Good Morning 😃

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

How do I save and budget my ₦48,000 monthly income effectively as a youth corper? I am a fresh graduate and serving corp member. I find it difficult to save from my “allawee.” I do not live with my parents, so I fund my own day-to-day living expenses like transportation, food, data, and electricity bill. I’ve heard stories of people who were able to save a huge amount from their NYSC monthly allowance, and I’m wondering if I’m wasteful because I’m unable to save from mine. Please help!

Answer

First off, kudos to you for being proactive and thinking about your financial future during your youth service. It’s a great time to start building good money habits. Let’s break down some practical tips to help you effectively save and budget your ₦48,000 monthly income as a corps member:

Creating a budget is like having a roadmap for your money. It’s a crucial step because it helps you see where your money is going each month. Start by listing all your expenses—and I mean everything—from rent and transportation to groceries and that occasional restaurant hangout. This can be eye-opening. Once you have a clear picture of your spending, you can then make informed decisions about where you can cut back or allocate more funds. Essentials are those things you absolutely can’t do without like food, transportation, and keeping the lights on. When you get your allowance, make sure you allocate a portion to cover these crucial expenses first. This ensures that your basic needs are met before you think about spending on non-essentials.

We’ve all been there—that daily lunch delivery, those impulse purchases, or ordering a ride when you could’ve walked a bit. Cutting back on unnecessary expenses doesn’t mean you have to live like a hermit; it’s about being mindful of where your money goes. Cooking at home more often can save you a lot in the long run and can be a fun way to experiment in the kitchen.

Setting savings goals gives you something to work towards. Start with a reasonable goal, maybe 10% of your allowance, and gradually increase it as you get more comfortable with your budget. It could be for an emergency fund, a trip you’ve always wanted to take, or even long-term investments. Having a clear goal in mind can make saving feel purposeful. An emergency fund is your financial safety net. It’s for those unexpected curveballs life throws at you like a medical expense or a sudden car repair. The rule of thumb is to aim for three to six months’ worth of living expenses in your emergency fund. Building this cushion may take time, but it’s incredibly reassuring when you need it. One of the most effective ways to save consistently is to automate the process. Set up a direct transfer from your allowance account to a dedicated savings account. This way, you’re not tempted to spend the money you intend to save. It’s a “set it and forget it” approach that makes saving almost effortless.

Staying frugal doesn’t mean depriving yourself of everything enjoyable. It’s about making thoughtful choices. You can still treat yourself, but it’s all about moderation. Perhaps instead of dining out every weekend, make it a once-a-month special treat. Being mindful of your spending can lead to big savings over time.

Sometimes, your monthly allowance may not cover all your expenses, especially with the current state of the economy. If that’s the case for you, consider looking for part-time work or freelancing opportunities. These extra income streams can give your savings a significant boost. Plus, they’re a great way to gain valuable skills and experience.

It’s great to hear inspiring stories of people saving big during their youth service, but remember that everyone’s financial situation is unique. Don’t compare yourself too harshly to others. Focus on your own progress and celebrate every step you take towards financial stability. It’s your journey, and you’ll find what works best for you over time.

***

Question

Could you please explain what the OMO auction is all about?

Answer

First, OMO stands for “Open Market Operations.” It’s something that the government or a central bank does to control the amount of money circulating in the economy. This is typically done by buying or selling government securities (like bonds) in the open market. When the central bank buys these securities, it injects money into the economy, and when it sells them, it withdraws money from the economy.

An auction is a public sale in which goods or property are sold to the highest bidder.

Therefore an open market primary auction refers to a government-sponsored auction where government securities, such as treasury bills and bonds, are sold to the public, including banks, financial institutions, and individual investors. These auctions are typically conducted by the Central Bank of Nigeria or the Debt Management Office (DMO). (FAQ, CBN)

Here’s how it works:

1. Announcement: The government announces the details of the auction, including the type of securities being offered, the total amount to be auctioned, the auction date, and the maturity date.

2. Participation: Interested investors, including banks and individuals, submit their bids to purchase these securities at specific interest rates or prices. The minimum investment amount for a treasury bill is ₦50,001,000.

3. Competitive bidding: Investors can submit competitive bids, specifying the interest rate or yield they are willing to accept. The highest interest rates that are accepted are usually those with the lowest bids.

4. Non-competitive bidding: Investors can also submit non-competitive bids, where they accept the yield determined by the competitive bids. Non-competitive bids are typically guaranteed to be accepted.

5. Allocation: The government reviews all bids, and based on the competitive and non-competitive bids, it allocates the securities to the highest bidders at the lowest acceptable interest rates or yields.

6. Settlement: Once the auction is complete, successful bidders are required to pay for the securities they’ve won, and the government issues the securities to the winning bidders.

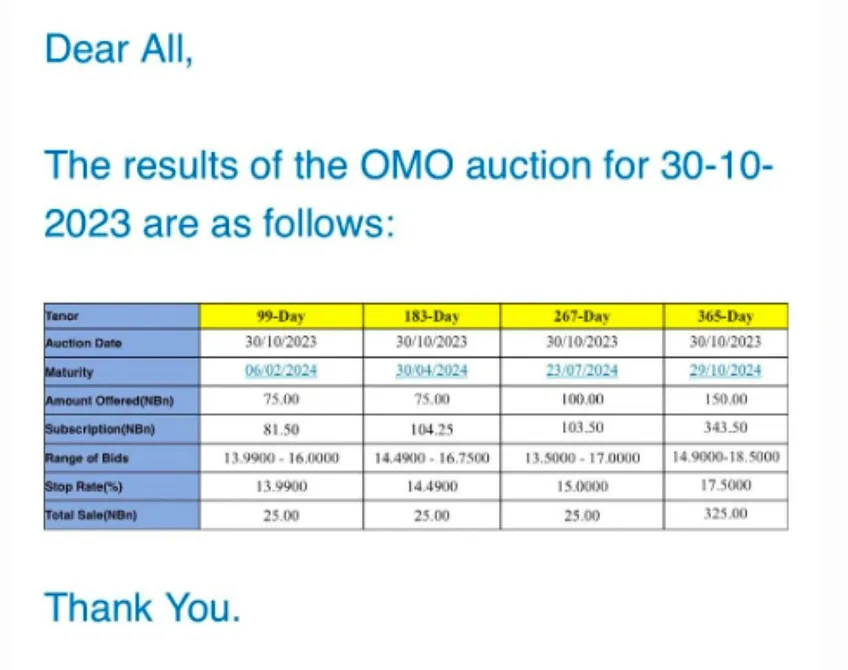

Example of results of OMO auction

In the context of an open market primary auction of government securities in Nigeria, the following terms are relevant:

1. Stop rate: The stop rate, also known as the clearing rate or weighted average rate, is the interest rate or yield at which the government accepts bids for the securities being auctioned. It is the rate at which the government is willing to sell the securities to investors. The stop rate is usually determined based on the competitive bids submitted by investors. Bids with the lowest interest rates are typically accepted, and the stop rate is the weighted average of these accepted rates.

2. Bid rate: The bid rate refers to the interest rate or yield specified by an investor in their bid to purchase government securities at the auction. Investors can submit competitive bids, indicating the specific interest rate or yield they are willing to accept. The bid rate represents the investor’s terms for purchasing the securities.

3. Effective yield: The effective yield is the actual rate of return an investor will earn if they hold the government securities until maturity. It takes into account the purchase price, the face value of the security, and any interest payments received. The effective yield may differ from the bid rate if the investor’s bid is accepted at the stop rate, or if the investor’s bid is non-competitive and they accept the yield determined by the competitive bids. It reflects the true return on the investment.

4. Yield to maturity (YTM): The yield to maturity is the total return an investor can expect to receive if they hold the government securities until they mature. It considers the purchase price, interest payments, and the face value of the security, assuming that all payments are made as scheduled. The YTM is a measure of the annualised return on the investment and is useful for comparing the attractiveness of different securities. It can be calculated using the bond’s price, face value, time to maturity, and coupon rate.

These rates and yields are crucial for assessing the potential returns on your investments and for the government to manage its debt issuance effectively.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com