Good Morning 😃

How are you doing?

According to a 2013 report by the United Nations Department of Economic and Social Affairs (UNDESA), the global population of older people (aged 60 years and over) will surpass the population of children under 15 years by 2050. In Nigeria, the proportion of the population aged 65 years and above is currently 3.1%, which is approximately 6 million people. It is projected to reach 6% by 2025 and 9.9% by 2050.

While population aging is considered a significant achievement in human development, it has implications for various aspects, including labour markets, healthcare, and financial strain on the younger generation. This highlights how important it is for young people to have a comprehensive understanding of their parents’ finances to empower both themselves and their aging parents, while also avoiding any unexpected financial challenges in the future.

Here are practical steps that young people should consider taking while their parents are still independent, to ensure their financial well-being:

- Understand their assets: Gain knowledge of your parents’ assets, such as retirement accounts, investment portfolios, real estate, and any outstanding debts or loans. This information will help you assess their financial situation and plan for their future needs.

- Identify income sources: Determine your parents’ income sources, including pensions, rental income, and other retirement benefits. This understanding will enable you to plan for their future expenses and ensure they have sufficient income to support their needs. Also, consider if they have any additional part-time or freelance work such as coaching or consulting that provides income.

- Discuss estate planning: Have open conversations about your parents’ estate plan, including their will, trusts, and any other legal documents outlining their wishes for asset distribution after their passing.

- Plan for healthcare costs: Anticipate potential healthcare expenses as your parents age, particularly long-term care. Explore options for managing and financing these costs in advance.

- Consider living arrangements: Discuss with your parents their preferences for living arrangements in their old age. Determine whether they may require a caregiver or if they plan to live with you or your siblings during retirement. Addressing this aspect early on will help avoid undue financial burdens on family members.

- Seek professional guidance: Engage the services of a financial advisor specialising in retirement planning and intergenerational wealth transfer. A knowledgeable advisor can assist you in navigating the complexities of caring for aging parents while managing your own financial goals.

Understanding and actively managing your aging parent’s finances is an essential step towards securing their financial well-being and avoiding unexpected challenges. By gaining insights into their assets, income, estate plans, healthcare needs, and living arrangements, young individuals can take proactive steps to ensure a smooth transition and financial stability for their parents.

Collaborating with a knowledgeable financial advisor adds an additional layer of expertise, enabling you to navigate the complexities of intergenerational financial planning with confidence and peace of mind. If this is something you would like us to set up for you, then send an email to us at info@themoneyafrica.com

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

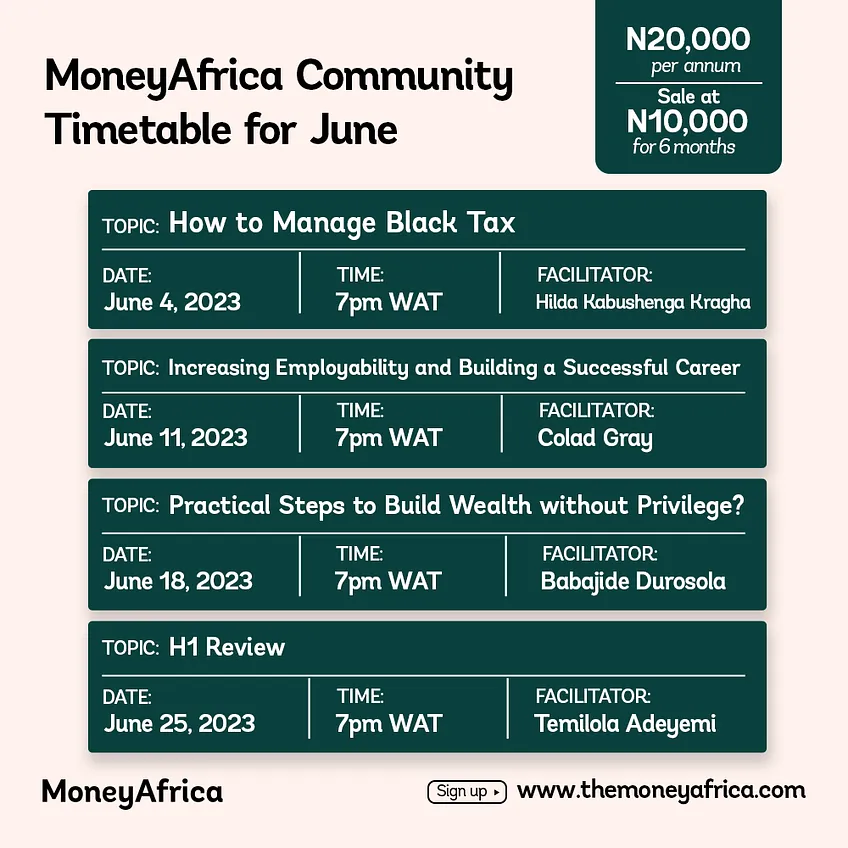

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com