Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

Kindly simplify debt (loans) and credit and how they can be used to create wealth.

Answer

Debt, often in the form of loans, is borrowed money that you need to repay with interest. It can be used to create wealth when used strategically.

Imagine debt and credit like tools in a financial toolbox. Debt is like borrowing a friend’s car – you get to use it, but you have to return it with a bit extra (interest) for their trouble. If you use it to drive for a ridesharing service and earn more than the cost of borrowing, you’ve created wealth.

Let’s say you want to buy a fancy car but don’t have enough cash. You take out a car loan, which is a type of debt. Over time, the value of the car can decrease, but you’re also paying down the loan as you make monthly payments. When you eventually sell the car, you might still make a profit, and that’s wealth creation through debt.

Now, credit is like your financial reputation. It’s what your friends think of you when they decide whether to lend you their car or not. If you’ve always been reliable, they’re more likely to lend it to you.

With a good credit score, you can borrow money at lower interest rates when you need it, which saves you money. For example, let’s say you want to start a small business. You can use a business loan, which is debt, to get it off the ground. With a good credit score, you’ll likely get a lower interest rate, which means you’ll have to pay back less. If your business succeeds and generates profit, you’ve just used credit and debt to create wealth.

Like any tool, you should be cautious. Just as you wouldn’t borrow all your friends’ cars at once, you shouldn’t accumulate excessive debt. The key is to use debt and credit thoughtfully like a skilled craftsman uses tools to build something valuable.

***

Question

How do I prepare for the holidays with the way prices of food items keep increasing at an alarming rate? I want to celebrate with my family in plenty. Is there a way to curb the effect of the increased prices of food items?

Answer

In our country, the holidays are a big deal, and we know how to celebrate with our loved ones. But, just like in many places around the world, the increasing prices of food items can be a concern. I have some suggestions with which you can curb these effects while making the holiday season joyful.

One thing you can do is communal cooking and sharing. You can invite your family members to come together and prepare dishes in bulk. It’s a way of not only saving money but also strengthening social bonds. You can all gather together in the same kitchen, chopping, stirring, and sharing recipes. It’s a beautiful example of togetherness during the holiday season.

You could also explore local markets for fresh and often more affordable options. Nigerian markets are vibrant and offer a wide range of affordable, fresh produce. Don’t forget to buy in bulk – it can save you money in the long run, especially for non-perishable items. You can also buy early and preserve the food items. If going to the market is not your thing, don’t worry there are services that could help you with that at the same affordable rate, even better than what you’d get at a supermarket. Check this out.

If you have access to a bit of land or even a small balcony, consider growing your own veggies and herbs. It’s not only cost-effective but also a fun family activity. This not only helps in saving money but also ensures you have access to fresh, organic produce.

I hope these tips help you and your family enjoy the holiday to the fullest!

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

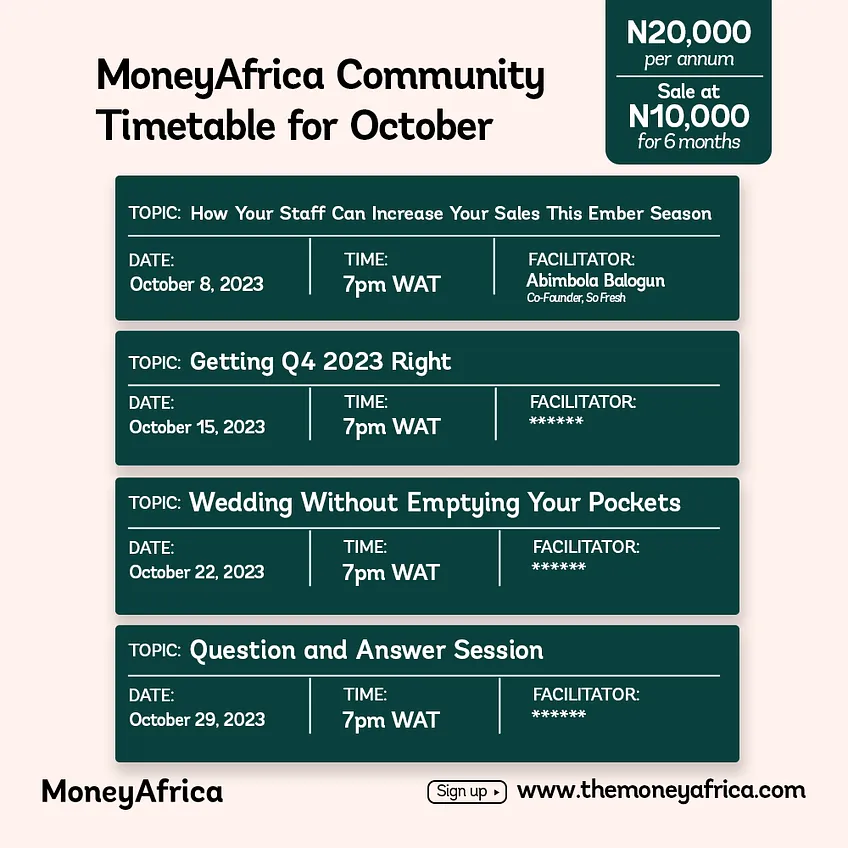

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com