Good Morning 😃

How are you doing?

For the longest time, I didn’t realise I had certain emotional connections with money. Whenever I felt down or faced overwhelming situations, my coping mechanism was to spend recklessly, often going beyond my budget. It was like a soothing distraction, especially when I strolled into a mall filled with tempting shoes, bags, pieces of jewelry, and dresses. Who could resist splurging in such a situation?

However, when I started budgeting monthly, I saw how these impulsive purchases provided only temporary happiness while leaving me financially drained in the long run. That’s when I decided it was time for a change. In today’s article, I’ll share five financial habits that transformed my financial journey for the better. These habits have helped me break free from emotional spending and build a more secure financial future.

- Cultivate the habit of budgeting

I understand that you’ve probably heard this advice countless times, but it remains a crucial step on your path to financial freedom. Budgeting provides a clear picture of where your money is going, helping you identify areas where you can cut back or save more. Consider obtaining your monthly bank statement and categorise your spending into different buckets to get a grasp of your monthly spending.

Alternatively, you can simplify this process by using apps that automatically track your expenditures whenever you make transfers from your bank accounts. This simple practice can be a game-changer on your journey to financial stability.

- Have an emergency fund

While it’s tempting to boast about owning shares in prominent companies like Zenith, UBA, Apple, or Microsoft, it’s essential to prioritise building an emergency fund in your financial journey. Life is unpredictable, and unexpected situations could arise, often beyond our control or with the help of friends and family. That’s why it’s wise to allocate a portion of your income each month to an emergency fund and refrain from using it unless a genuine crisis occurs. This simple practice can save you from financial stress or the need to rely on loan apps.

It’s also one of the reasons we developed Ladda to assist you in saving for unforeseen circumstances while earning a decent return. You can access the link here to start your savings journey: https://apps.apple.com/ng/app/ladda/id1531879570

https://play.google.com/store/apps/details?id=com.ladda.ladda

- Stop making poor spending decisions

Stop impulsive purchases. We often splurge on unnecessary purchases, whether it’s the latest trendy fashion piece or the newest gadget, sometimes using shopping as a way to seek validation. It’s crucial to remind ourselves that the most remarkable aspects of our identity aren’t tied to material possessions.

- Avoid Irresponsible borrowing

While debt is sometimes necessary, such as for education, business expansion, or mortgage, it’s essential to differentiate between reasonable and unnecessary borrowing. Utilising loans from financial institutions for significant investments like the ones mentioned above could be worth the while, but relying on friends and family to fund non-essential expenses like ceremonial clothing (aso-ebi) can harm your financial stability.

Taking on debt for items beyond your current financial means can lead to a cycle of indebtedness, making it challenging to cover essential expenses. It’s advisable to steer clear of such unnecessary expenditures to maintain a healthy financial outlook.

- Stop trying to use money to solve deeper problems

Avoid using money as a solution for more profound issues. Money can’t always fix the underlying challenges we face in life. Instead of relying solely on money to address these issues, we should often look within ourselves and explore alternative means to confront and resolve our deeper problems. While money can alleviate some concerns, true contentment and fulfilment often come from addressing the root causes of our troubles rather than merely applying financial remedies.

In conclusion, adopting these five financial habits can significantly impact your financial well-being and set you on a path to end the year successfully. By managing debt wisely, curbing impulse spending, prioritising an emergency fund and avoiding using money to solve deeper issues, you’ll be better equipped to navigate your financial journey.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

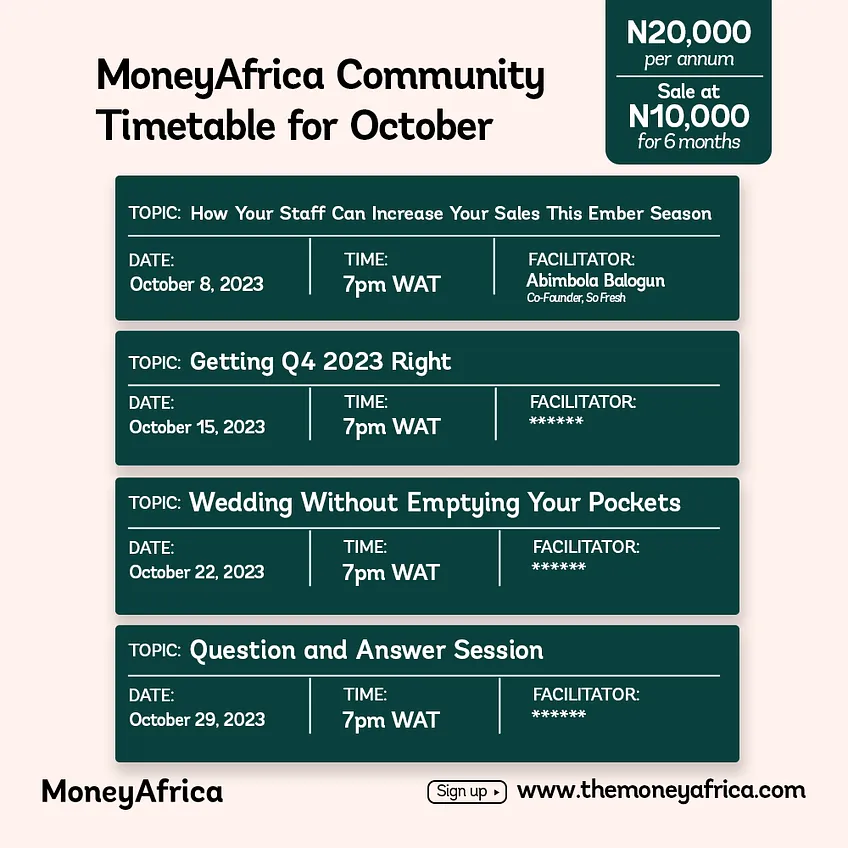

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com