Good morning!

How are you doing?

Friday letters are usually dedicated to taking questions from our community. Do you have a question for us? Please feel free to:

- send an e-mail to info@themoneyafrica.com; or

- send a DM to any of our social media channels, or

- simply fill out this form. Don’t worry, your responses are kept anonymous.

***

Question

Does REIT or traditional real estate investment make sense?

Answer

You don’t need to be physically in Nigeria (especially Lagos) to hear about the buzz around real estate in recent years. It shouldn’t come as a surprise as Land—properties included—is one asset that continues to appreciate with time.

It should interest you to know that there are several types of real estate investments. In this letter, we will be grouping them into two categories: traditional/physical real estate investments and non-traditional real estate investments or REITs.

The former, involves buying of land or property and the latter has you investing without owning a physical property such as REITs and crowdfunding platforms. Both categories have their pros and cons as we will see in no time.

What are REITs?

REITs or real estate investment trusts are companies that specialise in owning commercial real estate like offices and supermarkets. Investors buy shares of these companies listed on the stock exchange. The interesting part of this type of investment is that you can, to a good extent, mitigate the risks associated with owning real estate directly. It affords investors the opportunity to diversify their portfolio. Even the return on investment is pretty attractive, too.

Another benefit of REITs is that it offers more liquidity compared to other real estate investments since you can sell your shares on the stock exchange market when you need to. If you don’t have the time and can afford a stockbroker, this will also be a great option for you.

How about traditional real estate investments?

This type of investment offers a high return as well but usually requires large upfront payments when compared to REITs. In recent times, however, real estate companies have made it easier by permitting payments in installments but not without a cost. Let’s not forget the high ongoing costs and fees you might have to face. Finding a buyer when you need to liquidate can also be a challenge.

Now, do these investment categories make sense? It all goes back to your financial goals. If you are looking to invest for the long-term, going traditional should give you higher returns. If your goal is short-term, then REITs might be your best bet. This is not to take away from how good REITs are for long-term investments. If anything, they possess great qualities worth investing in for a long period of time.

***

Question

Do you advise that one should buy stocks when it’s rising?

Answer

Every other day, thousands of people ask Google when the right time is to buy stocks. This shows that you’re not alone, and the good thing is, we are here to help. Stocks are simply investments that give you part ownership of a company and definitely a great way to build wealth. You buy shares of the said company with the hopes of making a significant return on investment. The next question is:

What happens when a stock rises?

When the stock of a company rises in value, it means that the value of your investment also increases and when you sell, you make profit asides from the dividend paid on those stocks. Imagine you bought a stock at N300 per share and it rises to N500 per share. When you decide to sell it (we always advise long term investments), you will be having a profit of N200 per share plus any dividends paid per share.

When a stock value rises, it means that investors are willing to pay more for it because they believe the company is doing well or will do well in the future. This can happen for various reasons, such as strong earnings reports, new developments like Reddit and Astera Labs, positive news about the company, or increased demand for the company’s products or services. Now to the elephant in the room.

Should you buy stocks when they are rising?

First things first, be clear on your financial goals. Will you be investing short- or long-term? Traders who have short-term goals would rather buy when the stock is low so they can sell when it rises after doing their research, of course. At MoneyAfrica, we also advise having a long-term investment strategy and here is one of the best strategies to hit your goals while staying grounded regardless of the volatility of the stock market.

It is a technique known as dollar-cost averaging. This approach requires that you invest a specific amount at regular intervals (once a month works fine) instead of stressing over what the market is doing every other day. This way, you will be buying at various prices which will average out over time.

Truth is, it can be difficult to know the perfect time to get into the market and this approach has proven to be an excellent way to do so. Instead of waiting to see how the market unfolds in the next 6 months, your best bet is to go in little by little but consistently. Pair this strategy with stock funds like ETFs (exchange-traded funds) to diversify your portfolio as this will serve as an added cushion for any significant fall in the stock market.

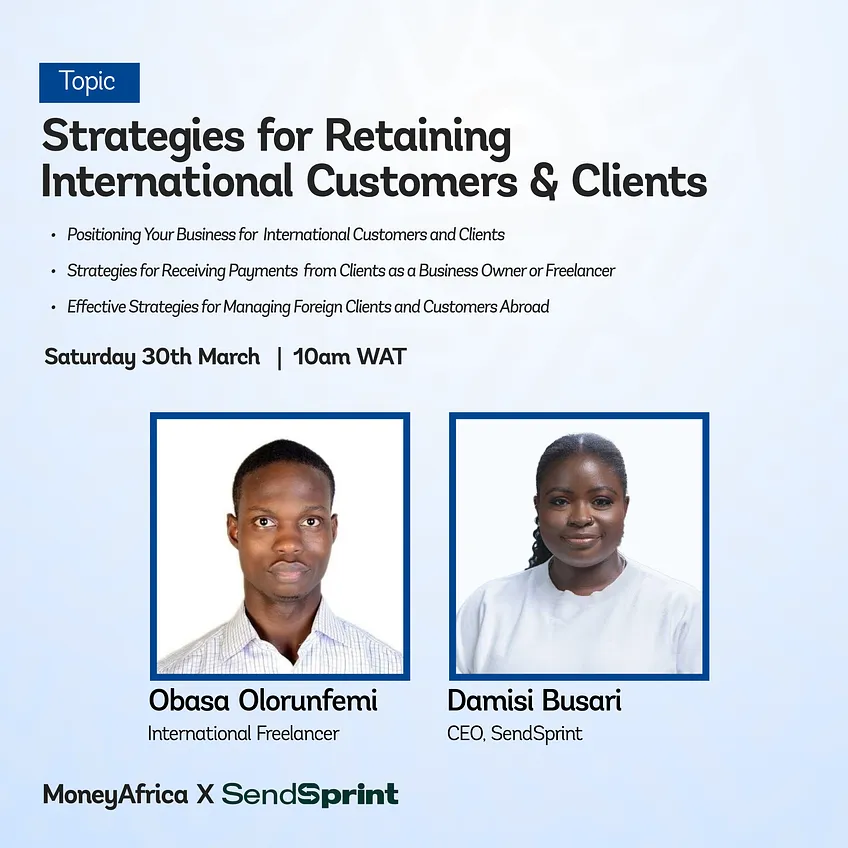

Currently, we have a webinar series in partnership with Sendsprint for entrepreneurs and freelancers who want to build a sustainable global brand. Register here to be a part of the next session happening on Sunday, April 7, 2024.

You can also watch the recap of the first session here after which, you should fill out this form to access the resources Sendsprint has provided for you!

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2024.

Don’t forget to:

- Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company’s staff? Please send an email to info@themoneyafrica.com