of them? Life insurance can ensure that your children are taken care of financially if the worst happens.

- Start investing

You can no longer leave your future to uncertainty. You need to divide your goals into different buckets (short-term, medium-term and long-term) and know what investment (stocks, mutual funds, ETFs, REITs, etc.) fits each. When you invest money, you can build wealth as it grows over time. This is different from just saving money in your normal saving account. If you’ve never invested money before, you can start now (it’s not as difficult as you think it is). You can speak to one of our financial advisors to help you by visiting www.themoneyafrica.com.

In conclusion, money can be a major source of stress for single parents, but it doesn’t have to be. The above tips should get you started on your journey to financial freedom. It can take time to implement, of course. But if you’re committed to creating a better life for yourself and your children, you will definitely hit your goal.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

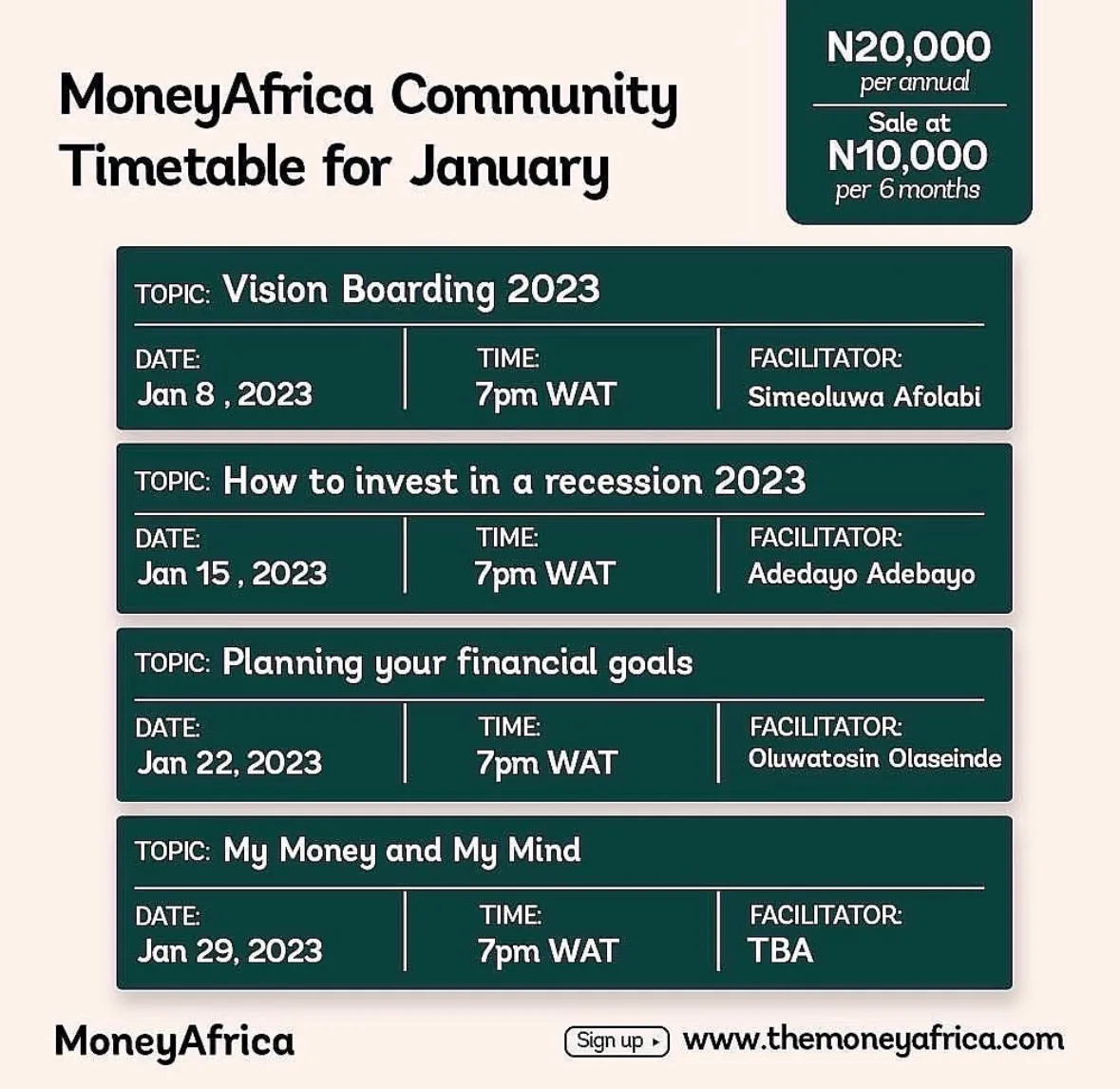

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com