Good Morning 😃

How are you doing?

Sometime last December, MoneyAfrica had the pleasure of being invited to educate a group of young lawyers on personal finance and wealth building. It was a delightful event centered around bonding, personal growth, and, of course, good food and drinks. The day featured various sessions covering topics like mental health wellness, career development, networking, and positioning, alongside personal finance.

(And just so you know, you can also invite us for corporate sessions or friendly hangouts to discuss personal finance. Feel free to send us a direct message at sales@themoneyafrica.com.)

Everyone had their notepads ready, eagerly seeking advice on how to improve their financial well-being or rectify past mistakes. During the session, a question that resonated with me was asked: “How can we build wealth without depriving ourselves of life’s pleasures?” I found this question quite intriguing, as it shed light on deeply ingrained habits and attitudes.

Building wealth involves making challenging choices about how to allocate your money and time. If you are truly committed to building wealth or achieving your personal finance objectives, you’ve likely encountered the dilemma of whether to satisfy immediate needs or defer them for the future. Each time we confront this decision, we are essentially practicing what economists call the “scale of preference.” When wealth-building ranks as your top priority, every decision you make becomes intertwined with it, even the choice of purchasing a new car because you can afford it, or you’re saving for it, particularly when it’s a necessity.

In this article, I’ll discuss three fundamental and essential principles for those who are truly committed to both wealth building and life enrichment.

Principle #1: Consistently save and invest a portion of your income.

It’s crucial to establish a steadfast practice of saving and investing, whether it’s 10%, 20%, or a percentage that aligns with your financial situation. Saving serves multiple purposes, including achieving emergency fund goals and fulfilling other short-term objectives like taking a short vacation, purchasing a car, or buying a laptop. On the other hand, investing allows you to build resources for your child’s education, secure your retirement, and work towards other long-term financial goals. Both saving and investing are indispensable, so it’s essential to prioritise and commit to both.

Principle #2: Allocate funds for your happiness.

Regardless of how much we emphasise the need to cut back on non-essential expenses, some individuals may find it challenging to do so. We often criticise others for spending excessively on items like bags, wigs, electronics, and more. But take a closer look, and you’ll likely discover something you genuinely enjoy spending money on. These expenditures aren’t always about luxury; they provide happiness.

For instance, some people prioritise skincare over supplements or wellness. While some people would like to spend on gadgets, others would rather spend on designer clothes.

If you fall into this category and it’s causing financial strain, it’s time to set aside a specific budget for what brings you joy. Of course, this should come after you’ve allocated money for your essential needs. The key discipline here is to limit your spending to what you’ve allocated for your happiness. By doing so, you can enjoy these things guilt-free without resorting to borrowing or dipping into other financial resources. If it’s within your means, go ahead and set money aside for it.

Principle #3: Nurture healthy financial relationships.

And this isn’t just limited to marital relationships; it extends to your friendships as well. Surrounding yourself with people who don’t prioritise discussions about money may not motivate you to take your financial matters seriously. Your choice of a life partner is also important. If you plan to get married, understand that marriage represents one of the most significant financial decisions you’ll ever make. It’s crucial to grasp your partner’s money personality and strive for a harmonious balance. Both of you might be inclined toward spending or giving, but there should also be someone who emphasises saving and investing, to say the least. This equilibrium ensures that you don’t solely focus on spending or giving without a solid financial plan for your future.

Additionally, it’s vital to align your money values. Consider whether your potential partner leans towards borrowing for purchases or saving up for them. Marrying someone who frequently borrows may lead to a substantial portion of your income being dedicated to debt repayment.

In conclusion, these three rules—saving and investing, allocating funds for happiness, and nurturing healthy financial relationships—are key to building wealth and financial well-being. By following these guidelines, you can make informed choices that pave the way for a secure and prosperous financial future.

Over to you: which rule should serve as the fourth principle? It’s your turn to add your voice.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

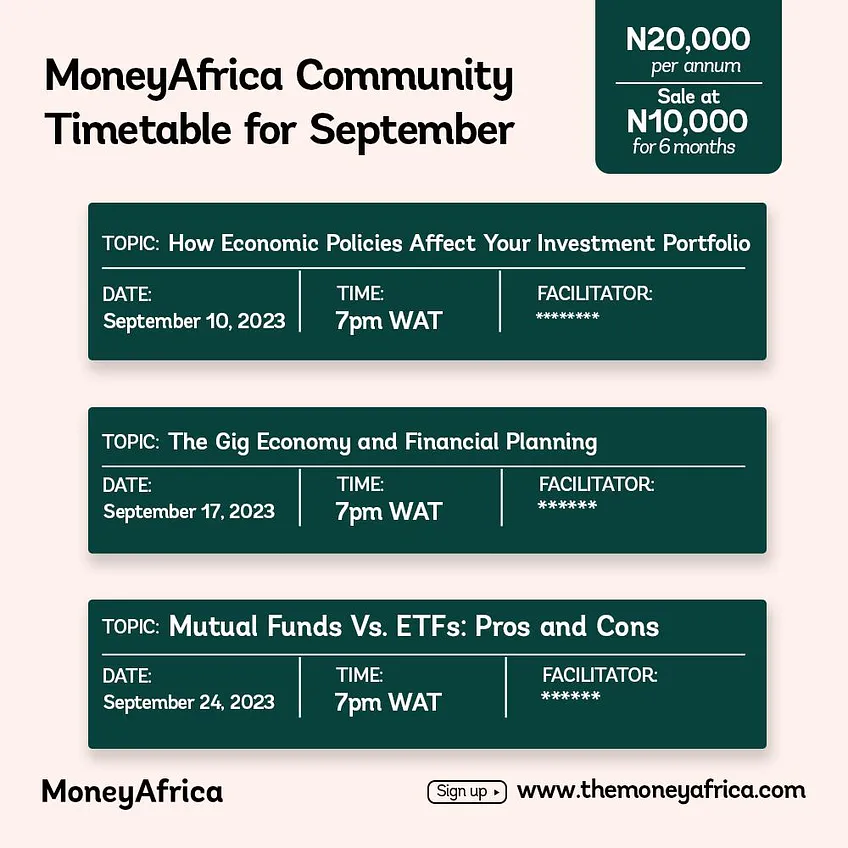

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com