Good Morning 😃

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

I’ve been taking some of my past savings to save myself recently. Am I doing it wrongly? That’s what savings are for, right? Or, when am I supposed to take from my savings? I feel guilty anytime I take from my savings.

Answer

Your savings should always have a goal. Whether it’s for buying a house, a car, or simply ensuring financial security, it’s essential to align your saving strategy with your goals.

While savings are indeed there to help you in times of need, it’s also important to see them as a tool for achieving your goals. Here are ways you can manage your savings properly:

- Emergency Fund: Ensure you have a dedicated emergency fund that covers at least three to six months’ worth of living expenses. This fund should be your first line of defense in unexpected situations, like medical expenses or family issues.

- Budgeting: Create a monthly budget to manage your expenses. This can help you avoid dipping into your savings for non-essential spending. Try to distinguish between wants and needs in your budget.

- Savings Goals: Establish specific savings goals for short-term and long-term objectives, such as a vacation, home purchase, or retirement. This will help you avoid feeling guilty when you do need to tap into your savings for a valid reason.

- Replenish Savings: Whenever you withdraw from your savings, make a plan to replenish that amount as soon as you can. Treat it as a loan to yourself, and budget for repaying it.

- Investment: Consider investing a portion of your savings in assets that can potentially grow over time, like stocks or bonds. This can help your savings grow faster than traditional savings accounts.

Ultimately, it’s okay to use your savings when necessary, as long as it aligns with your financial goals and you have a strategy in place to maintain and grow your savings over time. The key is to balance your immediate financial needs with your long-term financial security.

Question

What is MoneyAfrica about?

Answer

MoneyAfrica is a personal finance and investment literacy company that is committed to educating you about all you need to know about money and how it affects your pockets.

MoneyAfrica has a fintech platform known as Ladda where you can save your money in naira or dollars with an interest rate of 10%. The investment arm of Ladda is coming soon. You will be able to diversify your investments and earn more with this special feature.

You can click on the link below to download Ladda and get started on your savings journey.

To download Ladda for iOS, click on this.

To download Ladda for Android, click on this.

MoneyAfrica also has communities and platforms for various age brackets (children, students, and adults), where it provides financial literacy and engages members of the communities.

The financial literacy platform for children is known as MoneyAfrica Kids. Here, MoneyAfrica teaches children about money, encourages healthy money habits, helps them start saving early among many other things. Above all, MoneyAfrica makes learning about money fun and relatable.

The financial literacy platform for students—MoneyAfrica Student Community—is an exclusive community of young and smart students in some of the leading universities across Nigeria and Africa. The students are equipped with the right knowledge and tools to help them better manage their personal finances and wealth. There are other benefits of the student community and you can enjoy these benefits here for free.

For those who don’t belong to the children or student categories, MoneyAfrica offers financial advisory services and helps clients embark on the journey to financial freedom. Here, different plans exist through which you can book a one-on-one session or a consultation.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

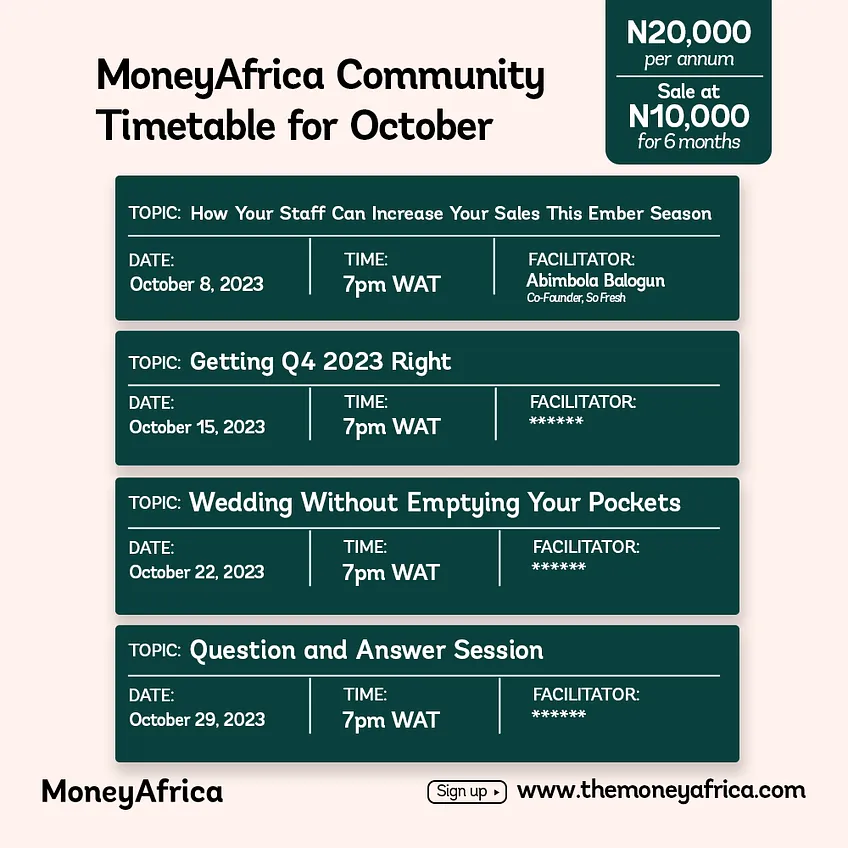

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com