Good Morning 😃

How are you doing?

In the past, you might have hesitated to say “Amen” when someone prayed, “May Nigeria not happen to you.” But with the recent surge in prices for nearly everything, you may find yourself saying “Amen” as if the heavens themselves are on the brink of collapse. The escalating cost of living has made us acutely aware of the need for positive change, and the fervent hope for a better future is what everyone is praying for.

To be honest, how have you been managing the recent surge in the prices of goods? From fuel to food and virtually everything in between, it often feels like the only thing that hasn’t seen an increase is the air we breathe – and even some folks pay for that too.

Food prices have continued to surge in the last year. The latest data from the National Bureau of Statistics shows that the composite food index increased to 30.64% in September 2023—a staggering 7.30% higher than the same period in 2022.

Not just that, the Selected Food Price Watch for September 2023 shows that the average price of 1 kg of boneless beef stood at N2,816.91, which implies 28.08% rise in price on a year-on-year basis from N2,199.37 recorded in September 2022. While the average price of 1kg of local rice sold increased by 60.59% on a year-on-year basis from N471.42 in September 2022 to N757.06 in September 2023.

From the look of things, the hike in food prices would persist for a while. It is therefore expedient for everyone to learn how to cope with the situation until things are restored.

Here are five ways to save on food prices.

- Eat at home.

Eating at home can sometimes feel like a chore, especially when you’re juggling a 9 to 5 job and possibly getting your children ready for school. The thought of waking up early to prepare meals without any help might seem overwhelming. However, the truth remains: one of the most effective ways to save money during this time is by ‘eating at home.’

Consider this: the amount you’d spend on a single restaurant meal could often cover the cost of preparing a wholesome meal for a family of four. So, as much as possible, embrace home cooking. Not only will you be saving money, but you’ll also gain control over the ingredients that go into your dishes, ultimately preserving your health.

- Have a food budget or plan.Someone once said If you stumble around the grocery store and fill your cart with everything that catches your eye, you’ll spend more even if you prepared a shopping list in advance. So, here’s the deal: plan your meals in advance. Look a week ahead, jot down all the ingredients you would need to prepare those meals, and don’t forget to list their prices. When you hit the market, stick to your list like glue, avoiding those tempting impulse buys at all costs.

Here’s a little trick I employ by all means: pay with cash. This keeps you from dipping into your account and falling victim to temptation. A well-planned budget and a thoughtful meal plan are your secret weapons for saving money while still enjoying great food.

- Buy in bulk and stock your kitchen for the holidays.

Preparation is key, especially when it comes to the holiday season. Buying food in bulk or ensuring your kitchen is well-stocked ahead of Christmas can work wonders in more ways than you think. Not only will it help you save precious time, but also it’ll cut down on frequent trips to the market, ultimately reducing transportation costs.

- Take advantage of apps offering free or cheap food items.

People have started signing up on apps such as Pricepally for discounted prices on food items. Do you know you can secure December food items at current prices for your essential food items like rice, semovita, oil, etc? This is what Pricepally’s Price Lock Campaign is all about. You can save on your budget and reduce costs during this critical period by visiting pricepally.com/pricelock and join the Price Lock Campaign today.

- Save on protein!

Reduce your food expenses by opting for cost-effective vegetarian protein sources, such as beans, eggs, tofu, and legumes, in place of pricier meats, fish, or poultry. These budget-friendly alternatives not only save you money but also offer health benefits. Beans and legumes are packed with fibre and essential nutrients, while eggs provide high-quality protein at a fraction of the cost of meats. Tofu is a versatile, affordable protein source that can be used in various dishes. By incorporating these options into your meals, you can maintain a balanced diet without straining your wallet. Embracing meatless options is a win-win that benefits your finances and overall well-being.

Now over to you. I know I didn’t cover all the strategies you are adopting this season.

Which of the ones shared are you going to start adopting? Kindly share your thoughts in the comment section.

Don’t forget to sign up on Ladda for an opportunity to earn up to 10% on your savings or 20% when you invest in our real estate opportunities.

Download the app here:

Ladda: https://apps.apple.com/ng/app/ladda/id1531879570

https://play.google.com/store/apps/details?id=com.ladda.ladda

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

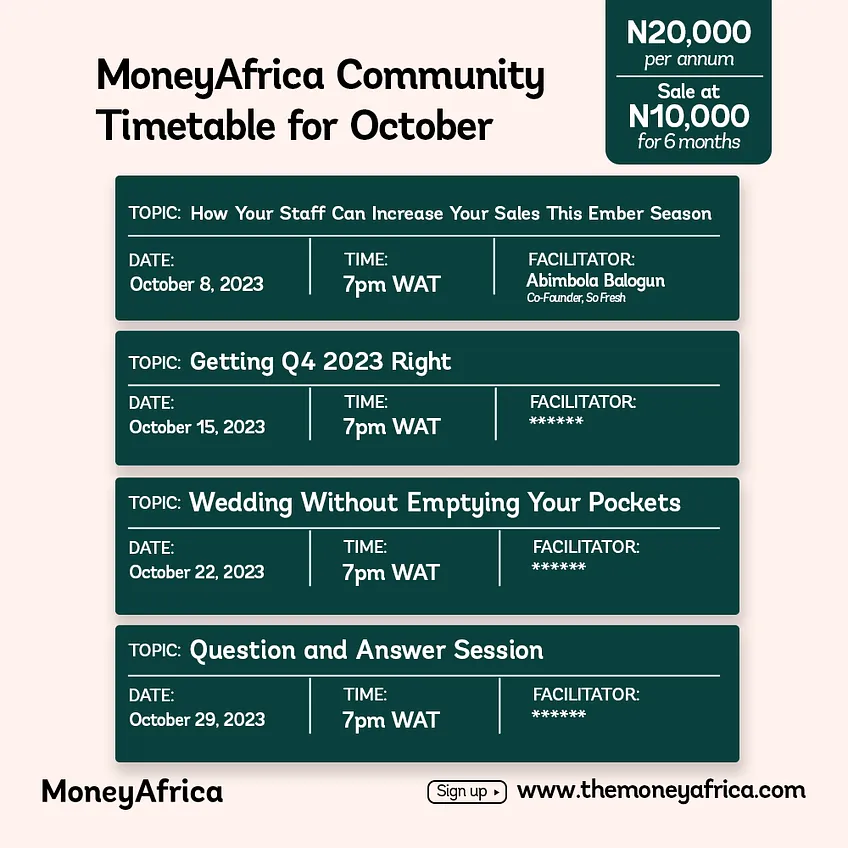

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com