Good Morning 😃

How are you doing?

This is a question we have been asked numerous times: Since I don’t have a large amount to start investing, is it advisable to still invest in stocks, bonds, and other financial assets?”

Recently, Tosin Olaseinde, founder of MoneyAfrica, was invited to a panelist session at the University of Lagos where she spoke about the three financial stages. She stated there are actually three distinct stages in an individual’s financial life. These three stages are wealth accumulation, wealth preservation, and wealth distribution. Much like life in general, you can’t enter one phase without the other.

Here are the three stages:

- Accumulation stage: This stage typically occurs during the early years of one’s career or wealth-building journey. The focus is on accumulating assets and building a solid financial foundation. The focus is more on how to increase one’s earnings potential by upskilling or writing certification examinations. People in this category may prioritise paying off debts, establishing an emergency fund, contributing to retirement accounts, and investing in long-term assets such as stocks or real estate.

- Preservation stage: As individuals progress in their financial journey and approach mid-life or retirement, the focus shifts to preserving and protecting the accumulated wealth. This stage involves maintaining financial stability, managing risk, and safeguarding assets. Strategies may include diversifying investments, reviewing insurance coverage, and implementing estate planning measures to ensure the smooth transfer of wealth to future generations.

- Distribution stage: This stage typically occurs during retirement or when individuals start relying on their accumulated assets to fund their lifestyle. The focus shifts to distributing or using the wealth accumulated over the years. The strategies involve carefully managing withdrawals from retirement accounts, considering tax implications, and creating income streams from investments, pensions, or social security. Estate planning becomes crucial during this stage to ensure a smooth transfer of wealth to beneficiaries.

Considering your income or age bracket, you can determine which group you fall into. If your earnings are not high enough to invest a lump sum, don’t pressure yourself. Instead, focus on increasing your income by upskilling and adopting the following strategies:

- Start with a budget to understand your financial situation and identify areas to cut expenses and save more money for saving or investing.

- Set clear financial goals, whether they involve emergencies, education, or retirement. Having defined goals will keep you motivated and focused.

- Start investing as early as possible, even with small amounts. Consistency and time in the market can lead to compounding growth.

- Diversify your investments across different asset classes, sectors, and regions to manage risk.

- Look for low-cost investment options like index funds or ETFs to minimise expenses and maximise returns.

- Automate your contributions to savings or investment accounts to make investing a regular habit.

- Remember that investing carries risks, so understand your risk tolerance and conduct thorough research before making investment decisions.

Finally, bear in mind that investing always carries some level of risk. It’s important to understand your risk tolerance and do thorough research before making investment decisions.

Did you find this newsletter useful? You can read previous newsletters here

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

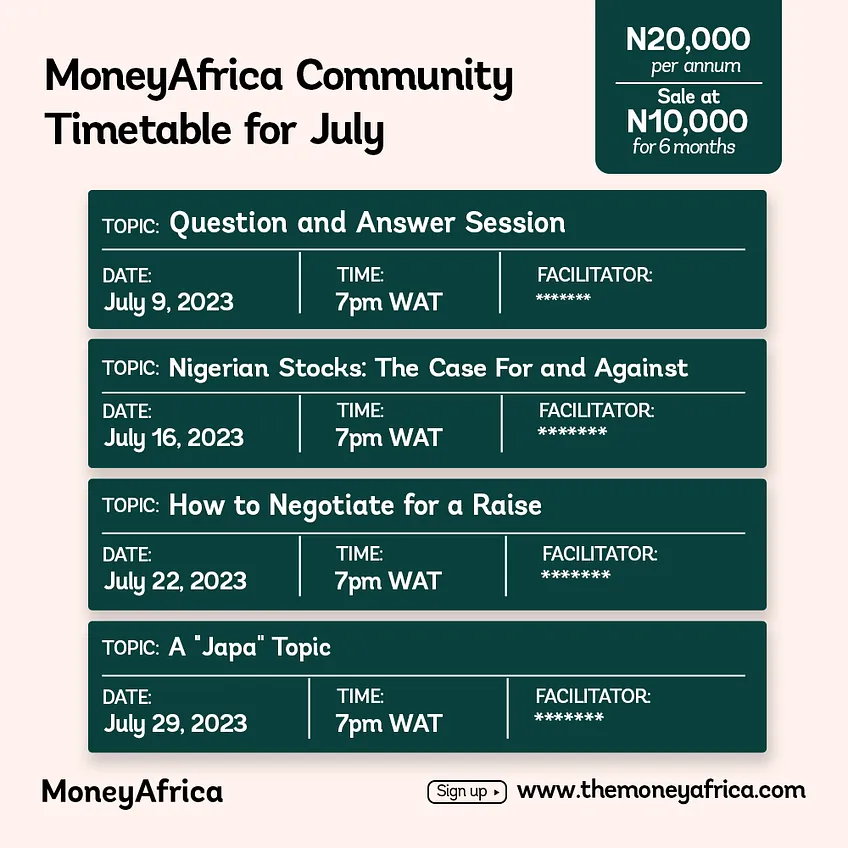

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com