Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

**

Question

I am a youth corper. I earn about N100,000 monthly. I really want to buy a bone straight wig but I don’t know if it is sensible. I only have one wig. The wig I want to buy is N350,000. Is it advisable to use all my savings from work so far to buy this wig? I can’t settle for anything cheaper because I like quality things. What should I do, please?

Answer

My advice would be to consider the practicality of purchasing a wig that costs more than three times your monthly salary. While it’s understandable that you want to have quality items, it’s also important to prioritise your needs and financial goals over your wants.

Instead of using all your savings to purchase the wig, you may want to consider setting aside a specific amount of money each month for a certain period of time until you can afford it without dipping into your savings. This way, you can still work towards your goal of owning the wig without compromising your financial stability.

You may also want to consider alternative options that offer similar quality but at a more affordable price. Research and compare different brands and stores to find a wig that fits your budget and meets your expectations. Remember that quality doesn’t always have to come at a high price.

Prioritise your financial goals and make practical decisions with your money. Set aside a specific amount of money each month towards purchasing the wig, and also explore alternative options that offer similar quality at a more affordable price.

***

Question

I’m a fresh graduate and I just finished NYSC. I got a job that pays N80,000 per month and I spend N30,000 on transportation, which leaves me with 50k monthly. I don’t spend money on food because breakfast and lunch are served in the office. I just want to know how to save or invest money. Honestly, I studied accounting but I can’t even help myself. I just want a great future. Also, there is a lot of pressure from social media, which makes me wonder why I am saving, or if I am missing out on a lot of things.

What do you advise?

Answer

Congratulations on your new job as a fresh graduate! It’s great that you’re already thinking about how to save and invest your money for your future.

Start by creating a budget that outlines your monthly expenses, including rent, transportation, utilities, food, and any other bills you may have. This will help you identify areas where you can cut back on expenses and save more money.

Then think about what you want to achieve in the short-term and long-term. Do you want to save for an emergency fund, pay off any debts, or invest in your future? Set specific financial goals and create a plan to achieve them.

Make it a habit to save a portion of your monthly income each month. Aim to save at least 20% of your income, and consider setting up automatic transfers to a savings account to make it easier.

Invest a portion of your savings in a mix of low-, medium-, high- and very high-risk assets. For example:

- Low-risk: cash and cash equivalents

- Medium-risk: Fixed income, real estate

- High-risk: Equities

- Very high-risk: Cryptocurrency

It’s important to do your research and consult a financial advisor before making any investment decisions.

It’s easy to feel pressure from social media and the desire to keep up with others, but remember that everyone’s financial situation is different. Focus on your own goals and priorities, and don’t feel the need to keep up with others. Don’t be afraid to seek advice from a financial expert at MoneyAfrica if you need help. Good luck!

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

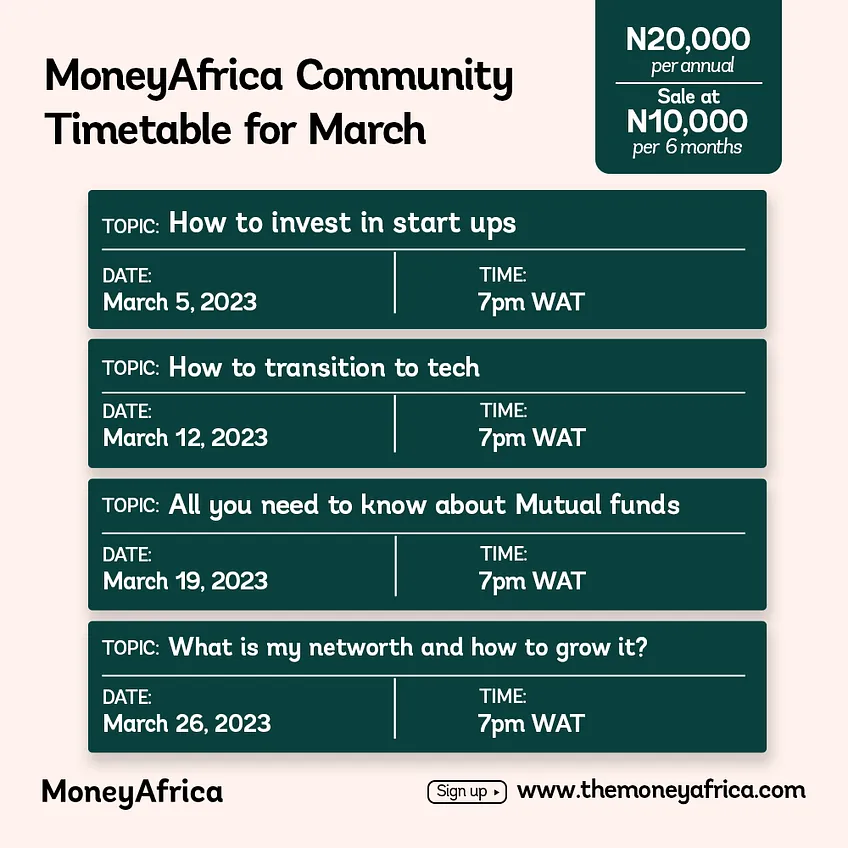

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com