Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

I will complete my NYSC in a few months. I have about N500,000 in savings. I want to start a business after my NYSC but my parents want me to get a job. I’m confused. What can I do? Should I take a job or start a business? I don’t have any business ideas for now.

Answer

It sounds like you’re at a crossroads between getting a job and starting a business after your NYSC. It’s understandable that your parents want you to have job security, but what are your own thoughts and feelings about these options? What kind of business or job interests you the most right now?

When deciding between starting a business and finding a job, it’s essential to consider your long-term goals and what truly excites you. Entrepreneurship can be immensely rewarding if you have a passionate business idea, as it allows you to turn your passion into a career. On the other hand, jobs offer financial security and a stable income, making them a practical choice for meeting immediate financial needs. To strike the right balance, you might explore your business idea while keeping an eye on job opportunities, ensuring your decision aligns with both your aspirations and financial stability.

If the entrepreneurial path is calling your name, it’s worth contemplating gaining some prior work experience within your chosen field. This practical experience can be a significant asset on your journey. Not only does it offer a chance to refine your skills and knowledge, but it also allows you to build a network of valuable contacts who can potentially support your future business endeavours. Working in your field prior to launching your own venture provides a real-world education that helps you understand industry dynamics, customer preferences, and potential challenges.

It’s crucial to assess your financial situation carefully. Make sure you have a solid financial safety net or backup plan in case your business takes some time to become profitable. Having this safety cushion can alleviate financial stress and allow you to focus on building your business without unnecessary worries.

Having an open and honest conversation with your parents about your aspirations and concerns is crucial. It fosters understanding and can lead to mutual support. While they may prioritise job security, sharing your entrepreneurial passion helps them see your dedication. This dialogue can be beneficial both ways, with their life experiences possibly offering valuable insights to refine your business ideas.

***

Question

I have not started earning yet. Although I’m a 22-year-old female graduate with no job, I’m very big on financial independence.

It is so difficult to get a job. The little money I get from friends and family in a month can sum up to N10,000. I’ve tried getting a job and earning more money to no avail. Lately, I came across sports betting on X (formerly Twitter) with people earning a lot from it. Then I started betting in August this year. Right now, I am so addicted to betting that, in that same August, I spent over N6,000 on sports betting. And when I lose, I am bent on recovering my money and I go again.

Please save me!

Answer

I’m glad you reached out to us. It’s completely understandable to feel concerned about financial independence, especially when you’re just starting out in your career. The job market can indeed be tough, but let’s explore some healthier ways to address your financial situation without relying on sports betting.

First, addiction to sports betting can have a significant impact on your financial stability and emotional well-being. Recognising this challenge is a crucial first step. Seeking support or counselling to overcome this addiction is a wise choice, as there are numerous organisations and trained professionals who specialise in assisting individuals dealing with gambling addictions. Reaching out for help can provide you with the guidance and tools necessary to regain control over your finances and emotional health. Start with these videos.

When it comes to your job search, I want to reassure you that even though it can be challenging, there are proactive steps you can take to improve your prospects. Start by networking with fellow graduates or professionals in your desired field; they might have valuable advice or connections to offer. Don’t underestimate the power of a well-crafted resume that highlights your skills and experiences, and consider tailoring it to specific job applications. Reaching out to potential employers directly can also set you apart and demonstrate your enthusiasm.

Volunteering or seeking internships, even if unpaid, can serve as a foot in the door for future job opportunities. These experiences not only enhance your resume but also provide valuable industry insights and the chance to showcase your dedication and abilities. Persistence and adaptability are key in navigating the job market, and each step you take brings you closer to achieving your career goals.

Acquiring a marketable skill while job hunting is essential. It distinguishes you in a competitive job market and increases your employability across various industries and roles. Marketable skills in any field of interest makes you a valuable asset to potential employers, as it improves your chances of landing a job. Your well-being should always come first; so, consider addressing your addiction to sports betting as a priority. There are resources available to assist you on this journey to financial stability and a healthier relationship with money.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

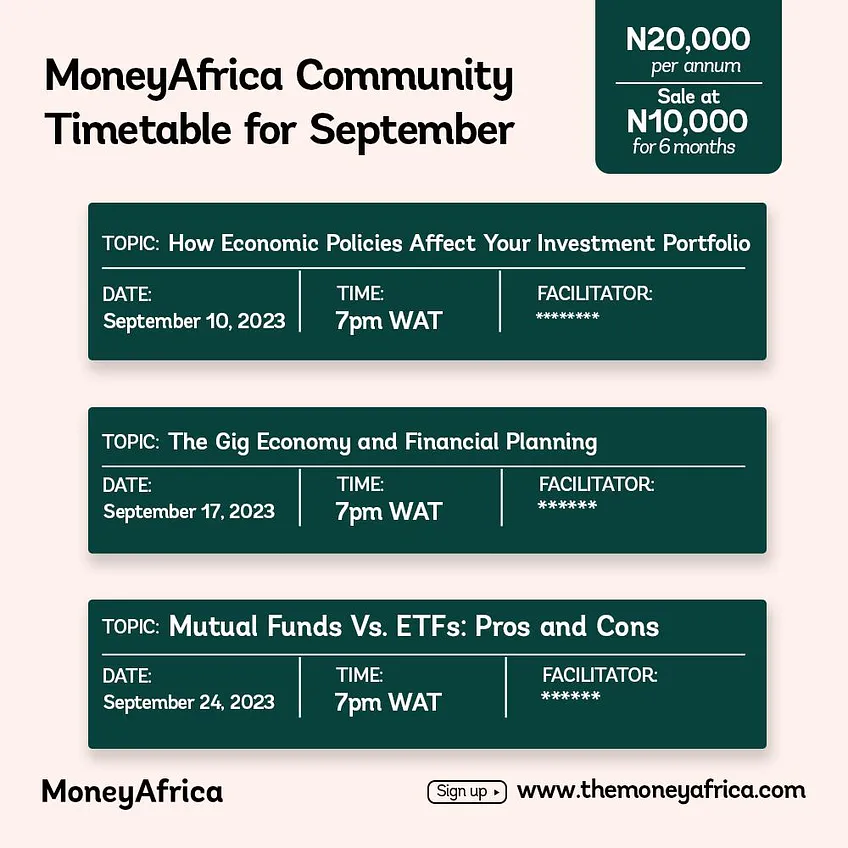

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com