Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

I earn about ₦60,000 monthly fixed income, but currently paying back my ajo monthly (₦25,000) till January 2024. My problem is that I find it hard to save afterward, even though I desire to start investment savings. What do you advise?

Answer

Considering your fixed income of ₦60,000 per month and your current loan payment of ₦25,000 per month, here’s what I suggest:

- Evaluate your expenses: Take a closer look at your monthly expenses and identify areas where you can potentially reduce or eliminate unnecessary spending. Look for alternative means of getting things done that cost less than what you’re currently spending. This will help you free up some additional funds that can be used for savings and investments.

- Start a search for a new job: ₦60,000 is a small amount of money to be earning in the current situation of the nation’s economy. You can start a search for a new job that can bring in a sufficient amount of money on a monthly basis or look for a side hustle that wouldn’t affect your current role. Building additional streams of income will help to lift the burden off your shoulders. It’s challenging to pay off a monthly ajò repayment of ₦25,000 and still save and invest while also having other expenses to make. You can search for side jobs that fit a skill you’re very good at and you know people will pay for, or search for a higher paying job.

- Build an emergency fund: It’s essential to have an emergency fund in place to handle unexpected expenses. Start by setting aside a small portion of your income each month until you reach your desired emergency fund target. Aim to save at least three to six months’ worth of your living expenses. If this seems daunting for you, then start with saving a percentage of your earnings in a high-yield savings account. I will recommend Ladda, it offers 10% per annum on return.

- Prioritise debt repayment: Since you mentioned you have an ajò repayment to make until January 2024, it’s crucial to focus on repaying it within the designated time frame. Make sure you allocate the necessary amount each month to cover your loan payment. If possible, consider paying more than the minimum amount to fast tract the debt repayment process.

- Start saving for future goals: Once your loan is paid off, you can redirect the amount you were using for loan repayment toward saving and investing. This will give you an opportunity to build your savings and work towards achieving your financial goals. Determine your short-term and long-term goals and set aside a portion of your income specifically for those goals.

***

Question

I’m currently a youth corper and my only income is the ₦33,000 given by the government. My monthly expenses add up to ₦30,000 and it is becoming increasingly hard to save. What should I do? I need help.

Answer

Here are some suggestions to help you save money and improve your financial situation:

- Track your expenses: Keep a record of all your expenses to understand where your money is going. This will help you identify areas where you can cut back or reduce unnecessary spending.

- Create a budget: Develop a monthly budget that outlines your income and expenses. Allocate specific amounts for necessities such as rent, utilities, transportation, and food. Be mindful of your spending habits and prioritise essential expenses over expenses on wants.

- Minimise living costs: Look for ways to reduce your monthly expenses. Consider sharing accommodation with roommates to split the rent and utilities. Opt for affordable transportation options like sharing a cab with friends, getting a ride with a trusted friend, or public transportation. Save on food expenses by cooking at home and packing meals instead of ordering food.

- Find additional income sources: Explore opportunities to earn extra income during your free time. You could consider taking up part-time jobs that align with your skills and interests. These side gigs can supplement your primary income and provide you with more savings potential.

- Automate savings: Set up an automatic transfer from your bank account to a savings app each month. You can use the Ladda app for this. Unlike traditional savings accounts that give an annual return of 4.5%, Ladda offers an annual return of 10%. This way, a portion of your income will be saved without you having to think about it. Even if it’s a small amount, consistent savings will add up over time.

- Prioritise financial goals: Identify your short-term and long-term financial goals. It could be building an emergency fund, paying off debt, or saving for further education. Having clear goals in mind will help you stay motivated and focused on saving.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

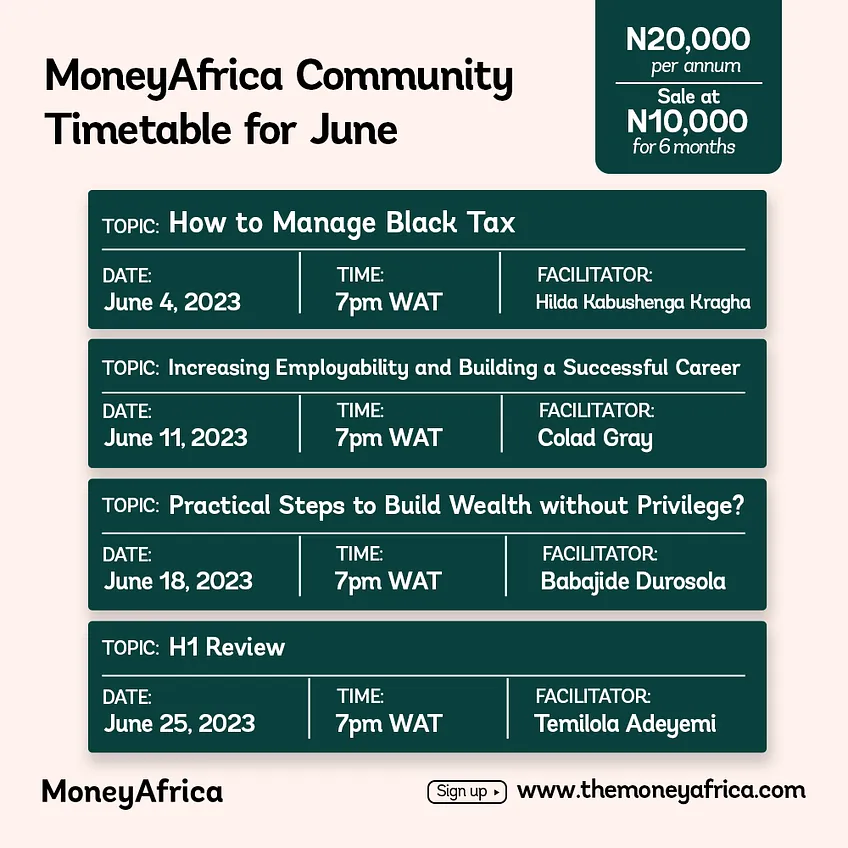

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com