Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

I am re-starting my financial journey, and I want to start out on the right foot. I am currently a full-time staff and stuck to budgeting, which has been beneficial and productive. However, I will be transitioning to self-employment soon. How do I set and follow my budget, considering that the pay does not come in bulk as salaries do? My instinct says to not touch the income until the month’s end when I can pay myself, but I don’t see how that is feasible at this time. What would you advise me to do to maintain my budgeting lifestyle, live a good life (where I take care of myself adequately) and still save and invest?

Answer

It’s important to note that budgeting can be a bit more challenging when you’re self-employed because your income may vary from month to month. So we’ll look at a few things you can do to make it work.

Setting your budget

The first step is to set a budget that is based on your average monthly income. This means looking at your income over the past year or two and calculating your average monthly earnings. Once you have this number, you can start to allocate it to different categories, such as housing, food, utilities, transportation, debt repayment, savings, and investments.

Following your budget

This is the most challenging part for most people but once you have a budget, it’s important to stick to it as much as possible. This can be difficult when your income is irregular, but there are a few things you can do to make it easier:

- Pay yourself a regular salary. Even if your income varies from month to month, try to pay yourself the same amount of money each month. This will help you to budget more effectively and avoid overspending.

- Pay important bills upfront. One of the best ways to avoid financial stress is to pay your important bills upfront. This includes things like your rent, mortgage, car payment, and utilities. By paying these bills upfront, you won’t have to worry about them hanging over your head and you can focus on other expenses. Of course, you may not always have the money to pay all of your important bills upfront. That’s where budgeting comes in, so take the first step very seriously!

- Create a separate business account. This will help you to keep track of your business income and expenses, and it will also make it easier to pay yourself a regular salary.

- Set up automatic transfers. Set up automatic transfers from your business account to your personal account each month. This will help you to stay on track with your budget and avoid spending too much of your business income.

Living a good life, saving, and investing

It is possible to live a good life, save, and invest even when you have an irregular income. The key is to be disciplined with your spending and to make sure you are putting away money each month for savings and investments. You can start doing the following:

- Create a budget that you can afford. Emphasis on “you can afford.” Don’t try to budget for a lifestyle that you can’t afford. Instead, focus on creating a budget that allows you to cover your essential expenses and still save and invest money.

- Cut back on unnecessary expenses. Take a close look at your budget and see where you can cut back on unnecessary expenses. You have to be brutally honest with yourself when doing this. This could include things like eating out less, cancelling unused subscriptions, or shopping around for better insurance rates.

- Automate your savings and investments. Set up automatic transfers from your business account to your savings and investment accounts each month. This will help you to save and invest money without even having to think about it. Also, instead of saving in a traditional savings account that gives little to no interest, try saving in a high-yield savings account (HYSA)—this is where Ladda comes in. You can get up to 10% per annum on your savings so it can even serve as a form of a low-risk investment for you. It’s available for android and iOS devices.

***

Question

I keep dipping into my savings for my upcoming wedding. I am afraid I may not have the wedding of my dreams due to my spending habits. I rationalise in my head that the spending is valid but at what cost? How can I maintain a strict spending budget in order to save for my wedding?

Answer

Weddings can be expensive, and it’s easy to get carried away with spending. However, it’s important to stick to a budget so you don’t end up in debt or having to sacrifice your dream wedding. You can put the following things in place to help you be more strict with your spending:

- Set a budget and stick to it. This is the most important step. Once you know how much money you have to spend, you can start to allocate it to different categories, such as the venue, food, drinks, flowers, photography, and music.

- Prioritise your spending. Decide what is most important to you and allocate more of your budget to those things. For example, if you really care about having a beautiful venue, you may want to spend more money on that and less money on other things.

- Be creative with your spending. There are many ways to save money on your wedding without sacrificing quality. For example, you could make your own invitations and platforms like Canva have made it very easy. It could be e-invites so you won’t spend on printing as well, or you could cater for the wedding yourself with the help of your family.

- Don’t be afraid to ask for help. If you’re struggling to stick to your budget, ask your family and friends for help. They may be able to offer you financial assistance or help you with tasks like planning or decorating.

I know it can be difficult to rationalise spending when you have a specific goal in mind. It’s important to remember that every time you dip into your savings, you’re delaying your goal. If you really want to have the wedding of your dreams, you need to be disciplined with your spending.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

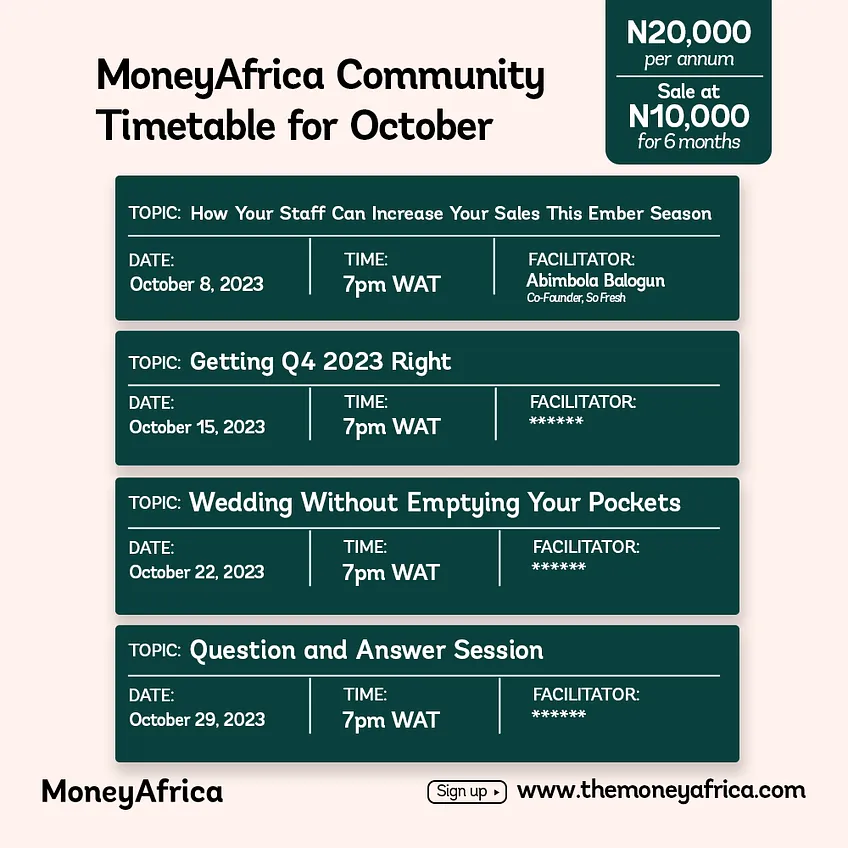

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com