Good morning!

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to:

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

What are your thoughts on health insurance? Do you think it’s a good financial decision or is it better to stick to a yearly checkup?

Answer

The topic of insurance in Nigeria often sparks thoughtful conversations and this one is not exempted. Today, a number of us are caught in between stopping at the yearly health checkups and getting an insurance policy. If this is you, you are in the right place.

Why do you need to have a health insurance policy?

It will be difficult to see the use of a thing without understanding what it is, right? So, here is a simple way to understand what a health insurance policy is.

It is an agreement where an insurance body agrees to pay for some or all of medical issues that may arise in the future for a monthly premium payment.

Now that you know what it is about, it’s safe to go on to why you need it. You simply need it to ensure you have something to fall back on if and when a need to pay for any medical bill arises without interfering with your financial goals. Not everyone buys into the idea of having one but it does not take away from the value this policy provides!

The good thing is that some companies offer health insurance as part of their employee benefits (take time out to ask your HR manager if you are not sure, so you don’t keep paying for medical bills covered by your insurance policy).

If you do not fall into the above category or are self-employed, all is well. Take this as your cue to start making plans to own one.

Is having a health insurance policy a good financial decision?

In fact, it is a great decision, especially as it protects you and your loved ones from the financial impact of unforeseen events such as illnesses, natural disasters, and accidents.

Secondly, anything that takes away the possibility of making those unplanned withdrawals, especially those that will get you to your financial goals, is highly recommended. Thankfully, the health insurance policy is one of such.

Finally, consistent health checkups are great and should be done regardless of whether you have an insurance policy or not. However, they don’t provide the coverage the latter has over unforeseen events, as mentioned earlier. It is also important that you do your research before picking a policy the same way you do when choosing an investment plan. This is so you don’t fall into the hands of scammers. Some of the important things to look out for when searching for an insurance policy for yourself are:

- Your personal and financial risk level determines the type and level of coverage you need.

- The cost of the insurance premium is compared to the benefits the policy you are considering offers.

- How comprehensive and sustainable the protection of the insurance policy is, especially in line with your long-term plans and goals.

Whenever you feel overwhelmed, you can consider seeking advice from licensed insurance professionals, who can help you navigate the complexities of insurance products and tailor solutions to your specific needs and goals.

***

Question

What is an annuity, and how do I manoeuvre it?

Answer

Annuity is not the most common financial term out there but that’s why we are here—to make this jargon as simple as it gets, ensuring you are learning and well-informed!

Annuities are simply long-term investments you make before retirement that could provide a steady means of income during your retirement period. They work quite similarly to pensions, but the truth is, there is so much your pension can do, and that is why having an annuity is very crucial to living a comfortable life in retirement. Annuities allow you to carve out the retirement life that you want.

How does it work?

It all starts with investing either a lump sum or a series of payments to receive regular payments in retirement. The amount you get paid will depend on how much you have invested, how long you want to receive your annuity payment in retirement, and how much time you give your investments to grow before you start receiving payments.

Ideally, the longer you wait or invest, the more chances your investment will have to grow, and the larger your payouts will be. In the same vein, the longer you decide to receive payments in retirement, the smaller your payments will be. The way to maximise annuities is to start early and allow your investment to grow! It is also important to invest a reasonable amount of money, especially considering the inflation factor, which could make the payouts in retirement small. For instance, the price of a bag of rice now will not be the same 20 years from now.

Now, to my Gen Z friends and young readers, you have so much time ahead of you and should stop seeing the “retirement plan” talk as a topic for the older generations. The earlier you start, the more wealth you accumulate!

***

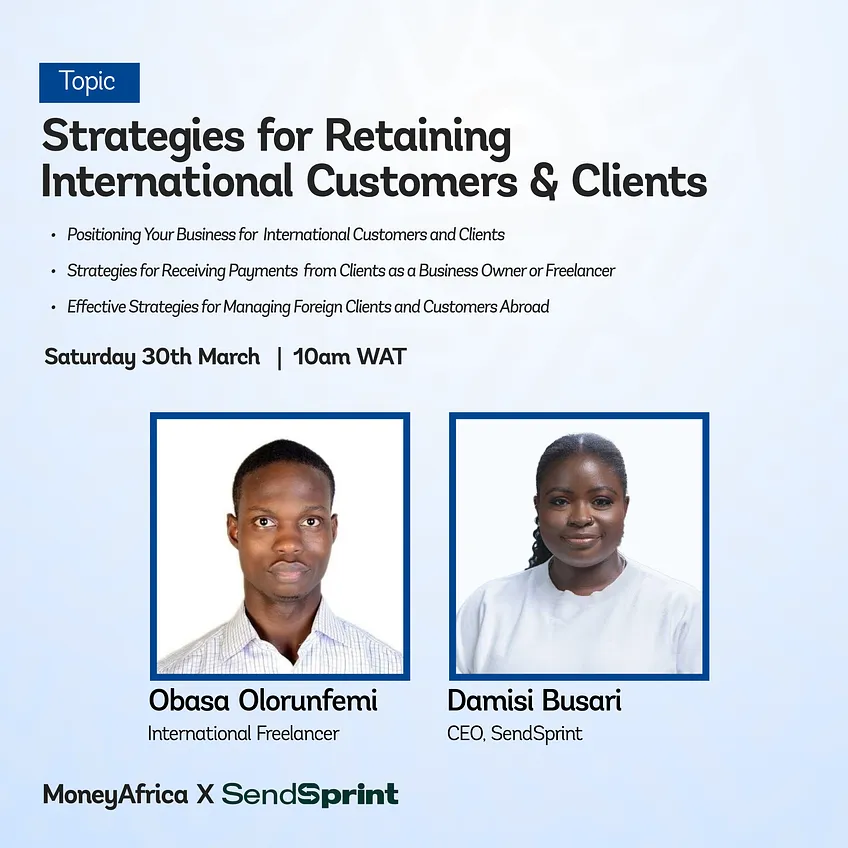

At MoneyAfrica, we encourage people in different phases of life to take charge of their finances. Join our community here to learn more and gain access to a pool of resources. We have a webinar series in partnership with SendSprint for entrepreneurs and freelancers who want to build a sustainable global brand.

Register here to be a part of the next session happening this Sunday, April 7, 2024.

You can also watch the recap of the first session here after which, you should fill out this form to access the loads of resources SendSprint has provided for you!

Topic: Strategies for Retaining International Customers & Clients

Time: Apr 7, 2024 07:00 PM Africa/Lagos

Join Zoom Meeting

Meeting ID: 847 9496 6830

Passcode: 658944

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2024.

Don’t forget to:

- Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com