Good Morning 😃

How are you doing?

Decent and affordable housing is a basic need for individuals, families, and communities. Housing has a significant impact on health, social behaviour, satisfaction, and overall well-being. In Nigeria, the housing problem extends beyond quantity to include the quality of available housing units. Urbanisation rates, particularly in Lagos, Nigeria’s most populous and industrialised state, have been increasing over the past two decades. While only 7% of Nigerians lived in urban centres in the 1930s and 10% in the 1950s, over 60% of Nigerians now reside in urban areas of varying sizes.

Rent increases are skyrocketing in Lagos, and many renters are facing difficult choices regarding affordable living options. With over 15 million people in Lagos alone, making it the fourth largest city in the world, there is a limited number of houses available to accommodate them. This, coupled with factors like inflation and rising construction costs, contributes to the high cost of housing in Lagos.

If you find your rent to be expensive and concerning, consider the following suggestions:

- Relocate to an affordable area: To maintain financial balance, ensure your rent does not exceed 25% of your income or three months’ worth of your yearly income. For example, if you earn 200,000 Naira per month (2.4 million Naira per year), your rent should not exceed 600,000 Naira per year. Bearing this in mind can help you focus your search on more affordable housing options in Lagos.

Ladda is a fintech app that pays you up to 11% return on your investment.

If you aren’t using a high-yield savings account today, you’re basically throwing money down the drain. Sign up on Ladda and start saving for your next house rent.

Here is the link to download the Ladda app for Android users; https://play.google.com/store/apps/details?id=com.ladda.ladda

And for iPhone users

- Negotiate with your landlord: While it may seem challenging, many people have successfully negotiated lower rent payments. If you love where you live and are struggling with the cost, it’s worth trying to negotiate with your landlord. Being a good tenant may increase your chances of success, provided you are one.

- Stick to a budget: Establishing and adhering to a budget is essential for managing your housing costs. Without a budget, your rent could gradually consume a significant portion of your income, making it difficult to afford other necessities.

- Increase your income: If your budget reveals that there’s not enough money to cover your expenses, you may have an income problem rather than a rent increase problem. Consider asking for a raise at work, exploring new job opportunities, or taking on a side hustle. Finding ways to increase your income can alleviate financial strain.

- Find a roommate: Sharing your living space with a roommate can significantly reduce your rent expenses, especially if you’re single. Although it may require some adjustment and compromise, choosing a compatible roommate can help you achieve more affordable housing. Conduct proper research to find a suitable match.

- Save in advance: If your next rent payment is due in a year, start saving as soon as possible. Setting aside a portion of your income each month, well in advance, can help you meet your rent obligations without financial stress. Consider using a savings platform like Ladda, which offers the opportunity to earn interest on your savings.

Remember, it’s crucial to prioritise affordability and ensure that your rent remains within 25% of your income. Straining yourself to maintain a rental home that is beyond your means is not sustainable.

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

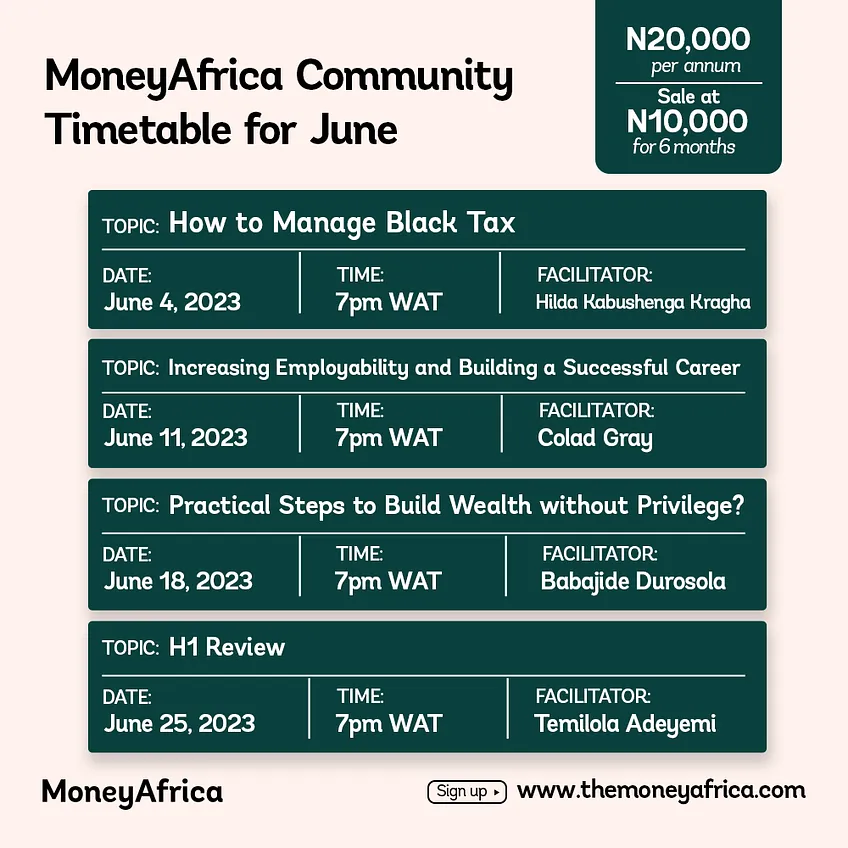

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com