Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

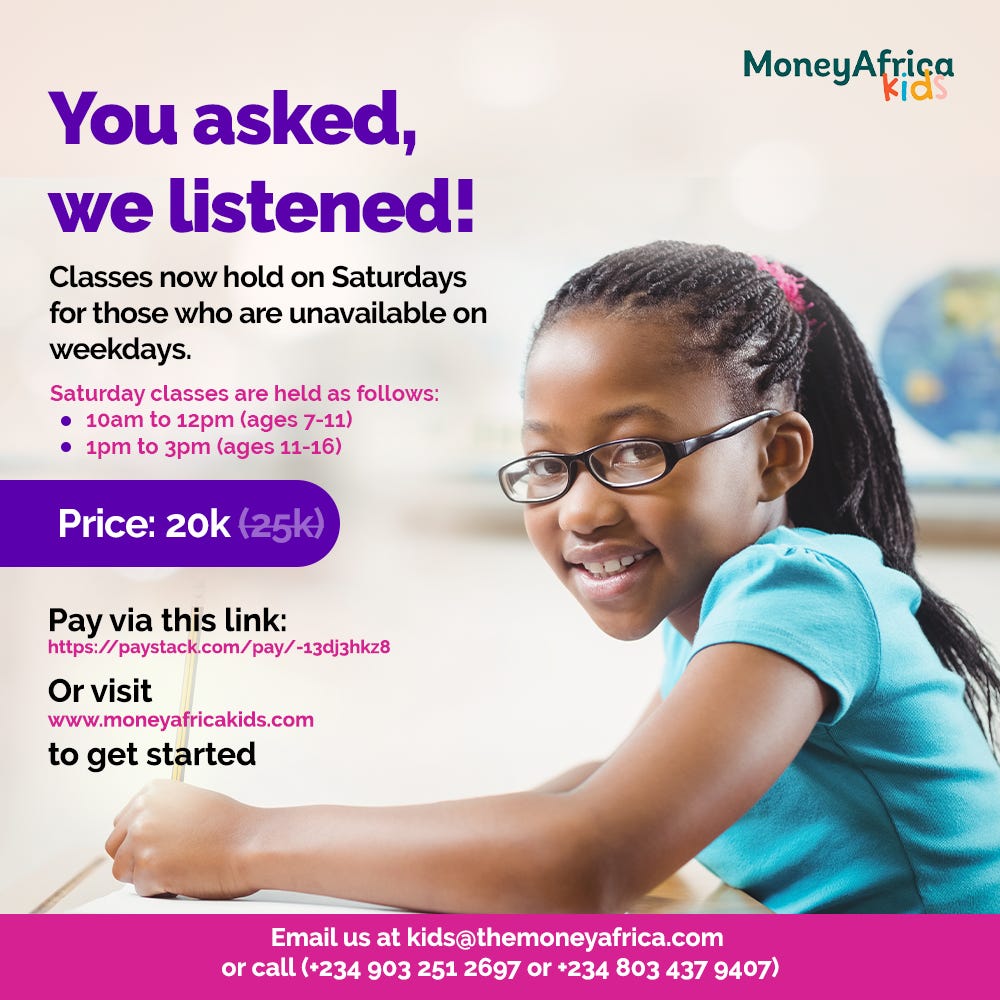

Do you want your children to learn about the stock market, budgeting, saving, and investing? Our annual financial literacy boot camp is here. The classes are self-paced with 8 live classes for each age group.

Hurry and sign up.

***

Question

I recently moved to the US as a graduate student on a scholarship. How can I make the most of my stipend and spend wisely?

Answer

Congratulations on your scholarship and your move to the US! Making the most of your stipend and spending wisely is important. Here are a few tips:

1. Create a budget: Determine your monthly expenses, including rent, groceries, transportation, and other essentials. Allocate a certain amount for each category and stick to it.

2. Track your expenses: Keep a record of everything you spend. This will help you identify areas where you might be overspending and adjust accordingly.

3. Cook at home: Cooking your meals at home is generally more cost-effective than eating out. Look for budget-friendly recipes and cook in bulk to save time and money.

4. Public transportation: Use public transportation or consider biking/walking if feasible. This can save you a significant amount on transportation costs.

5. Student discounts: Take advantage of student discounts on various services, entertainment, and transportation options.

6. Build an emergency fund: Set aside a portion of your stipend for emergencies. Having a financial safety net is crucial.

7. Use student resources: Utilise resources provided by your university, such as libraries, fitness facilities, and career services. This can help you save on various expenses.

8. Part-time work: Consider taking up a part-time job or freelancing if it doesn’t interfere with your studies. It can provide extra income.

***

Question

I have learnt a lot from your emails on having a healthy financial lifestyle. I’d like to know how to create an emergency fund, especially now that the removal of fuel subsidy is biting so hard. Although I’m trying to keep track of how I spend my money, I still find myself borrowing 20k or 30k to keep myself floating till the next pay. I’d like to stop this lifestyle so I can have reasonable money aside.

Answer

Creating an emergency fund is a smart and essential financial move. To start, follow these steps:

1. Set a goal: Decide how much you want in your emergency fund. Aim for 3 to 6 months’ worth of expenses. It varies depending on a lot of factors like age and the number of dependents you have. Someone who is older would need to have a larger emergency fund and someone who has a lot of dependants would also have a larger emergency fund.

2. Track your spending: Continue monitoring your expenses. Use apps or budgeting tools to identify areas where you can cut back.

3. Create a budget: Allocate your income towards necessities like rent, groceries, and utilities. Then allocate a portion to savings.

4. Automate savings: Set up an automatic transfer to move a portion of your paycheck directly into your emergency fund.

5. Build gradually: If you’re borrowing frequently, start small. Contribute what you can to your emergency fund each month, even if it’s a modest amount.

6. Prioritise debt: If you have high-interest debt, prioritise paying the debt before fully funding your emergency fund.

7. Stay consistent: Stay disciplined and consistent in contributing to your emergency fund, even when times are good.

8. Explore extra income opportunities: Look for ways to earn extra money outside of your regular job. This could involve freelancing, part-time work, selling unused items, or starting a side business. Direct the additional earnings straight into your emergency fund to boost its growth. By actively seeking out extra income sources, you’ll not only increase your emergency fund contributions but also improve your overall financial stability.

***

Do you want your children to learn about the stock market, budgeting, saving, and investing? Our annual financial literacy boot camp is here. The classes are self-paced with 8 live classes for each age group.

Hurry and sign up!

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com