Good Morning 😃

How are you doing?

Some financial habits can either help you achieve your financial goals faster or leave you with empty accounts and financially drained.

It is true that many people had good goals and intentions last year, and some even started well by saving and investing in different opportunities. However, it was not long before they found themselves in a cesspool of bad investment advice, debts, impulse purchases, black tax, urgent medical needs, to mention a few.

If you are serious about improving your finances, you need to be deliberate about breaking bad money habits and replacing them with new ones.

“Spending money to show people how much money you have is the fastest way to have less money.”

― Morgan Housel, The Psychology of Money

Do you want to avoid the pitfalls and do more with your hard-earned money this year? Here are seven bad money habits that can make it impossible for you to achieve your financial goals in 2023.

- Spending more than you earn

We cannot overemphasise the importance of budgeting. This has come up several times in our newsletter. Budgeting your income and spending will help you track your financial health. How much of your income do you spend on your needs and wants? Are you spending more than you earn? You should always aim to spend less than you make each month, with the goal of saving 20% of your income each month.

We are aware that most people tried this without success, because, sometimes, life gets in the way. Perhaps they had unplanned medical expenses, lost their source of income, or just didn’t make enough to meet their basic needs each month.

Even if you find yourself unable to spend less than you do right now, earning more money than you spend should always be your ultimate goal when it comes to putting your financial house in order.

- Living beyond your means

Say to yourself: “This year, I will not live beyond my means.” Living beyond your means can put a serious dent in your finances if you are not careful. While you probably don’t need to start living like a pauper just to be financially disciplined, you should avoid expensive and unnecessary purchases like new cars, expensive wigs, luxury apartments, and fancy vacations if you’re still trying to get your financial footing.

This doesn’t mean you can’t treat yourself every once in a while, but it does mean you should make it work within your budget.

- Not building an emergency fund

By now, you should know how you can budget your spending. After you’ve set a budget and tracked your spending each month, you should start to put money away each month towards an emergency fund. Having an emergency fund will serve as your safety net during difficult or unpleasant situations.

Financial experts normally recommend that you save between three and six months worth of expenses in an emergency fund.

- Get a health insurance plan

Most people claim not to need a health insurance plan because they rarely fall sick. But do you know that not having an insurance plan can put you in a worse financial situation when you need help the most. However, unexpected tragedies like a car accident or school accident (for those with children), urgent surgery could result in significant financial setbacks.

If you’re able to, invest in insurance including health insurance, life insurance and others. Don’t leave your life to chances

- Not investing for retirement

Once you’ve established a budget and set aside a certain amount for your emergency fund, the next step on your path to financial freedom is to start investing for retirement. Some employees reading this letter would argue that they have a pension plan in place. But to be honest, that amount may not likely last you for more than ten years. This is because your pension is invested in low return assets, which is usually less than the long-term inflation of 12% in Nigeria.

It’s a different case if you’re a freelancer and do not have a pension plan. You should create an investment plan and be more deliberate with investing because of job instability. The same applies to business owners.

This year, don’t join the people who say that the interest is not worth it. Do you know if you start saving N100,000 per month for the next 20 years with an average expected return of 10%, after 20 years, you will have about N76 million if you are consistent. Your total invested amount will be N24 million, and interest earned will be about N52 million. Now imagine you do it for N150,000, N200,000, N250,000 and much more.

No amount is too small when it comes to investing. Start this year if you have not started. And if you have started, be consistent, and don’t let the market discourage you from investing.

- Not educating yourself about personal finance

Poor financial literacy can have negative consequences when it comes to your financial well-being. Knowing enough about personal finance to make responsible and educated decisions when it comes to money is very important. A lot of bad investments you made last year was as a result of lack of sound financial knowledge. This year, prioritise investing in your personal finance education, so that you can be confident about your investment decision.

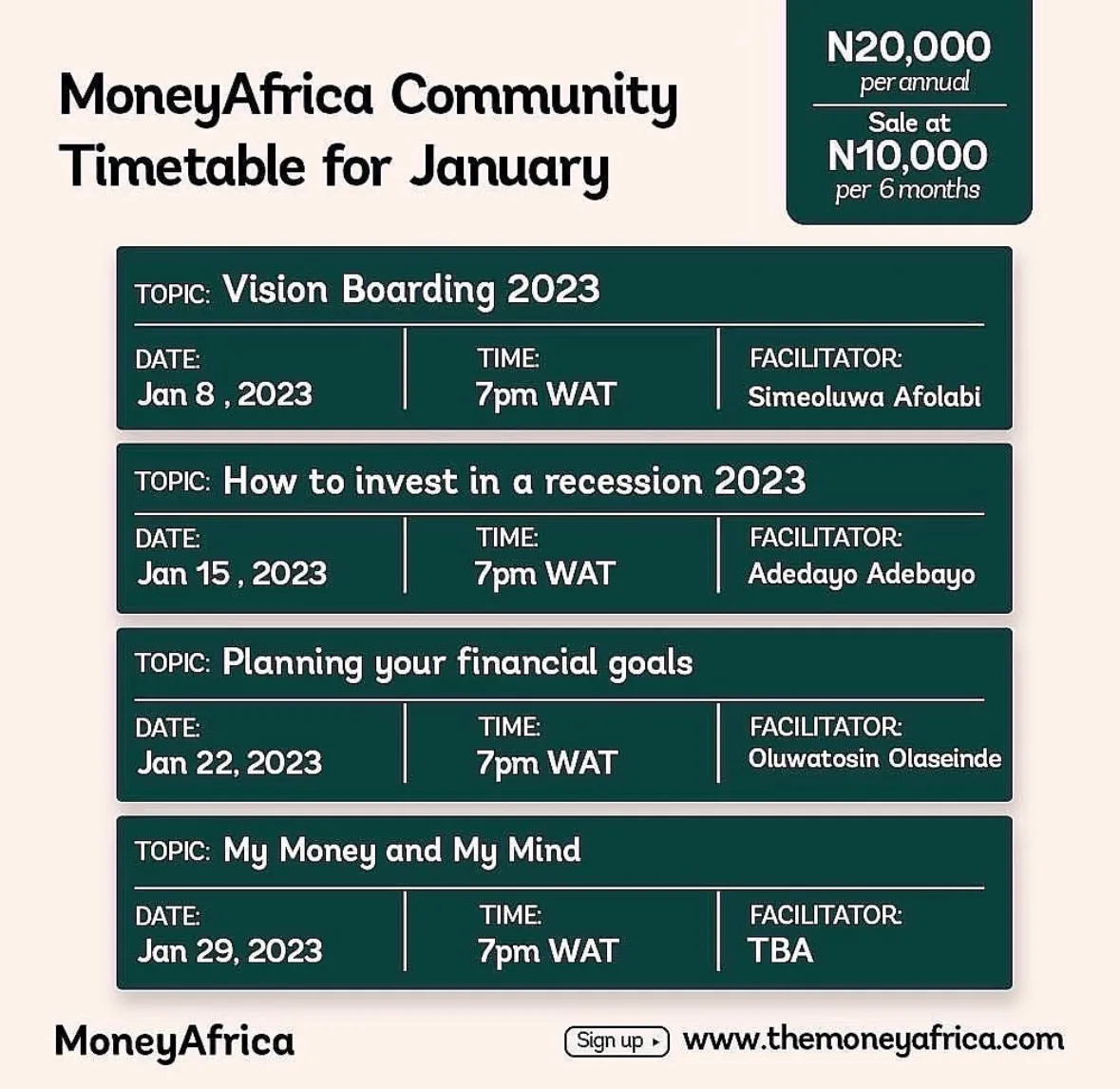

Fortunately, there are plenty of free resources that you can start with when you join us at MoneyAfrica. Again, here is the link to join: www.themoneyafrica.com.

Thank you for reading Money Africa’s Blog.

Please feel free to share it.

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here.

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

- Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

- If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

- Get a budget sheet to track your monthly expenses. Click here

- Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

– social media handles

– platforms for paid community members (for adults and students)

– webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company? Please send an email to info@themoneyafrica.com