Good Morning 😃

How are you doing?

Lara is a 30-year-old lady, living in Lagos, Nigeria. She has been working on the Island since 2021 and earns up to N300,000 per month. For ease of movement, she moved to an area close to the Island. She took N1.2m to achieve this, to be repaid in nine months at 5% interest. This implies that she would pay up to N200,000 per month on a N300,000 income. She hardly gets by with N100,000 in a month. She will only experience some relief after nine months of payment, before she starts the cycle of loan repayment again. This decision has affected her ability to save, or even invest toward any goal. She’s prudent but still feels financially stressed based on this decision.

Financial stress can be a significant source of anxiety and worry for many women. Whether it is about debt, saving for retirement or meeting daily expenses, managing finances can be challenging without proper structure.

There are lots of benefits attached to taking control of your financial decisions. By creating a budget and monitoring your spending habits, you have the power to plan for your future and make sure you have the means to achieve your dreams and aspirations. Education fund will allow you to take care of your children’s school fees when they are of age. Health insurance will help you manage huge medical bills. Regular investing in stocks or other asset classes provides an additional layer of security and potential profits, which can improve the long-term financial outlook.

Taking charge of personal finances is more than just securing your future but reclaiming your financial independence. With a carefully crafted strategy and consistent effort, you can take control of your financial lives and create wealth on your terms.

There are several steps women can take to mitigate financial stress and improve their financial well-being. Here are some of them:

Create a budget: Creating a budget is a crucial first step in managing finances. It helps you understand where your money is going and identify areas where you can cut back. Start by tracking your spending for a few weeks or a month, and then use that information to create a realistic budget that takes into account your income, expenses and financial goals.

Build an emergency fund: Having an emergency fund can provide a safety net and help alleviate financial stress. Aim to save at least three to six months’ worth of living expenses in a separate savings account that you can access in case of unexpected expenses or job loss.

Address debt: Debt can be a significant source of financial stress for many women. As a general rule of thumb, financial experts recommend that debt repayment should not exceed 20–30% of one’s monthly income. You should avoid debt altogether if you lack stable income, lack financial discipline, struggle with impulsive buying, or the interest on the debt is high.

Invest in retirement: Women face unique challenges when it comes to saving for retirement, including the gender pay gap and time out of the workforce for caregiving responsibilities. However, it’s essential to start saving for retirement as early as possible to ensure long-term financial security. Take advantage of individual-crafted plans which you can commit to doing every month. You can reach out to our financial advisors to help with this.

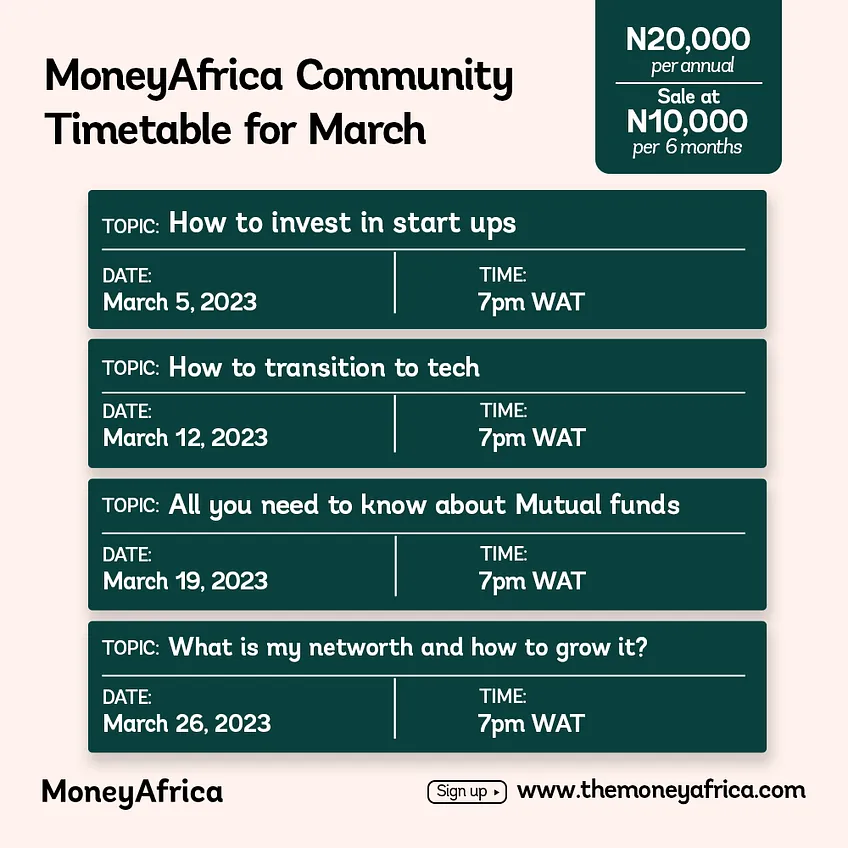

Seek financial education: Financial literacy can help women make informed decisions about their finances and reduce financial stress. Consider attending financial planning workshops, reading personal finance books or joining a community to improve your financial knowledge. The MoneyAfrica community is one good place to start. Send an email to info@themoneyafrica.com to know how you can join.

Practice self-care: Financial stress can take a toll on mental health and well-being. It’s essential to practice self-care by engaging in activities that reduce stress such as exercise, meditation or spending time with loved ones.

By taking these steps, women can reduce financial stress, build financial security, and improve their overall well-being. Remember, managing finances is an ongoing process, so it’s essential to revisit your financial plan regularly and make adjustments as needed.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com