Good Morning 😃

How are you doing?

We are still in the month of love, so let’s talk about one of the conversations most couples tend to ignore in marriage.

We have all been given the advice to have money discussions with our spouse or would-be spouse. But most people do not know what questions to ask, or which issue should be tackled when it comes to finances.

In this article, we are going to discuss when you should have this important discussion with your spouse, the script to kick-start a money conversation and what you should not say to your spouse when you are having money discussions.

Now, let’s get into it.

Ideally, it’s a good idea to talk about money with your partner early on in the relationship before you make any major financial decisions together. This can help you both to understand each other’s financial goals, values and habits, and avoid misunderstandings or conflicts later on. It’s also important to have regular check-ins about your finances to ensure you’re both on the same page and you can make any necessary adjustments as circumstances change.

So, when should you have a finance discussion with your partner?

- When you’re just dating. Of course, you should not divulge major information about income, debts, and properties to your partner. That might be coming off too early. Rather, you can talk about their money goals, how he or she manages money, how they overcame financial difficulties in the past, what they think about combining finances in a relationship, etc.

- When you’re about to say “I do.” Once there is a serious commitment between you both that’s leading to marriage, you should have major discussions like how to share your bills or how to divide expenses. How do you manage the wedding bill? Will attendance be strictly by invitation, or will the hall be open to all your friends and family? Is there any deal-breaker that you need to know before you get married? How will you divide your assets in case of divorce?

- When you are married, remember your goals and financial situation may change. So, it is important to get into the habit of reviewing your plan and be open with your partner. It’ll make any potential change a lot easier to handle.

Scripts for starting the money conversation

In marriage, you may find discussions about money stressful or confusing. This script can serve as a guide.

Hey, Sugar! (insert your romantic name) winks*

I have been learning about how to manage money lately, and I would like us to talk about it.

What do you think about saving or investing?

If you don’t get your desired response, try this instead.

Hey, Sugar! What do you think about my spending habits?

Is there anything I should change?

(Even though it may seem like you’re laying yourself on the butcher’s table, your partner will open up and that will give you an opportunity to speak your mind).

Another time, you could say;

I know we use cash or savings to get the things we need, but what do you think about the “buy now pay later” method of acquiring assets? Does this seem off to you?

The idea is to get them to want to discuss your finances.

Here are other questions you could ask your partner

- What are your short-term and long-term financial goals?

- How do you prefer to manage money and track expenses?

- Do you have any running debt?

- What are your current savings and investment accounts?

- How much money do you think we should be saving each month?

- What are your thoughts on joint bank accounts?

- Have you ever experienced financial difficulties in the past, and how did you overcome them?

- How do you feel about taking on debt for large purchases, such as a car or a house?

- What are your thoughts on investing in stocks, mutual funds, or other financial assets?

- How would you handle unexpected expenses such as a medical emergency or job loss?

Remember, these are just starting points. Be open and honest in your discussions and try to work together to create a financial plan that works for both of you.

What you should not do when talking to your partner about money

- Don’t be accusatory or judgemental: Money can be a sensitive topic, so it’s important to approach the conversation with empathy and understanding. Avoid blaming or criticizing your partner for their financial decisions.

- Don’t hide financial information: Be honest about your financial situation and disclose any debts or financial obligations. Keeping secrets about money can lead to trust issues and further complications down the line.

- Don’t interrupt or dismiss your partner’s concerns: Listen actively to your partner’s concerns and show that you understand their perspective. Dismissing their concerns can make them feel unheard and create tension in the relationship.

- Don’t make decisions without consulting your partner: Financial decisions should be made jointly, especially if they involve shared expenses or assets. Don’t make major financial decisions without consulting your partner first.

- Don’t be inflexible: Be willing to compromise and find solutions that work for both of you. Being inflexible can create unnecessary stress and conflict in the relationship.

In conclusion, it’s important to remember that these questions are just a starting point, and you should approach the conversation with an open mind and willingness to learn about your partner’s values and priorities.

The season of love is upon us. One way you can show love is to be intentional about the growth of your partner/loved one. If you love them, you’d want them to be financially intelligent.

With our super easy Valentine offerings, you can go on your financial independence journey together with your partner/loved one.

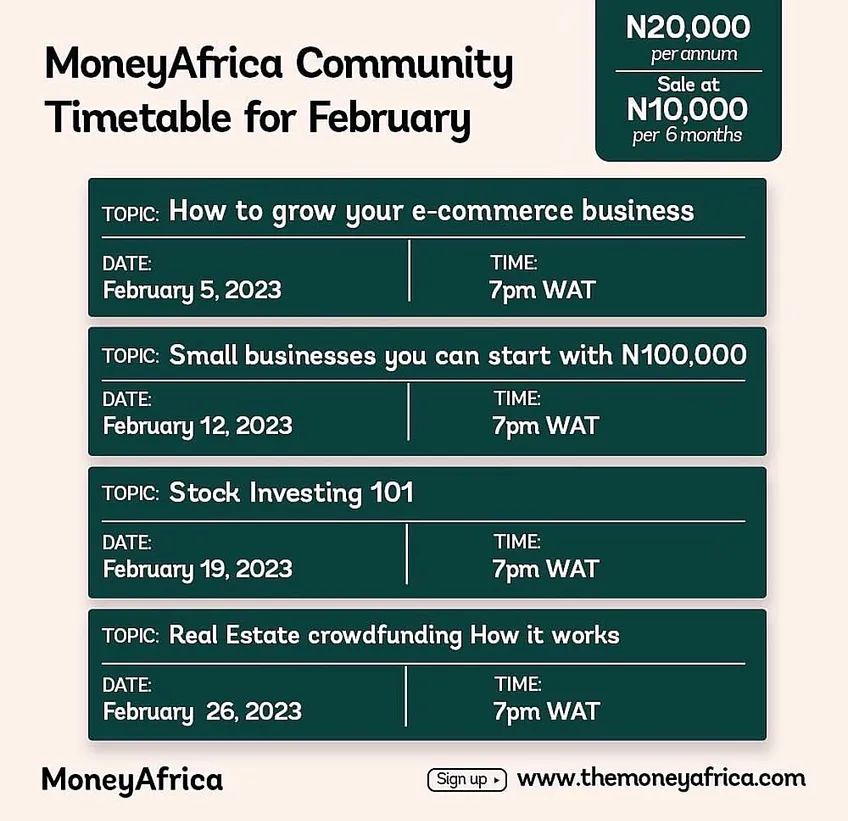

- 50% off our annual community plan (

₦20,000₦10,000).

On the community plan, you’ll have:

- Access to over 5 hours of recorded finance and investment videos on subjects like budgeting, savings, investing, etc. on our edtech platform that you can watch at your pace

- Access to a Telegram community

- Community support from the MoneyAfrica team and fellow investors like you

- Access to an ongoing weekly finance and Investment class (personal finance marathon). Recordings are available)

- Access to freebies

To make payment for the annual community plan, please visit www.themoneyafrica.com

- Did you know that money matters is one of the top three reasons for divorce?

As we celebrate Valentine’s Day, we are offering intending and married couples a flat fee of ₦100,000 for personalised one-on-one financial planning. Here, two people get the price of 1 premium plan:

To make payment, please visit https://paystack.com/pay/couplesession

When there’s money, the love is sweeter (in Davido’s voice).

Join our community today.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com