Good Afternoon 😃

How are you doing?

I stumbled upon a heart-wrenching story of a 20-year-old Unilorin student who tragically took her own life because she found herself in debt to multiple apps, totalling a staggering N500,000. Her despair stemmed from a morning spent trying her hand at affiliate marketing, which ultimately led to financial ruin.

While her story is undeniably tragic, it serves as a stark reminder that many people find themselves ensnared in the same web of debt. It’s a tale as old as time. Lured by promises of extraordinary returns, individuals often borrow money to invest in businesses or opportunities that fail to deliver as expected. This is a poignant reminder that we should always plan for a sure outcome rather than placing our hopes in ventures that are shrouded in uncertainty.

For many, debt becomes a necessary means to an end. People use loans to bridge the financial gap, enabling them to attain aspirations that might otherwise remain out of reach. Whether it’s purchasing a home, a car, funding a wedding, a business, travel, or simply sustaining a particular lifestyle that meets societal expectations, debt becomes a tool in the quest for fulfillment. Sometimes, individuals resort to borrowing to cover existing debts, unwittingly entangling themselves in a never-ending cycle of financial obligations.

In a world where the allure of debt often disguises itself as an opportunity for advancement, it is paramount to approach financial matters with wisdom and discernment. It’s not about avoiding loans altogether but about using them responsibly, with a clear and realistic plan for repayment. Each financial decision should be approached with the foresight to lead us toward a future we aspire to, rather than one overshadowed by debt and its perils.

Before we delve into that, have you started saving on Ladda? Do you know you can get up to 10% in return when you do? Go ahead, download the app and start saving.

Apple store: https://apps.apple.com/ng/app/ladda/id1531879570

Google store: https://play.google.com/store/apps/details?id=com.ladda.ladda

Now that we know, let’s talk about how loans affect people.

- Continuous Cycle of Debt. This occurs when you need to take out new loans to repay existing ones. You don’t want loan apps coming after you, so you end up borrowing high-interest loans to settle your current debts. Once you embark on this path, it can become extremely challenging to break free because you’ll find yourself paying even more in interest. This only provides temporary relief.

- Financial Impact. One of the most immediate effects of loans is the financial burden they place on borrowers. Monthly payments and interest can strain budgets, potentially leading to stress and anxiety.

So if borrowing is this destructive, why do people still do it?

Loans enable people to acquire assets like homes or cars. This can improve one’s quality of life and provide a sense of accomplishment. However, it’s essential to recognise that relying on loans alone can provide only temporary relief and may eventually lead to a debt cycle. The most prudent approach to fulfilling such goals is through diligent savings and financial planning. Not only does this enable you to acquire the assets you desire, but also helps you do so without the weight of excessive debt.

- Emotional and Psychological Impact. The weight of financial obligations can lead to stress and anxiety, profoundly impacting one’s mental health. The constant concern about repayment and financial stability can gradually erode overall well-being. This turmoil can have repercussions that extend beyond personal life. It can influence your level of productivity and affect your performance at work or in your business.

In some unfortunate cases, it might even reach a point where employers are compelled to make difficult decisions like relieving you from your job due to these issues. If you’re a business owner, the mental strain can hinder your ability to devise effective strategies to propel your business forward, potentially resulting in stagnation or decline.

- Lifestyle and Relationships. Loans can delay life milestones like marriage, having children, or retirement. The need to repay debt often takes precedence over personal goals and causes strain in relationships. Disagreements about how to manage debt can lead to conflict within families and between partners.

- Career and Opportunity. Some individuals may opt for higher-paying jobs they dislike to repay loans quickly, rather than pursuing a career they’re passionate about. The weight of debt becomes such that it compels them to prioritise financial obligations over their own passions. This can lead to years spent in a career that doesn’t bring joy or fulfillment, all because debt must be repaid and bills must be met.

The fear of financial instability caused by loans casts a shadow over one’s professional aspirations and influences the paths they choose. This fear might dissuade individuals, including potential business owners, from pursuing their entrepreneurial dreams and embarking on new endeavours. This deprives them of the chance to follow their passions and ambitions.

Loans are a double-edged sword, offering opportunities while imposing responsibilities. To minimise the negative impact of loans, it’s crucial to approach borrowing with careful consideration. Understanding the terms and implications of loans, creating a budget, and seeking financial advice can help individuals manage their financial health and mitigate the potential adverse effects of debt.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

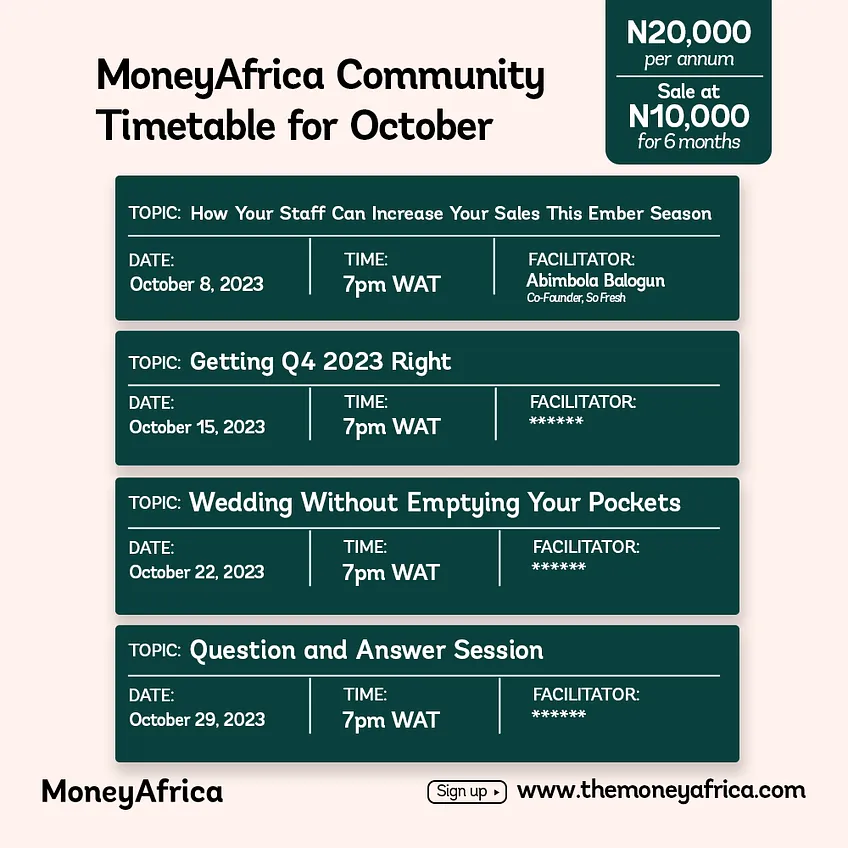

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com